The American Power Act is the latest climate bill making its way through the Senate. For both of my classes this term we have talked about the tradeoffs between policies that economists like and policies that might have a chance of passing. Ted Gayer at Brookings definitely puts the APA in the latter camp:

The American Power Act is the latest climate bill making its way through the Senate. For both of my classes this term we have talked about the tradeoffs between policies that economists like and policies that might have a chance of passing. Ted Gayer at Brookings definitely puts the APA in the latter camp:

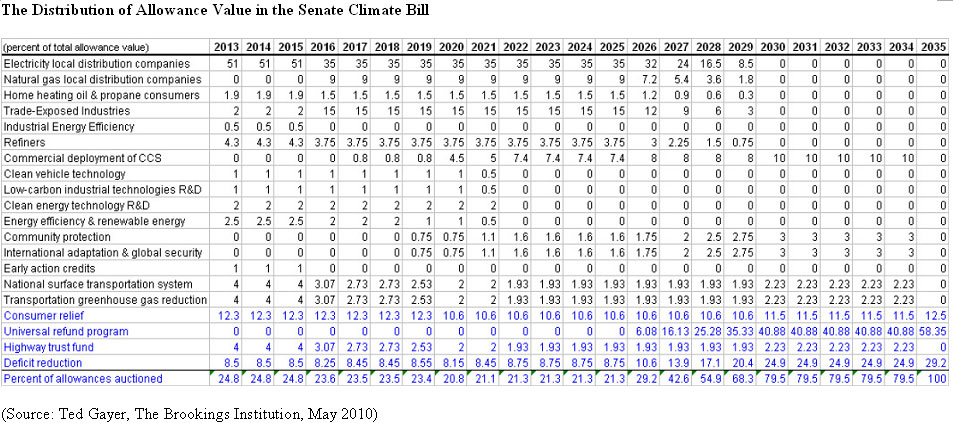

The bill auctions only 24.8 percent of the allowances in the early years (the share devoted to auctions is highlighted in blue), the remainder of the allowances being given away to such things as electricity local distribution companies, trade-exposed industries, refiners, commercial developers of carbon capture and storage, and a National Industrial Innovation Institute. The auctioning ramps up to 79.5 percent of allowances in 2030, and then full auctioning only occurs in 2035

And concludes:

By failing to use a full allowance auction to offset economically harmful taxes and deficits, the Senate bill sacrifices economic gain for political support from interest groups.

Robert Stavins, on the other hand, seems to look up at the sky and see a different color. Stavins is perhaps the most prominent environmental economist in the field, and he seems pretty upbeat about the whole thing:

Over the entire period from 2012 to 2050, 82.6% of the allowance value goes to consumers and public purposes, and 17.6% to private industry. Rounding error brings the total to 100.2%, so to be conservative, I’ll call this an 82%/18% split.

I’m going to have to side with Gayer on this one. It may well be the case that on average the “value” goes to some “public purposes,” but it sure doesn’t seem that way looking at the early splits (Here’s the blown up version for those of you preparing to squint).

For the first 13 years of the program, more than half of the allowances are going to industry, it appears. Not until 2025 do we see the industry percentage phased out (rapidly) and the auction percentage jump (also rapidly). So, to put it another way, today’s Congress is committing the 2025 Congress to implement the tough changes that will accompany climate change. I am going to put the odds on this commitment being credible as “improbable.”

Gayer doesn’t seem to plot the distribution from 2035-2050 at all, so my guess it is in those years that “public purposes” really get fed with the auction market.

Clearly, most economists will tell you that there is pain associated with turning over a capital stock, so there is good reason to ease the transition in this fashion for other than nakedly political reasons. We call this a ramp, I believe. On the other hand, it seems a bit disingenuous to claim that 82% of the benefits flow to consumers when the benefits are back loaded in this fashion.

The last thing about this is the nature of the value of the permits in the first place. It seems to be that what a cap-and-trade system does is increases the costs of producing goods based on the carbon intensity of the production process. With electricity generation, for example, this would (possibly) lead to some pass-through and result in higher electricity prices. Consumers pay higher prices, but some permits are cashed in and rebated to consumers, generating consumer “value.”