Today’s Financial Times indicates that Deloitte Touche Tommatsu plans to hire 50,000 workers per year over the next years. Take advantage.

The Liberal Arts and UCLA Economics

Again, welcome back to those returning to campus. I’m looking forward to getting back myself and cranking up the 300 class. Meanwhile, a few weeks ago we instituted a segment titled “free market Monday,” which will emphasize the ideas of some seriously pro-market economists.

In that spirit, here is a piece of interest from the latest edition of Econ Journal Watch — an interview with William Allen (of Alchian and Allen fame) about his path to a professorship UCLA, as well as the heyday of the UCLA economics department under the leadership of Armen Alchian (of Alchian; Alchian & Demsetz; Klein, Crawford, & Alchian fame, among others). Allen begins with a shout out to the liberal arts, as he extols the virtues of his time at Iowa’s Cornell College:

[E]specially for one who is headed for graduate work, there is much in favor of first attending a small liberal arts college. At Cornell, there was a great deal which could be learned about the various aspects of the world and its evolution in the mandatory year-long freshman courses in English, history, and the social sciences. The learning was facilitated by classes of small size taught by non-T.A.s, and by much interaction with fellow students in the dorms and dining halls. And one can be captain of the tennis team without being a professional jock.

I’m not sure that the mandatory nature of the courses was the linchpin of his undergraduate education (at least I hope not, since my alma mater has no such requirements), but certainly writing and discourse are important. Indeed, one of my professors in graduate school said that liberal arts students seemed to have a better feel for what an interesting question is.

Welcome Back, Econofolks

Hello and welcome to the friendly Appletonian confines for the 2010-2011 academic year. A few noteworthy elements:

- The first Economics TeaBA will be Monday, September 20 at 4:20. The location is TBA, but it will certainly be somewhere on Briggs 2nd.

- Professor Gerard is out of town until Wednesday, and may be difficult to locate around campus until then.

- There is plenty of room in Economics 300. If you are interested, register or put your name on the waiting list, and enroll in The Moodle (enrollment code 0300). It will meet Monday this week, but not Tuesday. There is a quiz Wednesday. The class meets M, Tu, W, F at 3:10.

- The fall departmental course offerings for those of you in need.

- Notice the fall course offerings include history of economic thought with professor emeritus, Jules LaRocque. This could be a one-shot deal as far as history of thought goes for many of you, so you might poke your head in there on Tuesday and see how it sounds.

- The annual CTL workshops for folks looking to bone up on their quantitative skills.

- Schumptoberfest™ is October 22-24 up at the Björklunden facility. I will post more about this later in the week. Those of you interested, should see Professor Gerard (when he gets back; see above).

It’s shaping up as a good year.

Motivating Econ 101

Alex Tabarrok talks to NPR about the story he uses to motivate his 101 class at George Mason. It is a tale of the English shipping their prisoners off to Australia, with the sorry result that many of the prisoners perished during the sea voyage. Yikes. How could they have prevented this sorry fate? Oh, I just wonder.

Alex Tabarrok talks to NPR about the story he uses to motivate his 101 class at George Mason. It is a tale of the English shipping their prisoners off to Australia, with the sorry result that many of the prisoners perished during the sea voyage. Yikes. How could they have prevented this sorry fate? Oh, I just wonder.

Cowen and Tabarrok are authors of an introductory textbook that I am willing to endorse, at least on the micro side. They also blog at Marginal Revolution.

CTL Workshops

Are you confused about matters quantitative? Well, do we have good news for you. The Center for Technology and Learning (CTL) is offering its annual workshops in algebra, graphing, and word problems. The workshops are in Briggs 420 and run 90 minutes.

Algebra Workshop

- 7:30 PM on Wednesday, Sept 15, OR

- 6:00 PM on Monday, Sept 20

The algebra workshop will cover the following topics:

- Basic algebraic operations and the law of exponents

- Binomial multiplication and factorization

- Important algebraic identities

- Techniques for solving quadratic and fractional systems of linear equations

- Basic concepts and identities of trigonometry

Graphing Workshop

- 7:30 PM on Thursday, Sept 16, OR

- 6:00 PM on Tuesday, Sept 21

The graphing workshop will cover the following topics:

- Graphs of linear equations, quadratic equations, exponential functions, trigonometric functions and more…

