There is a continuing debate, as you must know by now, as to whether Keynesian fiscal stimulus is an effective macroeconomic policy tool, especially with the US economy stuck in its current doldrums. There is probably no bigger detractor to this idea than Robert Higgs of the Independent Institute. Many on the Keynesian side say the $750 billion fiscal stimulus wasn’t big enough.

Higgs argues that the whole Keynesian paradigm is out of whack, that, in fact, more robust governmental involvement in times of a crisis creates pervasive uncertainties for the private sector. This “regime uncertainty,” whether it be from potential tax increases or other regulatory hurdles, shakes investor confidence and stifles capital formation. Who is going to play a game when the rules of the game are subject to potentially radical change?

Those of you who have taken Economics 240 might recall Higgs’ “ratchet effect,” but he is perhaps better know for this regime uncertainty idea. Higgs forwarded some of these arguments in the Journal of Economic History, and has recently bolstered it both in the Independent Review. He doesn’t see this as a unifying macro theory, but more as an element that is generally ignored (or ridiculed) by many macro theorists.

You can also catch Higgs talking about these issues with Russ Roberts on EconTalk.

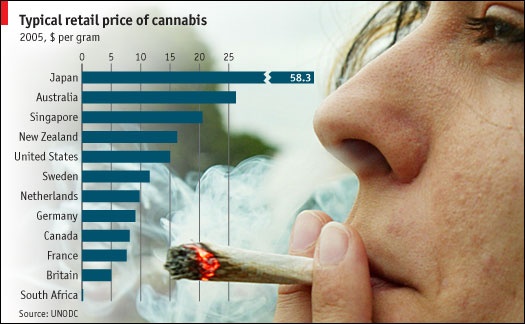

It is a good couple of weeks for those interested in the economics of (and innovation in) illicit drug markets. First, HBO started up its mega super miniseries,

It is a good couple of weeks for those interested in the economics of (and innovation in) illicit drug markets. First, HBO started up its mega super miniseries,

We would like to engage students who have a good understanding of micro theory and are interested in innovation and entrepreneurship. The readings dovetail nicely with my Economics 400 (IO) and 450 (theory of the firm) courses.

We would like to engage students who have a good understanding of micro theory and are interested in innovation and entrepreneurship. The readings dovetail nicely with my Economics 400 (IO) and 450 (theory of the firm) courses.