You might be interested to know that a new 200-level economics course has been added to the schedule for the quickly approaching spring term. ECON 225, Decision Theory, will be taught by Professor Galambos MWF 1:50 to 3:00. He has offered this course in the past as “Game Theory and Applications.” The new title reflects a greater emphasis on the decision theory foundations, after which game theory and its applications will follow in the second part of the course. If you’d like to get an idea of what the course is like, take a look at last year’s syllabus. This year’s offering will not be exactly the same, but it will be very similar. The course is now listed on Voyager, so you can register any time.

Category: Course Advertisement

Econ Read — Francis Spufford’s Red Plenty

This term’s Economics Department Read features Francis Spufford’s Red Plenty: Industry! Progress! Abundance! Inside the Fifties Soviet Dream. The book is a hybrid history-fiction that uses many historical events and people to characterize the salad years of the Soviet Union, back when people thought central planning wasn’t a pipe dream.

Well, of course it was a pipe dream, and this book goes a long way to developing an understanding of planned economies and also the Soviet mentality. According to historian Marhall Poe, who has actually done some work on the Soviet Union himself, Red Plenty is the real deal:

[Red Plenty] contains more “truth” about the Soviet project than an entire library of “serious” novels and dry-as-dust histories. If I had to recommend one book on the Soviet Union to someone who wanted to understand it, Red Plenty would be it.

In the interview Poe says that Spufford “is one of those people that took all of that liberal arts crap seriously.”

Hey! Sounds like our kind of guy.

As for the logistics, it is a one-unit directed study that will meet most Tuesdays during winter term from 11:10-12:15. You can get sign up sheets and signatures from Professor Galambos or Professor Gerard.

(As long as we’re on the subject, Poe also interviews Appleton-native David Brandenberger about his recent book, Propaganda State in Crisis: Soviet Ideology, Indoctrination, and Terror under Stalin.)

Economics Department Schedule, Winter 2013

Here are the course offerings in economics coming up this winter. Click the links for course descriptions and availability. See you there.

ECON 100 ● INTRODUCTORY MICROECONOMICS ● 9:50-11:00 MTWR BRIG 223 09:50-11:00 ● Mr. Gerard

ECON 170 ● FINANCIAL ACCOUNTING ● 11:10-12:20 MWF BRIG 223 ● Mr. Vaughan

ECON 202 ● GLOBAL ECONOMIC RELATIONS ● 12:30-01:40 MWF BRIG 206 ● Ms. Beesley

ECON 215 ● COMPARATIVE ECONOMIC SYSTEMS ● 2:30-04:20 TR BRIG 217 ● Mr. Galambos

ECON 220 ● CORPORATE FINANCE ● 8:30-9:40 MWF BRIG 223 ● Mr. Azzi

ECON 271 ● PUBLIC ECONOMICS ● 3:10-4:20 MWF BRIG 217 ● Mr. Georgiou

ECON 380 ● ECONOMETRICS ● 1:50-3:00 MWF BRIG 223 03:10-04:20 T BRIG 223 ● Ms. Karagyozova

ECON 400 ● INDUSTRIAL ORGANIZATION 12:30-2:20 TR BRIG 223 ● Mr. Gerard

ECON 410 ● ADV GAME THEORY & APPLICATIONS 9:00-10:50 TR BRIG 217 ● Mr. Galambos

ECON 601 ● SENIOR EXPERIENCE: READING OPT 02:30-04:20 T BRIG 317 ● Mr. Gerard

Senior Experience Reading Option

As you know, or should know, departments must now offer a Senior Experience to fortify those of you who will be heading from this world into the next one. Here in economics, we actually provide you with two options. One is to augment a research paper,* and the other is to participate in a reading and discussion seminar — the Reading Option.

For this year’s Reading Option, we will be taking on The Nature of the Farm: Contracts, Risk, and Organization in Agriculture by Doug Allen and Dean Lueck. Allen & Lueck — students of the great Yoram Barzel — lay out a transaction cost theory of farm organization, and then test this theory using mounds and mounds of data on farm contracts that they obtained from far and wide. Of central interest to Allen & Lueck is why, despite massive technological change, family ownership remains the dominant ownership form for planting and harvesting crops in America. Yes, you read that right.

We are going to learn a lot about North American agriculture.