- Significance of slope in various applications

- Displacement of graphs

Word Problem Workshop

- 7:30 PM on Friday, Sept 17, OR

- 7:00 PM on Wednesday, Sept 22

The word problem workshop will cover the following topics:

- Problem solving strategies useful in working with quantitative concepts

- How to extract useful information from a problem and how to relate similar problems

- Hands-on experience working on interesting and challenging word problems

Carrots or Sticks Redux

A while back we took a look at Daniel Pink’s recent book, Drive: The Surprising Truth about what Motivates Us. Well, actually, instead of reading the book, we waited for the movie version from RSA Animate. For those of you interested in a bit more meat without  actually committing to reading, you might check out his TED talk or even his recent EconTalk interview with the always engaging Russ Roberts.

actually committing to reading, you might check out his TED talk or even his recent EconTalk interview with the always engaging Russ Roberts.

Pink seems to be as pervasive as whatever that pink stuff was in The Cat in the Hat Comes Back. A former speechwriter for Al Gore, he also has a pretty cool website and blog that ranges from the minutiae of the day to his Johnny Bunko career guide.

Looking Ahead

Here’s the rest of the economics schedule for the year:

Winter Term 2011

- ECON 100 Microeconomics 08:30-09:40 MTWF 8:30-9:40 Professor Azzi

- ECON 211 In Pursuit of Innovation 11:10-12:20 MWF Professor Galambos and Professor Brandenberger

- ECON 220 Corporate Finance 1:50-3:00 MWF, Professor Azzi

- ECON 280 Environmental Economics 12:30-2:20 TR, Professor Gerard

- ECON 300 Microeconomics 1:50-3:00 MWRF 9:50-11:00 Professor Galambos

- ECON 380 Econometrics 9:50-11:00 MTWF 9:50-11:00 Professor. Karagyozova

- ECON 400 Industrial Organization 9:00-10:50 TR Professor Gerard

- ECON 465 International Finance 3:10-4:20 MWF Professor Karagyozova

Spring Term 2011

- ECON 100 Microeconomics 9:50-11:00 MTWR 9:50-11:00 Professor Gerard

- ECON 120 Macroeconomics 11:10-12:20 MWRF 3:10-4:20 Professor Karagyozova

- ECON 205 International Economics 3:10-4:20 MWF Professor Karagyozova

- ECON 215 Comparative Economic Systems 9:00-10:50 TR Professor Galambos

- ECON 271 Public Economics 12:30-2:20 TR Professor. Gerard

- ECON 320 Macroeconomics 8:30-9:40 TWRF Professor Finkler

- ECON 410 Game Theory & Applications 12:30-2:20 TR Professor Galambos

- ECON 425 Entrepreneurship & Finance 2:30-4:20 TR Professor Finkler

We will be meeting shortly, so if you have questions about offerings in 2012, please let us know.

Ready or Not

The term is upon us and that means it’s time to start posting things that might actually have some utility for someone (for instance, me).

So let’s start out with an easy one — are you registered yet? No better time to start thinking about it. Here are some potentially useful links:

- Class schedule and schedule search

- Important Dates & Deadlines

- Registration Rules & Procedures

- Getting Help with Registration

- Forms

And, as long as you are registering, you might as well check out our offerings for the Fall term. There is still room as of this posting, unless otherwise noted:

- ECON 100 Microeconomics 9:50-11:00 MWF, Professor Karagyozova (there is a long waitlist)

- ECON 100 Microeconomics 12:30-1:40 MWF, Professor Karagyozova (lots of room as of this posting)

- ECON 170 Financial Accounting 2:30-4:20 TR, Professor Vaughan

- ECON 200 Economic Development 12:30-2:20 TR, Professor Finkler

- ECON 300 Microeconomics 3:10-4:20 MTuWF, Professor Gerard (there is room, trust me)

- ECON 330 History of Economic Thought 2:30-4:20 TR, Professor LaRocque

- ECON 430 Capital and Growth 9:00-10:50 TR, Professor Finkler

- ECON 520 Advanced Macroeconomics 1:50-3:00 MWF, Professor Karagyozova

I will also be offering an independent study associated with Schumptoberfest™ weekend, October 22-24. Check with me for details.

See you on Briggs 2nd.

Extending the Bush Tax Cuts: A Mostly Resounding Yes

The Economist invites a group of economists whether the Bush tax cuts should be extended. For those of you who follow Washington politics, this has been a meat-and-potatoes contentious issue for some time, so I was interested to see what the big thinkers of the profession are saying.

