Economist Steven Landsburg famously claimed that economics can be defined in two words: “incentives matter.” For Landsburg, all else is commentary. In a 2013 book entitled The Why Axis, Uri Gneezy and John List explore in detail how incentives matter. Characterizing economics as a behavioral science, they seek to understand what affects individual behavior based on exploring various incentives and contexts. In particular, they use field experiments to illuminate which incentives matter and how through examples drawn from a number of policy areas including child day care, school performance, charitable giving, gender-related compensation, and health care. For more including a few examples, go here.

Tag: Economics is what economists do

“There has never been a more interesting time to be an economist, I think”

Quora is a website dedicated to “sharing and growing the world’s knowledge.” Ask a question, and the good folks at Quora will find someone with first-hand knowledge to answer it.

Today’s contribution to sharing and growing is “Why do technology companies hire economists?”

My response, of course, is Who wouldn’t want to hire an economist?. This response was unsatisfying enough that Quora asked Susan Athey, Professor in the Economics of Technology at Stanford’s Graduate School of Business, to address the question. Here is my condensed version of her response.

This is a great time for economists in tech companies—the most interesting firms in Silicon Valley are hiring chief economists as well as economic teams at a very rapid clip….

Each tech company, and each chief economist, is different, but there are several main categories. First are microeconomic issues involved in pricing and product design… Second is corporate strategy… Third is public policy… Fourth, and closely related, are direct legal and regulatory challenges — antitrust/competition policy issues and regulatory investigations.

More junior economists have a wide variety of roles in tech firms. They can take traditional data science roles, be product managers, work in corporate strategy, or on policy teams. They would typically do a lot of empirical work.

My emphasis (see also, here).

I was particularly interested in this nugget about why economists might be particularly valuable in a room full of data:

I have found that economists bring some unique skills to the table. First of all, machine learning or traditional data scientists often don’t have a lot of expertise in using observational data or designing experiments to answer business questions. Did an advertising campaign work? What would have happened if we hadn’t released the low end version of a product? Should we change the auction design? Machine learning is better at prediction, but less at analyzing “counter-factuals,” or what-if questions. (I’m currently doing a lot of research on modifying machine learning methods to make them more suitable for causal inference).

Click through for her complete answer to the original question, along with her insights on Bitcoin, the impacts of machine learning on economic science, the potential benefits of collusion, and some elaboration on her contention that “there has never been a more interesting time to be an economist.”

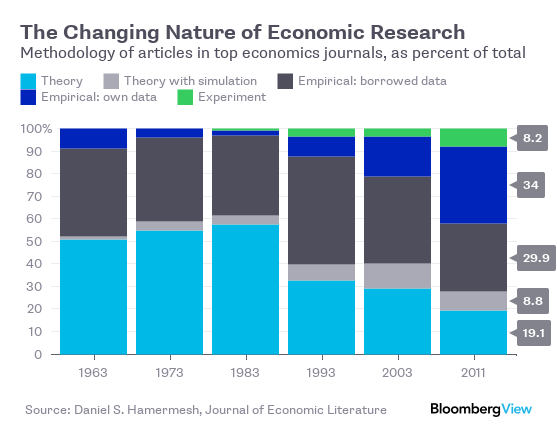

Economics is What Economists Do

The post title is, of course, from the late, great Jacob Viner, who tells us that it isn’t totally easy to characterize exactly what it is that we economists do. The alive, possibly great Daniel Hamermesh from the University of Texas has been making some headway on cataloging exactly what that is. And, increasingly, it appears that the top journals are featuring more empirical work and less theory.

Justin Fox at Bloomberg tells us all about it.*

Or just look at the picture:

Is this part of the big data revolution we’ve been hearing so much about?

Potentially more interesting is that experimental makes up almost 10% of the total.

* Actually, Hamermesh published the paper several years ago, but I guess the news cycle is slow getting around to reading the Journal of Economic Literature.

