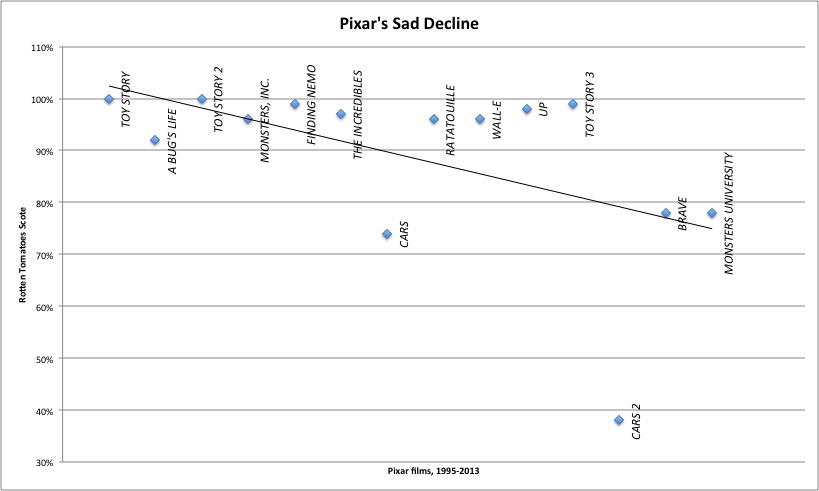

The generally “meh” critical response to the recent release, Monsters U, prompted The Atlantic to post a piece on the “sad decline” of the Pixar dynasty. Using Rotten Tomatoes approval data, Christopher Orr charts the trend toward mediocrity(though, in this market, mediocrity might be the best you can ask for). At any rate, Pixar generally produces “kids” movies, and the folks at Slate.com took the novel approach of actually asking the kids what they thought.

Shockingly, it turns out that kids and the critics don’t always see eye-to-eye on movie ratings. The biggest divergence seems to be with A Bug’s Life, a charming tale of a bug’s life featuring the voices of Dave Foley, Kevin Spacey, and Denis Leary (what kid doesn’t love Denis Leary?). More than 90% of critics rated this one fresh, whilst the kids covered the screen with maters, with an approval rating in the mid-30s.

Ouch.

In a similar vein, the critics fell all over themselves praising Finding Nemo, whereas kids were split down the middle in their approval of this mother-killing fish tale.

The critics were not thrilled with Cars (just over 70% approval), but kids loved it even less (just under 50%). I’m not sure I believe those numbers, actually, given the pervasiveness of Cars stuff (though the little girl quoted in the post title does make a compelling point). I do believe the second set of numbers, however, regarding Cars 2. The critics panned this hyper-violent Bond-esquey schlock (40%), whereas more than 70% of kids gave it a fresh rating (12-year old girls notwithstanding). My boy walked out of the theater laughing about “all the guns”. Huh.

When you add it all up, the approval trend is going quite the opposite for Pixar’s appeal to kids compared to its appeal to critics, which probably has a lot to do with its “sad demise”.