Our group will meet Tuesdays 2:30-4:20 or thereabouts. Students should plan to read and think hard about one or two chapters per week, and will be responsible for writing a book review or some other short, crisp essay related to the course material. If you are interested in sitting in without taking on the entire “Experience,” you should see me. Sophomore and Junior majors are certainly welcome.

Co-author Doug Allen will be on campus Thursday, February 14 to discuss his work and help you with your own, so mark that on your calendar. He will also give a public lecture as part of the Economics Colloquium.

Those of you taking the course can check out the course Moodle here.

For our first meeting on Tuesday, January 8, you should read the first two chapters, make sure to tackle the “economics vocabulary,” and be prepared to respond to the Fun Facts and Questions for Discussion.

Here is a selection of the vocabulary for our first meeting:

- Stylized fact

- Vertical integration, vertical coordination (see p. 184 if you need an example)

- Principal-Agent Model (Agency Model)

- Shirking

- Moral hazard

- Risk aversion, risk neutrality

- Residual claimant

- Endogeneity

If you don’t know what these mean, you might try asking someone. If that doesn’t work, Google is your friend, as they say. I find the New Palgrave Dictionary of Economics to be an excellent resource (available to on-campus IP addresses).

See you in January.

*See Professor Finkler for details.

Read Plenty

Next term’s Economics Department Community Read will feature Francis Spufford’s fascinating Red Plenty: Inudstry! Progress! Abundance! Inside the Fifties Soviet Dream. It is an idiosyncratic book that draws heavily on historical figures and events to characterize a period in the Soviet Union where central planners thought that central planning would actually work.

Though academics tend to take a dim view of works of historical fiction generally, University of Iowa historian Marshall Poe says this is clearly an exception:

Once in a great while, however, a book [of historical fiction] comes along whose truth is so powerful that even the literary critics and professors take notice. Francis Spufford’s Red Plenty: Industry! Progress! Abundance! Inside the Fifties Soviet Dream is such a book. It contains more “truth” about the Soviet project than an entire library of “serious” novels and dry-as-dust histories. If I had to recommend one book on the Soviet Union to someone who wanted to understand it, Red Plenty would be it. Read it.

The group will meet on most Tuesdays during winter term from 11:10-12:15, and you can sign up with Professor Galambos or Professor Gerard. The reading should be an ideal complement for those taking Professor Galambos’ comparative economics systems course.

If you have some time in the next 50 days before next term starts, you might even be able to get a head start.

We do this every term, so you could pick up half a course over the course of a year.

Courses for Fall 2012

Welcome back to the friendly confines of LU. Here are the Econ Department courses for the fall term:

ECON 120 INTRODUCTION TO MACROECONOMICS 12:30-01:40 MWF BRIG 224 03:10-04:20 R BRIG 224 Mr. Georgiou

A study of the principles, concepts, and methods of economic analysis, with a theoretical focus on the determination of national income. Special attention given to governmental expenditure and taxation, monetary policy, inflation, and unemployment. Especially appropriate for those who only want to take one economics course.

ECON 200 ECONOMIC DEVELOPMENT (G,W) 12:30-02:20 TR BRIG 223 Mr. Finkler

This course seeks to provide students with a broad based understanding of economic development and the choices countries face. To obtain such an understanding, students will read the works of contemporary economists who provide a variety of approaches to poverty alleviation and the tradeoffs that must be confronted. Emphasis will be placed on close reading, class discussion, and on writing a number of papers that compare and contrast different views of economic development.

ECON 211 IN PURSUIT OF INNOVATION (S) 11:10-12:20 MWF BRIG 223 Mr. Galambos, Mr. Brandenberger, Mr. Vaughan

This course acquaints students with innovation—its objectives, major characteristics, and likely origins. The course focuses mainly on scientific and /or technological innovation; it will be taught as a joint physics/economics offering. The course includes one or two lectures per week along with student presentations and hard-charging discussion based on readings from books, articles and case studies. Outside resource individuals (in most cases Lawrence alumni) who are well-placed and experienced in innovation will offer advice and guidance to particular student projects. Do yourself a favor and take this course.

ECON 300 MICROECONOMIC THEORY (Q) 08:30-09:40 MWF BRIG 223 08:30-09:40 R BRIG 223 Mr. Galambos

A study of the microeconomic foundations of economics. The course focuses on equilibrium models for consumers and firms in competitive markets, as well as deviations from perfect competition. Your first genuine step toward self-actualization.