We did a Similar Post Last Year

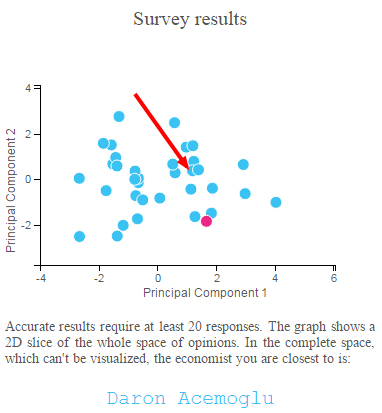

The 2015 edition of the eponymous Which Famous Economist are you Similar to? interactive tool is now available, and once again — though once again I probably shouldn’t be telling you this — yours truly has been paired with Daren Acemolgu. (Acemoglu, as you possibly know, is the MIT superstar economist who is the subject of the Daren Acemoglu Facts tumblr page, chock full of economist “humor”).

As far as the Which Famous Economist site goes, the data are from the University of Chicago’s IGM Economic Experts Panel, which periodically surveys many economists on issues of the day. The matching is done via principal components, which is somewhat ironic, given principal-component modeling isn’t really part of the economist’s standard canon of quantitative tools.

If you decide to take the poll, I recommend that you leave the questions you haven’t thought about (or don’t know anything about) blank. The authors say that “accuracy” requires at least 20 responses out of the 30 questions.

I’m the red dot, and the arrow points to Professor Acemoglu. Robert Hall and José Scheinkman are the dots closest to mine, and you can read the explanation for why I was not paired with one of them in the figure’s legend.

The site also allows you to highlight where your views differ from the consensus view (I have a higher opinion of my peers’ knowledge of book prices, for example.) It also contains a correlation matrix for each economist in the survey pool — all are positively correlated!

See you next year.

2015 American Economic Association Meetings

Every January, thousands of economists gather for the American Economic Association meetings, to present papers, discuss ideas, and hire new faculty members (!). Leave it to Nate Silver and his Five Thirty Eight website to send correspondents to cover the proceedings and reports back on what they consider to be the interesting sessions. These reports include session summaries of Behavioral Economics and Public Policy: A Pragmatic Perspective; The Economics of Secular Stagnation; and A Discussion of Thomas Piketty’s “Capital in the 21st Century”. Here is what the last one looks like:

Session Title: A Discussion of Thomas Piketty’s “Capital in the 21st Century”

Presenters: David Weil, Alan J. Auerbach, N. Gregory Mankiw, and Thomas Piketty

Key takeaway: Thomas Piketty, the French economist whose book Capital in the 21st Century — which documented a surge in economic inequality — was a surprising best-seller last year, stood by his work despite some academic economists questioning his statistical analysis and policy recommendations.

Discussion: In his book, Piketty argues that inequality rises when the rate of return on assets (“r”) is higher than the economy’s growth rate (“g”). To him, this is, the principal cause of the current high levels of inequality. He wants to tax wealth to reduce this inequality.

The other economists on this panel had some problems with Piketty’s data, but even more so with his analysis of rising inequality. Specifically, they thought Piketty overestimated “r” in not adjusting for other variables such as taxation and risk.

They further argued that even if he was right, they disagreed with his suggestion for a global wealth tax. Instead, they would favor a progressive tax on consumption — for example, an 80 percent tax on yachts.

Piketty responded that it’s hard to define and measure the consumption of the extremely rich. As he remarked, “billionaires consume more than food or clothes — they consume power, politicians, journalists, and academics.” He argued that a wealth tax has practical advantages over a progressive consumption tax: it’s easier to implement because wealth is easier to define.

Not surprisingly, the Five Thirty Eight correspondents gravitated to some of the high-profile sessions where some of the bigger names in the profession participated. The secular stagnation session, for example, includes Greg Mankiw, William Nordhaus, Larry Summers, and Robert Gordon, each “famous” in his own right.

If the titles above have piqued your interest, you can go to the AEA website and check out webcasts of selected sessions, including each of the sessions listed above.

Econo Life, It’s Super Fun!

