Future shortages will continue to plague the world in the minds of the pundit class, with the latest being The Atlantic story on the great on-coming wine “shortage.”

Citing Morgan-Stanley research they find:

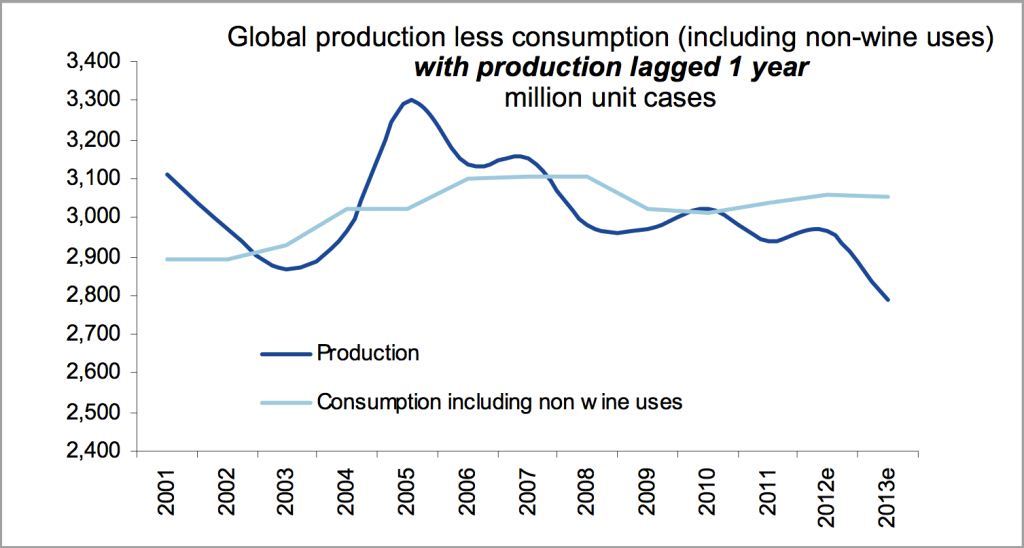

Data suggests there may be insufficient supply to meet demand in coming years, as current vintages are released.

Now here’s the punchline: the piece features four graphics showing production and consumption data and zero containing price data.

My favorite is below. It appears that they left out the “h” in wine.

I am going to go out on a professional limb here and predict that two years from now I will be able to stroll into a Wallgreens confident that I will be able to pick up a bottle of wine on the way to dinner.

The caveat, of course, is that it might be a bit pricier.

How much pricier, you ask?

A quick eyeball on this graph suggests that the production shortfall is about 10-15% lower relative to 2010, when production and consumption were somewhat equal. So, of the few hundred wine elasticity estimates available, let’s assume a price elasticity of demand for wine in the -0.5 and -1 range. This implies that a$10 bottle of wine will be going for $11-$13 when the “shortage” hits.

Of course, the higher prices are likely to induce either entry or expanded production, so I somehow doubt either the shortfall or the price increases will be long lived. And, two years from now the wine shelf will look pretty much like it looks today.

What’s somewhat discouraging is that it took me about a minute to convince myself that there is no shortage in any true sense of the term looming. Yet, pretty much every major news outlet has picked up the story and run with it.

Well, consider this another clear arbitrage opportunity!