ECON 430 CAPITAL AND GROWTH (Q) 09:00-10:50 TR BRIG 217 Mr. Finkler

An examination of the determinants of long-term economic growth and productivity. Particular attention given to the role of capital, international competitiveness, savings, tangible investment, and the role of public policy in all such areas.

ECON 495 TOP: LAW AND ECONOMICS 03:10-04:20 MWF BRIG 217 Mr. Georgiou

Along with an introduction to legal analysis, a study of the political economy of four core areas of the law: property, contracts, torts, and crime and punishment. Applies rational-choice theories to both economic and political decisions involving the law.

Advanced Topics in Law and Economics

Professor Georgiou will be offering ECON 495, Advanced Topics in Law and Economics, this fall on Monday, Wednesday, Friday in the 3:10 to 4:20 time slot. The prerequisite for the course is ECON 300 or consent of the instructor. If you have had ECON 271 or ECON 280, this might be an extremely attractive follow on.

Here is the teaser:

Should a grandson that killed his grandfather be allowed to be his heir? Should theft be punishable by death? Why is blackmail illegal? Should smoking be allowed in bars? Should a bystander be punished for not rescuing a drowning person? What is the purpose of limited liability for shareholders? Why is polygamy not allowed?

These questions seem to touch very distinct areas of the law. But there is one and (maybe) only one way to go about answering all of them: Economic Analysis! In this class we will show that economic efficiency is what makes a good law and that laws that don’t make sense can be critiqued with economic arguments. Law and economics is a class that expands the scope of economics and limits the arbitrariness of the law.

Registration resumes in a couple of days, so please stand up and be counted.

Registration Alert

Here are some course adds for the 2012-2013 campaign:

Fall Term

- Introductory Macro (ECON 120) MWF 12:30 – 1;40 and Thursday 3:10 – 4:20 – Georgiou

- Advanced Topics (in Law and Economics, ECON 495) 3:10 – 4:20 MWF – Georgiou (prerequisite Econ 300)

Winter Term

- Public Economics (ECON 271) MWF 3:10 – 4:20 – Georgiou

Spring term

- Introductory Macroeconomics (ECON 120) – MWF 1:50 – 3:00 and Tuesday 3:10 – 4:20 Change of instructors – Georgiou

- Law and Economics (ECON 245) – MWF 11:10 – 12:20. –Georgiou

- Investments (ECON 421) – MWF 1:50 – 3:00 – Karagyozova

Price controls don’t work

Here is the latest confirmation, from Venezuela. From the NYT article:

Asked where a shopper could get milk on a day when that, too, was out of stock, a manager said with sarcasm, “At Chávez’s house.”

At the heart of the debate is President Hugo Chávez’s socialist-inspired government, which imposes strict price controls that are intended to make a range of foods and other goods more affordable for the poor. They are often the very products that are the hardest to find.

Long lines of the kind described in the article were common in socialist countries. The decision making process of a consumer in an economy with chronic shortages is very different from that of our “standard Max U.” As a consumer, you might choose your desired consumption bundle from those you can afford, only to find that some of the items in that consumption bundle are not available. Or you might find that they are not available where you thought they were, and finding out where they are available is tricky. Economist János Kornai wrote a book on the Economics of Shortage, but his book on The Socialist System has a couple of chapters on the phenomenon of shortage as well. For more on this, take next year’s Comparative Economic Systems course (here is the course outline from last year).

This is Lawrence: Sierra Leone

This week’s This is Lawrence video features the Sierra Leone class and trip that Professors Skran and Karagyozova co-orchestrated this past fall.

From zero to sixty-five

Here is the latest installment of “Consider the Equilibrium,” Jeff Ely’s fun little series at Cheap Talk. Those of you in Econ 225 are about to start studying game theory—this video gives you a preview of the kinds of fun we are about to have.