John Cawley has updated his indispensable paper for young Ph.D. economists searching for new positions, “A Guide and Advice for Economists on the U.S. Junior Academic Job Market: 2014-2015 Edition.” Though I realize most of the paper is irrelevant for this (or any) audience, these facts are remarkable:

[A]lmost everyone lands a job that they like…. In fact, National Science Foundation data indicate that Ph.D. economists have the lowest unemployment rate (0.9%) of any doctoral field, as well as one of the highest median salaries of any doctoral field. Finally, the vast majority of people are happy with the outcome of their search. Of the new Ph.D. economists in 2001-02, 94% reported that they liked their jobs very much or fairly well.

My emphasis because, Wow! Those of you interested in pursuing a Ph.D. in economics, applied economics, agricultural economics, law & economics, or public policy, should consider having a chat with several members of our faculty.

For our previous coverage, see here.

Getting a Ph.D. in Economics

Over the next few weeks, we will be compiling some resources for those of you who are interested in doing graduate work in economics. Certainly, your first stop should be to talk with one or more of your professors (especially the economics professors, I suppose). The American Economic Association is probably your next stop.

Over the next few weeks, we will be compiling some resources for those of you who are interested in doing graduate work in economics. Certainly, your first stop should be to talk with one or more of your professors (especially the economics professors, I suppose). The American Economic Association is probably your next stop.

You might also check out the Miles Kimball / Noah Smith essay on the economics Ph.D.

I have this on my mind because I just received Stuart Hillmon’s Getting a Ph.D. in Economics in the mail. If you care to take a look at the book, you can come by and I’ll loan it to you.

Tyler Cowen comments.

Again?

The Wall Street Journal reports that “Corporate Economists Are Hot Again.”

This:

With more data available than ever before and markets increasingly unpredictable, U.S. companies—from manufacturers to banks and pharmaceutical companies—are expanding their corporate economist staffs. The number of private-sector economists surged 57% to 8,680 in 2012 from 5,510 in 2009, according to the Bureau of Labor Statistics. In 2012, Wells Fargo had one economist in its corporate economics department. Now, it has six.

And this:

The key to the revival of in-house economists, companies and economists say, is the need to digest huge amounts of data—from production volumes in overseas markets to laptop usage in urban areas—to determine opportunities and risks for companies’ business units, not just in the U.S. but around the world.

As those of you who read this blog probably already know, we think that life as an economist is pretty awesome. And it’s not just us saying it, either. Here’s Noah Smith from the Noahpinion blog who says it thusly:

People often ask me: “Noah, what career path can I take where I’m virtually guaranteed to get a well-paying job in my field of interest, which doesn’t force me to work 80 hours a week, and which gives me both autonomy and intellectual excitement?” Well, actually, I lied, no one asks me that. But they should ask me that, because I do know of such a career path, and it’s called the economics PhD.

“What?!!”, you sputter. “What about all those articles telling me never, ever, never, never to get a PhD?! Didn’t you read those?! Don’t you know that PhDs are proliferating like mushrooms even as tenure-track jobs disappear? Do you want us to be stuck in eternal postdoc hell, or turn into adjunct-faculty wage-slaves?!”

To which I respond: There are PhDs, and there are PhDs, and then there are econ PhDs.

The emphasis is mine and I scrubbed the links, but the sentiment remains. A highly recommended read for the thinking-about-a-Ph.D. set.

The Price of Economists Would Go Down?

Two Economists Walk Into a Bar…

When the indefatigable Saturday Morning Breakfast Cereal weighs in on economists, hilarity ensues.

Economists are further ridiculed here and also here. Oh, and here, too!

We are somewhat more heroic in this piece, I’d say! (For an explanation of the value of a painting vs. the value of grandma, see here. And then see here).

Thanks to Mr. T. for the tip.

No, Really, It’s Hard to Predict Stock Prices

The Economist and Vox each have nice pieces up on what economists do and do not agree upon. To take the second part first, the piece from Vox shows that there is a pretty large degree of consensus on this issues.

