Although there is some disagreement amongst economists, many argue that traditional monetary and fiscal policy will not take the US economy from its current relatively stagnant state to the robust growth needed to employ many of the 8 million who were unemployed during the recent recession as well as the new entrants into the labor force. As those in Intermediate Macroeconomics learned, since we add roughly 1.5 million people to the work force each year, we need about that number of jobs just to keep unemployment from worsening.

As several studies from the Kauffman Foundation have shown, the vast majority of new jobs created in the United States come from new firms (that is firms that are five years old or younger), not from large firms or small firms and not from governments. In recent years, fewer new firms have been created than in the past, and each of these firms has generated fewer jobs than in the past. The Kauffman Foundation has put together a non-partisan “Startup Act Proposal” to jump start the economy. It is entitled “Access to Capital: Fostering Job Creation and Innovation Though High-Growth Startups.” The four key provisions are as follows:

1. Provide a permanent capital gains exemption to investment in startups held for at least five years.

2. Reduce the corporate tax burden for new companies in the first three years they have taxable income. (This may be already doable under subchapter S of the corporate tax code.)

3. Reduce Sarbanes-Oxley requirements for firms with less than $1 billion in market capitalization.

4. Subject federal regulation to 10 year sunset.

Carl Schramm and Robert Litan, on behalf of the Kauffman Foundation also argue for removing the caps on skilled immigrants and immigrant driven entrepreneurial ventures.

These are intriguing ideas. They should encourage Lawrence students to sample our Innovation and Entrepreneurship courses. Check out Schramm and Litan’s presentation last week to the National Press Club.

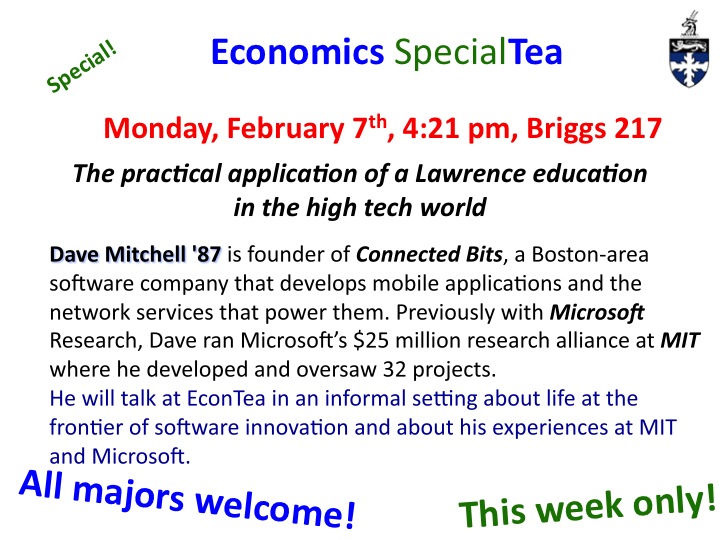

Invited experts also play critical roles in the program‘s core courses, including Innovation. These experts also help the program grow, expanding opportunities for students to engage in real-world entrepreneurship and innovation, through structured practical opportunities to take their course-based projects to commercialization, or internships in businesses or nonprofits that foster entrepreneurship or innovation. The NCIIA grant will help pay for travel expenses of several highly regarded experts who will contribute to the next offering of the Innovation course. The expectation is that students who take I&E courses will gain knowledge and cognitive skills that will equip them to be “change agents.” Combined with LU‘s emphasis on critical thought and information synthesis, the conceptual and practical knowledge gained through these courses will prepare students to undertake imaginative and ambitious innovative and entrepreneurial activities.

Invited experts also play critical roles in the program‘s core courses, including Innovation. These experts also help the program grow, expanding opportunities for students to engage in real-world entrepreneurship and innovation, through structured practical opportunities to take their course-based projects to commercialization, or internships in businesses or nonprofits that foster entrepreneurship or innovation. The NCIIA grant will help pay for travel expenses of several highly regarded experts who will contribute to the next offering of the Innovation course. The expectation is that students who take I&E courses will gain knowledge and cognitive skills that will equip them to be “change agents.” Combined with LU‘s emphasis on critical thought and information synthesis, the conceptual and practical knowledge gained through these courses will prepare students to undertake imaginative and ambitious innovative and entrepreneurial activities.

For those of you interested in an extra unit or two, this term we are offering an independent study / tutorial reading Joseph Schumpeter’s classic, Capitalism, Socialism, and Democracy. For those of you unfamiliar with the book,

For those of you interested in an extra unit or two, this term we are offering an independent study / tutorial reading Joseph Schumpeter’s classic, Capitalism, Socialism, and Democracy. For those of you unfamiliar with the book,  As I prepare to pick up Steven Johnson’s

As I prepare to pick up Steven Johnson’s  Cracker and Camper Van Beethoven have a festival, The Campout. It’s rather remote and since we produce the small festival ourselves we take considerable financial risk. While the previous years had been marginally successful we were worried about the rapidly deteriorating economy (I believe Bear Stearns had just gone bankrupt). So I started a campaign to get a “break even” amount of CVB and Cracker fans to commit to attend the festival. In this way our fan’s promises to attend would become a sort of promissory note. no pun intended. While you couldn’t exactly peg it’s value, these collective promises to attend at some point seemed to be worth enough to go ahead and book the flights, PA, lights, and port-o-potties.

Cracker and Camper Van Beethoven have a festival, The Campout. It’s rather remote and since we produce the small festival ourselves we take considerable financial risk. While the previous years had been marginally successful we were worried about the rapidly deteriorating economy (I believe Bear Stearns had just gone bankrupt). So I started a campaign to get a “break even” amount of CVB and Cracker fans to commit to attend the festival. In this way our fan’s promises to attend would become a sort of promissory note. no pun intended. While you couldn’t exactly peg it’s value, these collective promises to attend at some point seemed to be worth enough to go ahead and book the flights, PA, lights, and port-o-potties.