This year’s Nobel Memorial Prize in Economic Sciences once again goes to some folks doing the heavy lifting on organizational theory. You may recall that not too long ago, Elinor Ostrom and Oliver Williamson shared the award for their work on “governance mechanisms” — Ostrom on collective governance of natural resources, Williamson for organizational structure.

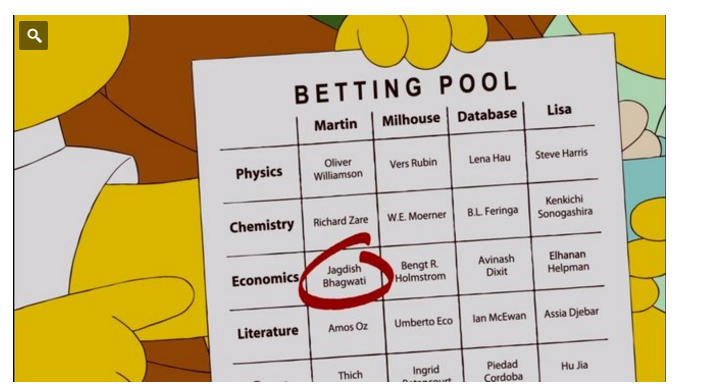

This year’s winners are Oliver Hart from Harvard and Bengt Holmström from MIT for their work on “contract theory”. Contract theory is pretty encompassing, and includes the classic “principal-agent” problem, along with the “incomplete contracts” problem.

For the uninitiated, An agency problem arises when you as a principal delegate a task for some agent to carry out for you. For example, you might own a business and hire someone (or someones) to work for you. That seems simple enough, except things can get all mucked up if output comes from a combination of effort and random factors, if you have several workers and can’t figure out who’s responsible for what (team production), if your workers have a bunch of things to do (multiple-task agency problem), and a host of other things.

Hart and Holmström have made fundamental contributions in getting to the heart of some of these matters, and were duly rewarded with the prize. Remarkably, Kevin Bryan from University of Toronto says that though Hart won the prize on the back of his contributions to “incomplete contracts,” he actually has not done much on incomplete contracts since two other Nobel winners — Eric Maskin and Jean Tirole, characterized the limitations of that approach:

Hart’s response, and this is both clear from his CV and from his recent papers and presentations, is to ditch incompleteness as the fundamental reason firms exist…. To my knowledge, Oliver Hart has written zero papers since Maskin-Tirole was published which attempt to explain any policy or empirical fact on the basis of residual control rights and their necessary incomplete contracts.

Professor Bryan has remarkably prescient characterizations of Hart and Holmström‘s work A Fine Theorem blog (incidentally, he often has excellent review and commentary on recent IO papers). The post on Hart is essentially a short history of the economics of the firm and organizational economics, which many of you will be seeing next term in Econ 450. There are a million other descriptions of their contributions (google it), including this critical piece by Arnold Kling.

And, congratulations to Milhouse! Well done.