What this shows is that out of about 80 questions, economists completely agree on just over 30 (about 40%) and agree between 90 and 99% of the time on about three of four questions. There are very few things that economists don’t generally agree upon, and those appear to be issues where “little” research has been done by anyone. Where research has been done, economists seem to agree on pretty much everything.

Next, we find out some of the central issues where not only do we do agree, we adamantly disagree with the conventional public view. For example, we all seem to agree that it’s hard to predict stock prices! (Who knew?!?). I think we are disabused of the notion early on when we sit down with our pet scheme and lose our shirts. My “investments” tutorials typically go something like this — “put your money in an index fund.”

We also agree that price instruments are better than fuel economy standards (I’ve been saying that for years), that supply & demand factors drive oil prices, and “buy local” policies don’t save jobs, among other things. It’s interesting to me that when it comes to net benefits of the stimulus, our views dovetail with the public views (i.e., who knows).

We previously posted about this important topic right here.

Our Annual Holiday Message: Give Her Something Expensive and Useless

Although most of LU is closed today due to the blizzardy conditions, the Lawrence Economics Blog trudges ahead. And, what better way to celebrate the snowfall than to look ahead to the holiday gift-giving season? As last year’s economists’ buying guide went over so well, I’ve decided to repost it here. So here we go…

It’s that time of year where we bid you Happy Holidays from the Economics profession.

Up first, we have a truly heroic figure, Joel Waldfogel, author of Scroogeonomics.* I don’t know your preferences as well as you do, so whatever I give you is probably sub-optimal, unless you tell me exactly what you want. And even then, wouldn’t you rather just have the cash anyway? For those of you intermediate micro students, you know that kids prefer cash over any in-kind equivalent.

Kudos to Professor Waldfogel for willing to be “that guy.”

Speaking of Scrooge, was he really such a bad guy? Not so, says Steven Landsburg. Let’s give it up for our annual Scrooge endorsement from this classic Slate piece:

In this whole world, there is nobody more generous than the miser–the man who could deplete the world’s resources but chooses not to. The only difference between miserliness and philanthropy is that the philanthropist serves a favored few while the miser spreads his largess far and wide.

If you build a house and refuse to buy a house, the rest of the world is one house richer. If you earn a dollar and refuse to spend a dollar, the rest of the world is one dollar richer–because you produced a dollar’s worth of goods and didn’t consume them.

Ah, I just feel all warm and fuzzy inside.

Moving on to The Atlantic, where we have “The Behavioral Economist’s Guide to Buying Presents.” Now this is some truly indispensable advice. Like Waldfogel above, the money point is to just give money. But, for the true romantics who feel compelled to give a gift, the behavioralists recommend this:

Buying for a guy? Get him a gadget. Buying for a girl? Get her something expensive and useless.

The gadget I get.** The expensive and useless? That’s from Geoffrey Miller’s, The Mating Mind. Here’s a brief explanation of courtship:

The wastefulness of courtship is what makes it romantic. The wasteful dancing, the wasteful gift-giving, the wasteful conversation, the wasteful laughter, the wasteful foreplay, the wasteful adventures. From the viewpoint of “survival of the fittest” the waste looks mad and pointless and maladaptive… However, from the viewpoint of fitness indicator theory, this waste is the most efficient and reliable way to discover someone’s fitness. Where you see conspicuous waste in nature, sexual choice has often been at work.

This presents something of a conundrum because “expensive and useless” seems to be at odds with Waldfogel’s hyper-utilitarian cold, hard cash suggestion.

Last year I suggested that we could solve the puzzle by giving her Euro!, but it seems that the EU keeps plodding along. Perhaps a holiday shrub?

…

* The book is a follow up to the classic, “The Deadweight Loss of Christmas.” Clearly, the book title Scroogonomics can be chalked up to the value-added of the publishing house.

**Conceptually, that is. I generally get ties and socks.

Do You Expect Me to Talk?

Welcome to winter break. One of the great things about returning home is that your family and friends can share not only in the new, colorful personal habits that you’ve picked up on campus, but also in the fruits of the valuable analytic skills that you have developed here at Lawrence.

