Undergraduates are not yet like the white queen, willing to believe 6 impossible things before breakfast. — Rakesh Vohra

Not sure what about that quote is so amusing to me.

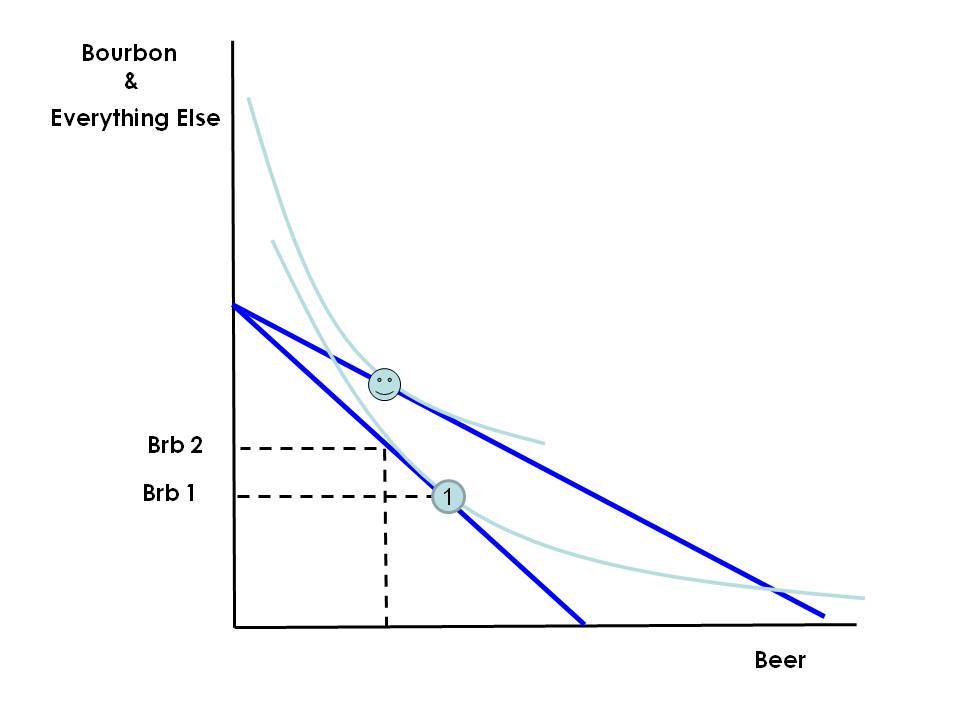

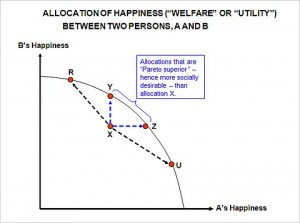

Professor Vohra is blogging on his re-imagining of the intermediate theory course. I am not certain that I am ready for a wholesale overhaul, but I will be following this one closely.

This question came up in class the other day — are you peeling your bananas wrong? As usual, the Armchair Economist Steven Landsburg has

This question came up in class the other day — are you peeling your bananas wrong? As usual, the Armchair Economist Steven Landsburg has  Jay Dansand and the gang for transporting the site.

Jay Dansand and the gang for transporting the site.