Yesterday, Congress passed legislation designed to avoid the strictures Congress enacted in the summer of 2011 to enable the United States government to borrow in excess of the existent debt ceiling. These provisions would have allowed the income tax cuts enacted in the George W. Bush era to expire as well as imposed spending limits on defense and discretionary non-defense spending.

There are numerous provisions in yesterday’s bill, summarized by the White House here. The Congressional Joint Committee on Taxation estimates the increased revenue from the bill to yield $62o over 10 years, far short of the 4 trillion dollars some estimate will be need to generate a sustainable level of debt. Furthermore, the debt ceiling and expenditure components of the “cliff” will remain subjects of political debate for at least the next two months when further action will be required. In short, we have “kicked the can down the proverbial road” again.

Bruce Bartlett, in a New York Times Economix posting yesterday, offers little in the way of enthusiasm regarding the political feasibility of making serious headway in addressing prospective budget deficits now and in the near future. His argument parallels the time inconsistency argument that earned Edward Prescott and Finn Kydland the Nobel Prize in Economics in 2004.

The Congress that raises taxes and cuts benefits will suffer politically, while the benefits of lower deficits will accrue to future Congresses.

He goes on to argue that

Historically, what has moved Congress to enact big deficit-reduction packages was the prospect of quick improvement in terms of inflation, growth and interest rates. Given that deficit reduction today is very unlikely to improve any of these in the near term, deficit hawks lack any real payoff from a grand bargain.

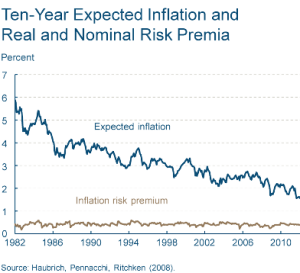

Inflation has been low and stable as has expected inflation.

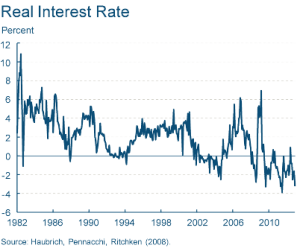

Even though expected inflation has been stable or declining for the past decade, real interest rates for treasuries (see chart below) – market rates minus expected inflation – has been negative for much of the past decade with the exception of the brief positive values in 2005 – 2007 and with expected deflation in late 2008. If real interests are negative, the crowding effects of public sector borrowing are non-existent; thus, the cost of running deficits has not “spooked” the markets. Of course, permanent negative real interest rates are not sustainable since few lenders will continue to offer their savings in exchange for reduced future consumption.

In the famous song from The Lion King, Hakuna Matata – there are no worries or no problem. Of course, such attitudes last only as long as those who lend money to the US government continue to do so. As Reinhart and Rogoff argue persuasively in This Time is Different: Eight Centuries of Financial Folly, this time is not different. Financial excesses and repression eventually must be paid for. We just don’t know when or how severe the price will be.