And what better way to get that conversation jump started than to break down which Bond villains had plans that actually made economic sense?

Economist Jean-Jacques Dethier gets us started. Here — right on schedule — is a taste of analysis of the evil scheme of one Christopher Walken in A View to a Kill:

Plot: Max Zorin (Christopher Walken) wants to secretly trigger a massive earthquake that will destroy Silicon Valley. This will then allow him and his investor allies to monopolize the microchip manufacturing market.

Plausibility: “As far as I know, microchips aren’t actually manufactured in Silicon Valley,” says Dethier. “They’re made all over the world, in China and other places, though the guys who commission the work may be in Silicon Valley.” Therefore, while taking out Silicon Valley would obviously be cataclysmic for the tech industry, he notes, it also wouldn’t entirely remove your competitors, and wouldn’t ultimately affect manufacturing that much.

Ah, pity Zorin didn’t commission a five-forces analysis.

Via the Cheap Talk blog.

UPDATE: Tyler Cowen has weighed in.

Gordon Tullock on Voting

As we wind down 3+ years of the presidential campaign, we stop to talk about the basic economics of voting. And if you’ve ever heard an economist talk about voting, you’ve probably heard of Gordon Tullock.

Here’s Professor Tullock in epic curmudgeon mode giving a three-minute pep talk for tomorrow’s election. He explains that he doesn’t vote because the chance that his vote will “matter” — in the sense that it is pivotal — is zero. In other words, he doesn’t vote because the likelihood of his vote being decisive is essentially zero. If that one guy who always sleeps through my classes also happens to sleep through the election, that one abstention will not affect who wins on Tuesday.

Of course, this prompts the response that starts something like “If everyone thought that way…”, to which Tullock responds:

“Suppose nobody voted?…. If nobody else voted I would vote… And the fewer other people vote, the more likely I am to vote.”

Again, here’s the Tullock video.

You think we’re kidding? Here’s more in the same vein from the Freakonomics site.

Better Late than Never, I Say

But why are economists, once thought to be humorless practitioners of the “dismal science” suddenly becoming celebrities? Since when did they become gurus to whom ordinary people can turn to for everyday-life advice?

That’s from “Rise of the Celebrity Economist,” at Salon.com.

If you have to ask why, then my guess is that you aren’t going to get a very flattering portrait.

“Economists are in surprising agreement about surprising statements”

Continuing our series of posts about what economists believe, my colleague reminds me of the list at the beginning of Deidre McCloskey’s text, The Applied Theory of Price, available free for download!

Here’s McCloskey in all her rhetorical glory:

Considering the obstacles, economists agree about a surprisingly large number of things. Their agreements, in fact, are often about things that noneconomists would think silly or wrong or even evil. That is, economists are in surprising agreement about surprising statements…

The list of surprising agreements is a long one. Most of the 20,000 or so members of the American Economic Association would answer yes to questions such as:

- If gasoline is taxed to conserve energy, will the quantity consumed go down by a nontrivial amount, despite the protestations of drivers that they cannot do less than the amount they are now consuming?

- Was the rise in the standard of living of the American worker over the last 50 years chiefly a result of better knowledge and more machines rather than of activity by trade unions?

- Is the American Medical Association, far from being a benevolent organization set on improving medical care, in fact a monopolistic trade union like the plumbers, longshoreman, and electricians?

- Does the resting place of the burden of the social security tax depend exclusively on how workers and employers react to a change in wages, and not at all on the legal division of the tax (paid half by workers, half by employers)?

- Is there an optimal amount, greater than none, of polluted air and water, noisy streets and airports, and ruined countrysides?

Although the text was written more than thirty years ago (!), the policy issues still seem rather germane — the burden of social security taxes, energy conservation, rising standards of living. I like the bit about the longshoreman.

McCloskey does not weigh in here on drug legalization, but my guess is that she would argue that economists would agree on certain aspects. First, decriminalization or legalization would definitely lead to more drug use, due to both supply and demand increases. Second, the level of violence associated with organized crime and others would decrease. What there appears to be no consensus on in whether the goods outweigh the bads, or if the distributive implications are desirable, or even whether we want to be a society that “endorses” drug use.

