This past week in 100 we tackled the unusual welfare economics and the effects of price controls. For introductory economics courses, rent control and minimum wage policies generally serve as the dominant examples of controls that mean well, yet have perverse impacts. But I’ve always had a soft spot for the U.S. sugar program, which continues to surprise and astonish.

As you probably don’t know, but might suspect, the average U.S. citizen consumes about 140 lbs of sweeteners per year, about half coming in the form of sugar and the other half in the form of some sweet corn goodness.

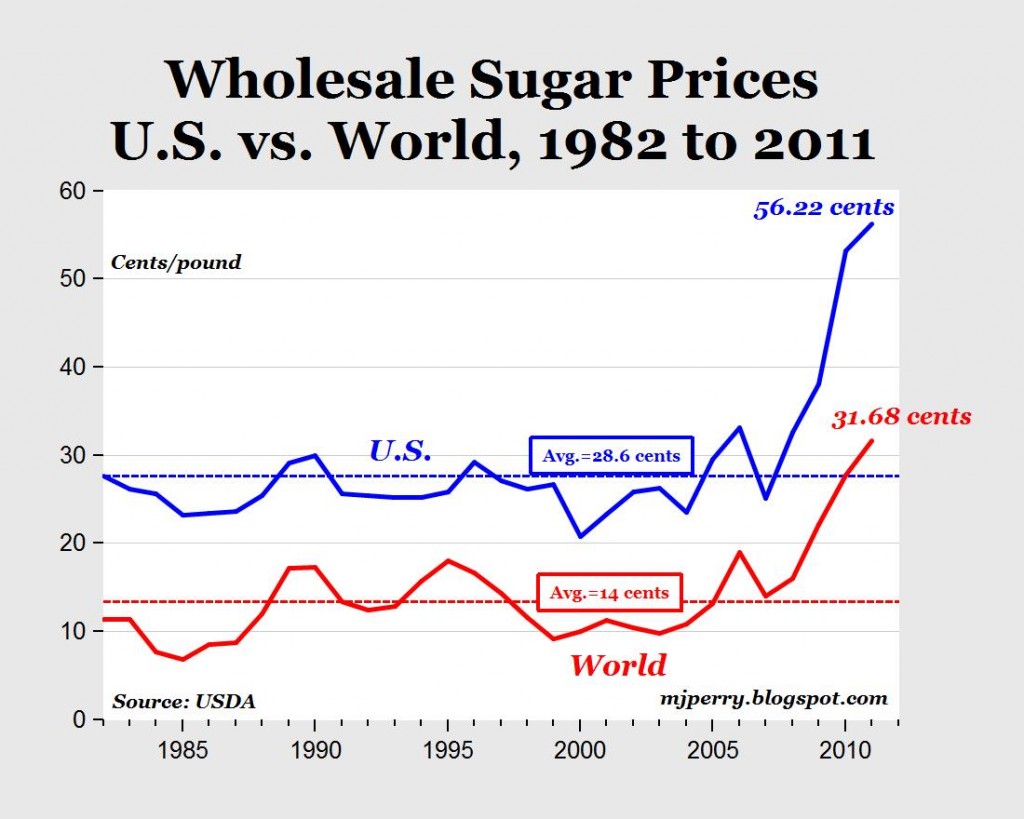

Because of import restrictions, however, U.S. consumers pay a rather steep markup over world price. In class I cited a 2010 article where U.S. prices were about $0.35 per pound compared with $0.20 on the world market. If you take $0.15 per lb. times 70 lbs. times 300 million people, you’re starting to talk about real money.

But on a trip over to Mark Perry’s blog, I see that sugar prices have gone absolutely bonkers in the past two years. Perry has a nice figure that shows the markup is now more like $0.25 per pound, meaning that sugar producers are now really going to the bank. Perry estimates that with the markup, U.S. consumers pay about $3.5 billion more for sugar than they would absent the quota. Although that is certainly a tall number, on a per capita basis it only comes to about $10-$12 per person.

On the other hand, the U.S. sugar producers pocket a healthy chunk of that $3.5 billion.

In one of the all-time great sound bites, Judy Sanchez from U.S. Sugar Corp. said sugar policy has “zero cost” to taxpayers and offered up this line:

Face it: Sugar is given away for free in restaurants, where they charge you for water, they charge you for an extra slice of cheese on your hamburger. The sugar is so affordable that it’s given away for free. That’s because American sugar policy works.

Do you suppose sugar would still be “given away for free” if the U.S. price was cut in half tomorrow?

UPDATE: For some background, here’s a Congressional Research Service report — usually readable, often helpful.