To a man, the answer is some form of yes.

- Tom Gallagher of the International Strategy & Investment Group says, “Yes, but only for a short period.”

- Michael Bordo of Rutgers University says, “Yes, their benefits outweigh their costs.”

- A personal favorite of mine, Alberto Alesina of Harvard, recommends that we “maintain the cuts and reduce spending to trim deficits.”

- Columbia’s Guillermo Calvo exclaims, “Yes!, as the rich will drive recovery.”

- Only Oregon’s Mark Thoma offers a partial dissent, saying “only some, and the saved revenue should be recycled.”

A more complete accounting of the replies here. The responses are quick reads, and are filled with economic logic that you have probably heard somewhere before.

Or at least let’s hope so.

UPDATE: Former Obama OMB director Peter Orszag weighs in in today’s New York Times. More Thoma than Calvo.

Swoopo

Auctions have been around for many centuries, and those who have had some game theory know that there are many kinds. In some, you outbid others by offering more and more for the object being auctioned, in some the auction clock starts with a high price and descends until someone (the winner) yells “stop!” Most auctions have the winner pay the last bid, though some have the winner AND the next highest bidder pay, or even have every participant pay (all-pay auctions). I came across a newly popular type of auction that has been attracting quite a bit of attention. In a pay-per-bid auction, such as swoopo, your every bid increases the price by a set increment (such as one cent), but every bid costs you 60 cents. Some websites claim that these auctions are rip-offs, some advertise the great deals (and iPad for $11, a gold bar for $5, etc.). It’s fascinating to take a look at recently ended auctions on swoopo: here is someone paying $787 ($727 in bids and $60 in the final price) for a smart phone that swoopo says costs $620 and you can get for probably $100 less than that elsewhere. On the face of it, this looks like a large-scale and real-life variant of the dollar auction. What complicates this calculation is that one can bid on “bid packs” on swoopo, so the person winning that phone may have used bids that in fact cost him much less than the face value of those bids. There are only a few academic papers analyzing this new craze. For some interesting theory as well as empirical analysis, take a look at this paper. So how can it be profitable to sell a $100 Visa gift card for $1.98 to someone who used just 96 bids and thus got $100 for $60? Well, for the price to get to $1.98, 198 bids had to be placed. Ignoring the aforementioned possibility to buy bids at a discount, those 198 bids mean an income of 198x$0.60=$118.80. According to the paper cited above, the profit margins for swoopo are astounding.

Art Mart

Although economists as a whole are a pretty imperialistic bunch, the economic analysis of the art world has been a rather undeveloped field of inquiry. One notable exception is Northwestern’s David Galenson, who has published widely on the topic, and even developed a ranking system for the greatest art work based on “visual citations” (number 1 is Picasso’s “Les Demoiselles d’Avignon.”)

Some of Galenson’s recent work examines how artists have earned a living over time and how that has shaped both the nature and creativity of their work. The New York Times piece cited above summarizes this argument:

To Mr. Galenson markets are what make the 20th century completely different from other eras for art. In earlier periods artists created works for rich patrons generally in the court or the church, which functioned as a monopoly. Only in the 20th century did art enter the marketplace and become a commodity, like a stick of butter or an Hermès bag. In this system, he said, breaking the rules became the most valued attribute. The greatest rewards went to conceptual innovators who frequently changed styles and invented genres. For the first time the idea behind the work of art became more important than the physical object itself.

It’s an interesting topic, especially for those interested in innovation and the arts. You might consider checking out Galenson’s book, Conceptual Revolutions in Twentieth-Century Art (available at The Mudd), for a fuller explication. You can read a summation of his argument over at my favorite clearinghouse, VoxEu, or yesterday’s piece in The American.

This might be a good I&E Reading Group selection or a building block for an independent study.

More on Teacher Performance

We recently posted a piece on the controversy surrounding the publication of teacher performance evaluations in Los Angeles. There are a couple of interesting follow ups circulating in our trusted news sources. The first piece is from the always contrarian and sometimes cantankerous Jack Shafer of Slate.com.

Nobody but a schoolteacher or a union acolyte could criticize the Los Angeles Times‘ terrific package of stories—complete with searchable database—about teacher performance in the Los Angeles Unified School District.

You probably don’t need to be a communications major to figure out where that piece is headed.

Shafer rightly applauds the LA Times FAQ page on what value-added analysis is, its strenghts and weaknesses, and other, well, FAQs.