That, my friend, is the classic positive v. normative distinction.

Do Economists Favor Drug Legalization?

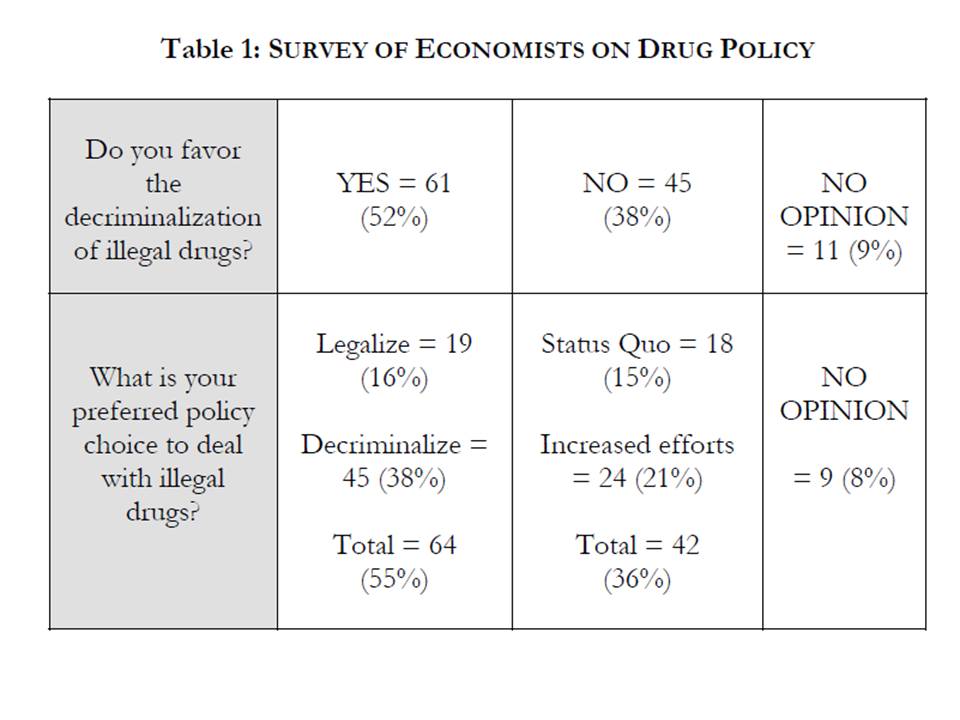

In our usually dormant comments section, Dr. T has questioned whether economists really overwhelmingly favor drug legalization, a claim made in a recent NPR segment. To address this concern, I consulted the Econ Journal Watchand its on-point article from Mark Thorton “Prohibition vs. Legalization: Do Economists Reach a Conclusion on Drug Policy?”

From the abstract:

A random survey of professional economists suggests that the majority supports reform of drug policy in the direction of decriminalization. A survey of professional economists who have published on the subject of drug prohibition and expressed a policy judgment indicates an even greater consensus which is critical of prohibition and supportive of policy reforms in the direction of decriminalization, and to a lesser extent, legalization.

Thorton concludes that there is in fact no consensus, and after taking a look at his summary statistics, I’d have to agree. That said, it does appear that there is solid support for some form of liberalization.

You can check the article to see some snippets from “vital” economists such as Robert Barro, Gary Becker, David Henderson, Jeffery Miron, and William Niskanen.

You can check the article to see some snippets from “vital” economists such as Robert Barro, Gary Becker, David Henderson, Jeffery Miron, and William Niskanen.