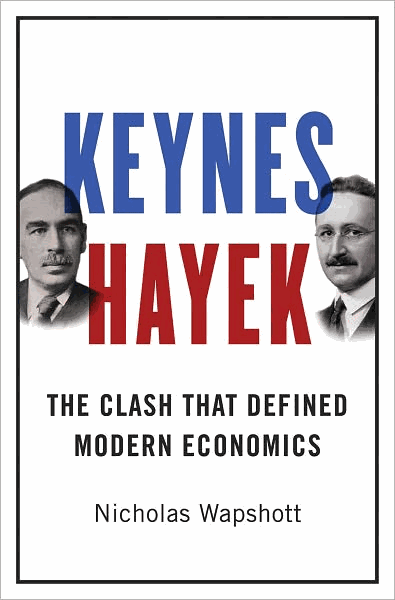

Keynes Hayek: Questions for Thursday’s Read

Alright, I still don’t have an accounting of our numbers (and I’m not even listed as an instructor), but it’s time to start talking about Wapshott’s Keynes Hayek book.

Alright, I still don’t have an accounting of our numbers (and I’m not even listed as an instructor), but it’s time to start talking about Wapshott’s Keynes Hayek book.

First up, roll call. Who are Edgeworth? Marshall? Mises? Menger? Robinson? Kahn?

Second up, what do we know about the personalities of Keynes and Hayek? Do they remind you of anybody? Do you think the recent rap videos are accurate characterizations? (see, for example, p. 48).

Third up, let’s revisit some basics — what is meant by “capitalism” and “socialism”?

A continuing question: What is Keynes view of government? As you answer this question, think of (1) his reaction to the war reparations and his characterization of the likes of David Lloyd George and Woodrow Wilson; (2) the Bank of England’s decision to raise lending rates in 1923 (p. 32); (3) Britain’s decision to return to the gold standard (pp. 39-40). In each case the government made what Keynes considered to be disastrous decisions, yet at the same time he believed the “he maintains the belief that the government or the Bank of England should manage the economy. Does Keynes believe that the British government as an institution is fundamentally sound, but that they just need better economic advice? The second point above, evidently, was the beginning of the Keynesian Revolution (p. 32; read footnote 3). Does that surprise you?

Another continuing questions: what is meant by “laissez faire”? The simple answer would seem to be that there is “limited” government intervention. Yet, the Bank of England sets interest rates, the government must make fundamental decisions about the currency — whether or not to adopt a “gold” standard, whether to have a central bank, whether to have a national currency, whether or not to tie that currency to precious metals (e.g., a gold standard or a “bimetallic” standard). What would constitute laissez faire in these contexts?

As a follow up to this question, on page 43 Wapshott argues that the battle lines are drawn: Keynes believes in using the government as a means to help the disadvantaged, Hayek sees intervention as futile. Again, given what’s going on in these previous two paragraphs, is this characterization too simplistic?

To what extent does Keynes’ advocacy (ideology?) affect his analysis? Consider his discussion of sticky wages and unemployment on p. 60.

What is the effect of fixing the price of currency to gold on the general price level and on the exchange rate? (see, for instance, pp. 38-9).

What is the “natural rate of interest”? (see, for instance, p. 43).

That should get us through the first hour. See you at 3:25 in Steitz.

For those of you with some extra spare time, reviews from Tyler Cowen, Peter Lewin (UT Dallas), and Brian Doherty (Reason magazine), and here’sNicholas Wapshott talkign with Russ Roberts (including beau coup resources at EconTalk).

Keynes, Hayek, and Other Dead Economists

This term’s economics read, DS 391 Keynes Hayek and Other Dead Economists, triumphantly kicks off this Thursday at 3:25 in Steitz 230.

This term’s economics read, DS 391 Keynes Hayek and Other Dead Economists, triumphantly kicks off this Thursday at 3:25 in Steitz 230.

You should pick up Wapshott and read the first six chapters (pp. 1- 94). We will circulate discussion questions Wednesday.

Next week we will continue down the Keynes Hayek track, and also begin with the Buchholtz chapter on Keynes.

It’s not too late to join, and you can pick up sign up sheets from Professor Galambos or Gerard.

Here’s some deep background from EconStories.tv.

Special Econ Tea Talk

George Georgiou from the University of California at Santa Cruz will be on campus Friday to give a talk, “An Introduction to Law & Economics.” Mr. Georgiou is completing his Ph.D. in international economics, with a specialization in applied micro and law & economics. His work focuses on whether post-incarceration supervision levels affect recidivism.

Mr. Georgiou will give the talk in Briggs 223 at 1:50.