A second piece plucked from the New York Times compares the pros and cons of value-added analysis in a more straightforward fashion. On the one hand:

“If these teachers were measured in a different year, or a different model were used, the rankings might bounce around quite a bit,” said Edward Haertel, a Stanford professor who was a co-author of the report. “People are going to treat these scores as if they were reflections on the effectiveness of the teachers without any appreciation of how unstable they are.”

On the other hand:

William L. Sanders, a senior research manager for a North Carolina company, SAS, that does value-added estimates for districts in North Carolina, Tennessee and other states, said that “if you use rigorous, robust methods and surround them with safeguards, you can reliably distinguish highly effective teachers from average teachers and from ineffective teachers.”

Certainly, the two sides each have a point. Even as a man of numbers (or perhaps, especially as one), I worry that people put too much faith in a quantitative rating. That said, it seems the cat has squirmed its way out of the bag on this one, and it is going to be difficult for opponents to get it back in.

Nathan Myrhvold is Really Cooking

Some of you may recall my earlier post on Nathan Myrhvold, one of the great renaissance men geniuses of our age. I follow that here with a tip to check out his TED talk on what he’s been up to of late. His topics range from animal photography of spawning whales to digging up dinosaurs to cooking up some world-class barbecue. (As an aside, the first few minutes on penguins is scatologically hilarious).

Mr. Myrhvold is back in the news for his new $500 cookbook that looks absolutely fantastic. As one of my friends puts it, “It’s exactly the kind of cookbook you’d expect the CTO of Microsoft to write.” The cookbook stems from a long-running interest in cooking, including taking a leave of absence from Microsoft to go to chef school if France. In his TED talk, he shows a picture of the cooker he’s engineered that he claims is more complicated than the nuclear reactor he designed.

If the cookbook is $500, I wonder what the oven goes for? And, is there anyone other than Myrhvold that can repair it?

Landsburg on Reinhart on Efficiency

Last week, Professor Finkler posted some preliminary thoughts on Uwe Reinhart’s “Is ‘More Efficient” Always Better?” This week, everybody’s favorite textbook author, Steven Landsburg, chimes in with a nice exposition on why it’s worthwhile for economists to beat the drum for efficiency analysis.

First, emphasizing efficiency forces us to concentrate on the most important problems. Second, emphasizing efficiency forces us to be honest about our goals.

He then runs through some nice examples (that Econ 300 students will be looking at when we get to Chapter 9), and concludes with this:

The advantage of an efficiency analysis (along, say, the lines suggested here) is that it would force Professor Reinhardt’s colleague to be clear about his priorities. Is he, for example, concerned primarily about increasing current output or about redistributing current output? Either might be a worthy goal, but we can’t have a useful debate with someone who won’t tell us what his goals are.

Wow, I’m getting excited just thinking about this.

10 Mistakes That Start-Up Entrepreneurs Make

For this piece, I refer you directly to Rosalind Resnick’s guest column in today’s Wall Street Journal. For those of you who have taken an entrepreneurship course, I’ll highlight numbers 9 and 10.

9. Not having a business plan

10. Over-thinking your business plan

Climate Change Updates

As far as I know, the climate is still changing, so nothing to update there. According to economists Matthew Kahn and Matthew Kotchen, however, we don’t seem to care as much about it (if “googling” is a good proxy for “caring”, that is). Ed Glaeser discusses this and some more of Kahn’s research in today’s NYT Economix blog post. One of the provocative points is the claim that climate change is a done deal, and that the big coming challenge is to adapt.

One person swimming against the apathy tide is the self-proclaimed skeptical environmentalist, Bjørn Lomborg. For years, Lomborg has been publishing pieces questioning the scale and scope of environmental problems. He has now reversed course and is calling for massive investments to tackle the problem. From my quick read, the tackling seems to be on the emissions side, as opposed to adaptation.

Anyone who has sat through my carbon capture and sequestration talk certainly knows I’m with the adaptation folks on this one. I simply am not convinced that the world can cut emissions enough to stabilize atmospheric concentrations, even under the most wildly-optimistic scenarios.

