On January 13, 2011, The Bureau of Economic Analysis in the the U.S. Department of Commerce reported that as of November 2010, the U.S. trade deficit with China for 2010 amounted to $252 billion. This number tells very little about the character of trade between the two countries. It just captures the difference in final sales value of exports minus imports. Pascal Lamy, director-general of the World Trade Organization, argues in today’s Financial Times that manufacturing products developed through a global supply chain of steps should be labeled “made globally.” His comments include the notion that the Apple iPhone contributed $1.9 billion to the recorded US trade deficit with China, but that the value added in China from this product would come to only $73 million. Other analysts have shown that the value added in China comes to less than half of the trade balance number published.

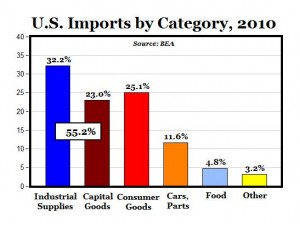

Furthermore, the Bureau of Economic Analysis published a report indicating that 55% of our imports are used in the U.S. to produce domestic goods and services. Stated differently, these imports enable our companies and workers to be both productive and profitable.

Discussion of trade deficits without these detailed clarifications at best misinforms the public as to the economics of globalization; at worst, it encourages us to close our borders to (some) imports which would lead to both higher domestic prices and lower domestic output. The effects on employment would be complicated but not positive in the aggregate.