The usual delicious Econ Tea accouterments should be available.

Keynes Hayek: Fight of the Century

For this term’s community read, we follow up on last term’s Keynes, Cowen, & Capitalism with two books. The main course will be Nicholas Wapshott’s Keynes Hayek: The Clash that Defined Modern Economics, featuring the co-evolution of the legacies of John Maynard Keynes and F. A. Hayek. Indeed, frequent readers of this blog or the economics blogospher generally are likely familiar with what I like to call “The Citizen Kane of macro battle rap videos.”

Here’s an excerpt of Tyler Cowen’s review.

Here’s Wapshott talking about his book with co-creator of the Keynes v. Hayek videos, Russ Roberts.

We will also read sections of Todd Buchholz’s now classic, New Ideas from Dead Economists, which should help us put some of this history in context.

As per usual, the course is one unit and requires you to read and to discuss. Please stop by and sign up this week with Professor Galambos or Professor Gerard. We need to get a head count and set a meeting time.

UPDATE: 391 DS — Keynes, Hayek and Other Dead Economists. Sign up sheets pinned on our bulletin boards.

We will meet Thursdays at 3:25.

Springtime in the Econ Dept

Here you go, no waiting. Most of these courses have space. Professor Finkler’s urban economics class is speaking intensive. Most of the other courses are thinking intensive. Econ 391 requires a signature of the instructor.

See you on Briggs 2nd.

ECON 120 ● INTRODUCTION TO MACROECONOMICS 9:50-11:00 MTWF 9:50-11:00 Ms. Karagyozova

ECON 170 ● FINANCIAL ACCOUNTING 2:30-4:20 TR BRIG 422 ● Mr. Vaughan

ECON 225 ● GAME THEORY AND APPLICATIONS ● 11:10-12:20 MWF BRIG 223 ● Mr. Galambos

ECON 250 ● URBAN ECONOMICS (S) ● 3:10-04:20 MWF BRIG 223 ● Mr. Finkler

ECON 280 ● ENVIRONMENTAL ECONOMICS ● 9:00-10:50 TR BRIG 225 ● Mr. Gerard

ECON 300 ● MICROECONOMIC THEORY ● 1:50-3:00 MWRF BRIG 223 8:30-09:40 ● Mr. Galambos

ECON 320 ● MACROECONOMIC THEORY ● 9:50-11:00 MTWF 09:50-11:00 Mr. Finkler

ECON 391 ● KEYNES HAYEK BATTLE OF THE CENTURY AND OTHER DEAD ECONOMISTS ● TBA 3:30 R

● Mr. Galambos, Mr. Gerard

ECON 421 ● INVESTMENTS ● 12:30-1:40 MWF BRIG 217 ● Ms. Karagyozova

ECON 450 ● ECONOMICS OF THE FIRM ● 12:30-2:20 TR BRIG 223 ● Mr. Gerard

Click here for the full schedule.

Keynes, Cowen & Capitalism — Related Items

I checked my RSS feeds today and saw two interesting items, spot on in terms of our class discussion. First up, an important technological breakthrough in medicine? Here’s Walter Russell Mead:

The medical world may be on the verge of a major breakthrough on par with the discovery of penicillin. As profiled in this NYT piece, a number of Silicon Valley companies and entrepreneurs are looking to lower the price of genome sequencing to the point that it will be within reach of the average consumer (below $1,000)—a development which could lead to the biggest revolution in drugs and medical treatments in years.

On par with penicillin? That’s a lot of value.

Now for something completely different, Derek Lowe suggests that maybe, just maybe, we don’t need more scientists after all. Hmm. I’m not sure I agree with that whole bit. Nonetheless, it’s thought provoking.

As a bonus, he cites a fantastically titled piece by Virginia Postrel, “How Art History Majors Power the U.S. Economy.” Postrel seems to agree with his point:

The argument that public policy should herd students into [Science, Technology, Engineering & Mathematics] is as wrong-headed as the notion that industrial policy should drive investment into manufacturing or “green” industries. It’s just the old technocratic central planning impulse in a new guise. It misses the complexity and diversity of occupations in a modern economy, forgets the dispersed knowledge of aptitudes, preferences and job requirements that makes labor markets work, and ignores the profound uncertainty about what skills will be valuable not just next year but decades in the future.

