As some of you may know, a number of states have legalized the sale and use of marijuana for general (that is, non-medicinal) purposes. For your weekend reading pleasure, I give you a theoretical and empirical assessments of what has happened since the votes were counted. First up is EconoMonitor‘s Ed Dolan, who diagnoses the mystery of the missing marijuana in his home state of Washington, complete with some tasty supply & demand diagrams. Dolan sees “government failure in the making”, as overzealous licensing requirements and prohibitive taxes work together to keep the market thin.

A little-ways east, however, the Colorado market has been blossoming, and there are some early empirical assessments of the results (see here for the story and here for the report). Is it not surprising that actual demand is 30-90% higher than the “experts” projected? Tough to say. Paging through the report, I see that 20% of the users account for roughly 70% of total demand, a familiar phenomenon. Taking that a step further, there are approximately 175,000 adults who smoke 21+ times per month, and these folks on average consume more “per time” than the less dedicated users (a lot more, it turns out).

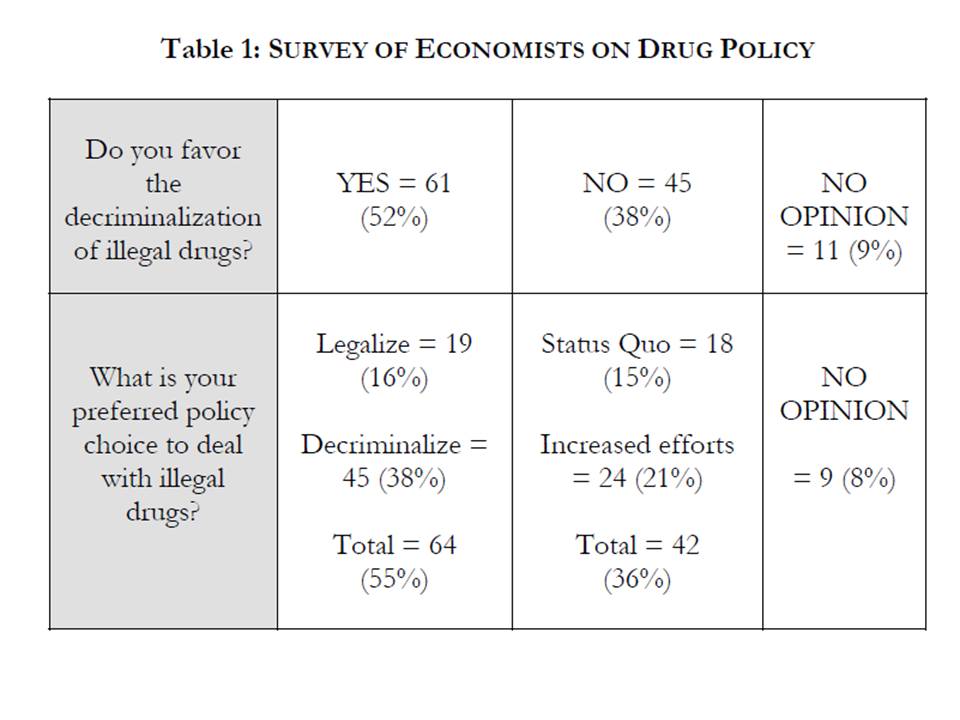

You can see more on economists’ views of drug prohibition and legalization in one of our previous posts.

It is a good couple of weeks for those interested in the economics of (and innovation in) illicit drug markets. First, HBO started up its mega super miniseries,

It is a good couple of weeks for those interested in the economics of (and innovation in) illicit drug markets. First, HBO started up its mega super miniseries,