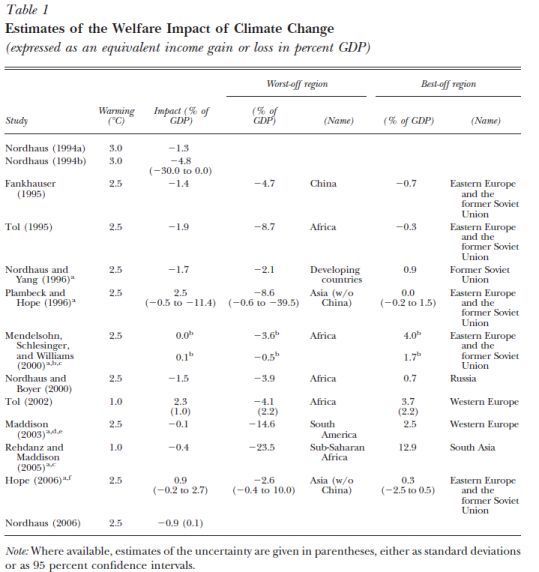

For a bit more meat on the climate change discussion, check out a recent symposium in the Journal of Economic Perspectives. Here’s a table of estimated net benefits across 13 studies.

Notice the overall impacts in terms of GDP per year seem to be on the order of -1% per year, though the estimate from the review author’s article (Richard Tol) shows net gains. You might also take note as to which countries are likely to win and lose in these estimates, and take that into account next time countries sit down to hammer out an agreement.

Should be an interesting century.

The Worst May Not Be Behind Us

Two days ago, I posted James Hamilton’s blog entry on Friday’s GDP numbers and suggested that the 1.6% growth in GDP was not as depressing as it might seem. Primarily, I noted that inventory growth had slowed and imports had risen. The latter might be viewed as demonstrating renewed economic strength whether the imports reflect increased household consumption and household income (which they do) or increased business purchases of intermediate inputs (which they also do.)

In today’s Financial Times, economists Carmen and Vincent Reinhart summarize their address given last week at the Kansas City Feds’ annual symposium which features central bankers from all over the world. The Reinharts warn us that financial crises of the sort we are emerging from do not generate robust rebounds.

Such optimism, however, may be premature. We have analysed data on numerous severe economic dislocations over the past three-quarters of a century; a record of misfortune including 15 severe post-second world war crises, the Great Depression and the 1973-74 oil shock. The result is a bracing warning that the future is likely to bring only hard choices.

But if we continue as others have before, the need to deleverage will dampen employment and growth for some time to come.

Although aggressive use of fiscal and monetary policies may be necessary to avoid the risks of economic depression, they are no substitute for changes in expectations and economic structure required to find a stable long term economic growth path. Attempts to avoid such “creative destructive” will only deepen the cost of the inevitable adjustment that must take place.

Austrian Economics and Politics

The Wall Street Journal profiles one of the standard bearers of Austrian economics, Pete Boettke of George Mason University, who blogs at Coordination Problem. The title of the piece is is “Spreading Hayek, Spurning Keynes,” so you know where he’s coming from. This, of course, is a topic we have touched on before.

The blog wasn’t always called Coordination Problem, either.

The resurgence of Austrian economics does have its hazards, Mr. Boettke says. The antigovernment fervor on cable-television shows and the Internet may have popularized its theories, but it also “reinforces the idea to critics that these are crackpot ideas,” he said. He has tried to distance himself from conspiracy theorists and even dropped “Austrian” from the name of his blog. But he hasn’t yet thought of a better term.

If you are unfamiliar with the Austrians, here’s Bottke’s description of Austrian economics at The Library of Economics and Liberty. We also have Israel Kirzner’s take from the New Palgrave Dictionary of Economics, available from campus IP addresses (thanks to the good folks over at The Mudd).

Kirzner is an especially important thinker about entrepreneurship, so those of you interested might take a peek at what he has to say. You might also check out Peter Klein’s The Capitalist and the Entrepreneur, which is some of the most mature work fusing the Austrian school with transaction cost economics.

Not that Depressing!

On Friday, the second report on 2nd quarter GDP was released; it displayed GDP growth at 1.6% instead of 2.4%. The decline came from a downward revision in inventory buildup and an upward revision in imports. James Hamilton in his Econobrowser posting argues that the report suggests that the economy is still moving upwards though at a modest pace. It does not suggest a double dip recession. Hamilton provides some nice charts and tables to tell the tale. Check it out.

Color Me Impressed

The Denver Post has some way cool photos back from the early days of color photography. From potato pickers in Caribou, Maine to fishing in the swamp in Belzoni, Mississippi to homesteaders in Pie Town, New Mexico, these shots are generally fascinating.