If you are interested in the average salaries and unemployment rates for different college major choices, Postrel cites this report out of Georgetown University that has some very illuminating figures.

Economics of Innovation in the New “Pamphlet” Era

This week seems to be innovation week for me, as I am reading two short books on the heels of The Great Stagnation. Reading these pieces, I can’t help but get the feeling that the economics profession is hurtling into a blog-soaked, pamphlet-era frenzy. First up for Econ 100 is Alex Tabarrok’s Launching the Innovation Renaissance (review here), where Tabarrok makes a case against patents, holds out promise for prizes, and makes a plea for broad educational reform in both primary and secondary education. For the Reading Group crowd we have Erik Brynjolfsson and Andrew McAfee’s Race Against The Machine: How the Digital Revolution is Accelerating Innovation, Driving Productivity, and Irreversibly Transforming Employment and the Economy, and with a subtitle like that, who needs a description?

So for those of you who have read one and need a primer on the other, here you go:

As a warm up to Renaissance, here is Tabarrok giving his TED lecture. Here’s a bit on education. (If you follow all the links at Marginal Revolution, you can pretty much read the whole book).

Here are Brynjolfsson and McAfee summarizing their argument in The Atlantic. See also Professor Finkler’s recent plug.

I’ve read both and recommend both. We’ll see what my Econ 100 students think. Thought provoking all around.

Keynes, Cowen & Capitalism Meets in Steitz 230

We have found a home for Econ 391, and it is in Steitz 230. We will see you over there at 3:25 on Thursday.

We began with Tyler Cowen’s The Great Stagnation, and in our first meeting we took a first cut at these questions:

1. What is the thesis of the book?

2.What does “the great stagnation” mean? What is stagnating? “Great” compared to what? Is the title a play on another “Great” episode do you suppose?

3. How is “stagnation” measured? Do you buy this means of measurement?

4. What does Cowen suggest is the cause of the great stagnation? How does he support his case? Can you think of alternate explanations?

5. What is Cowen’s remedy for the great stagnation, if any? Does it suggest a pro-market, get-out-of-the-way response? A more muscular federal policy response? New institutions? What?

6. Make a list of Cowen’s arguments that you buy and arguments that you don’t buy.

This week, we take on the “companion piece” from The American Interest, “The Inequality that Matters.” It’s hard to think about the future of capitalism without thinking a bit about what inequality is and why it is (and isn’t) important.

It seems an opportune time to point to the Financial Times’ recent in-depth debate, Capitalism in Crisis. There is some excellent material in there, and we will take a look at some of this when we get to the Backhouse and Bateman book.

Keynes, Cowen, & Capitalism Update

The first session rolled along pretty well, I thought, with 14 students and four faculty participating. I was pleased that everyone had something to say, and I hope you will make an effort to talk about this outside of the group. Our next meeting is February 16 at 3:30, and I am still looking for a regular room to meet.

For next time we will continue our discussion of The Great Stagnation, and in particular we will talk about whether we believe the central thesis. One synopsis of the thesis is that there are three pieces of bad news: there are fewer innovations, the yield on innovations has declined, and innovations are not resulting in high-quality employment gains. We talked a little bit about this idea of raising the status of scientists and what that might look like. In that vein, we might take a look at one of Cowen’s recent blog posts: a simple theory of why so many smart young people end up in finance and law. I’m not sure how to square one with the other.

On this point, I might add, Schumpter was optimistic that norms could change:

the prestige motive, more than any other, can be molded by simple reconditioning: successful performers may conceivably be satisfied nearly as well with the privilege—if granted with judicious economy—of being allowed to stick a penny stamp on their trousers as they are by receiving a million a year (CS&D, p. 208).

The discussion of science inevitably got at the nature of American higher education, an area that moves at a glacial pace, but might be amidst a revolution (who are you going to believe?). On this topic, Larry Summers’ offers his take on the future of education. I have been thinking about this for a while in terms of how we can do better down here on Briggs 2nd, and am wondering what the take of our new president will be.

We will also forge ahead with Cowen’s “The Inequality that Matters,” from The American Interest. It’s hard to think about the future of capitalism without thinking a bit about what inequality is and why it is (and isn’t) important. We read this in Econ 275 last term and I think it went over quite well.