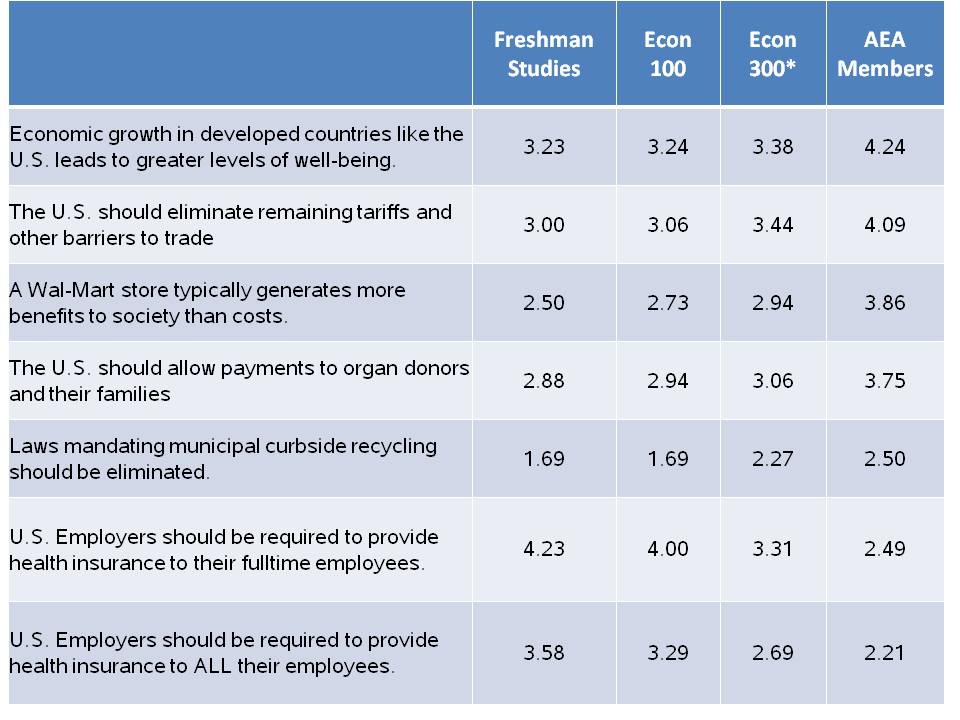

Lawrence Students v. Card-Carrying Economists

In the previous post, I mentioned the Robert Whaples survey of American Economic Association (AEA) members on their public policy views. Of course, Whaples isn’t the only one with access to Survey Monkey, and with the help of some of my colleagues, we gave the same survey to students in Freshman Studies, Economics 100, and Economics 300 courses.

The Freshman Studies sample (n=26) should be fairly representative of incoming freshman population, as every student takes freshman studies and these students are allegedly distributed randomly across the sections. I have data from two sections with a 90% response rate. The Econ 100 course is predominantly freshman as well, but is a much different cross section of the University, with 70% planning to major in economics or some other social science. The Econ 300 is, of course, generally for students taking the first “major” step to joining Team Econ down here on Briggs 2nd. It is well-worth noting that the Econ 100 (n=35) and Econ 300 students were surveyed at the beginning of the course,* not the end. Perhaps next year we will switch that up.

The survey participants rate the questions on a 1-5 scale, with 1 being strongly disagree and 5 being strongly agree.

Here are selected results, sorted by the scores of AEA members:

Continue reading Lawrence Students v. Card-Carrying Economists

Finally, Something We Can Agree On

You have probably heard about the exasperated President Truman asking for a “one-handed economist” because all of his economics advisers were prone to saying “on the one hand… on the other hand.” Or, perhaps you’ve heard of the First Law of Economists: for every economist, there exists an equal and opposite economist (with the Second Law of Economists being that they are both wrong). Or, you might have even heard that if you were to lay all economists end-to-end, they still wouldn’t reach a conclusion.

Hilarious, indeed, and fair enough, it’s true that our profession is prone to qualifying our assessments. But as a recent NPR Marketplace segment uncover, there are some thing views that seem to hold from east-to-west, from north-to-south, and, yes, from left-to-right across the profession.

And here they are, six shared policy beliefs among economists:

One: Eliminate the mortgage tax deduction, which lets homeowners deduct the interest they pay on their mortgages. Gone. After all, big houses get bigger tax breaks, driving up prices for everyone. Why distort the housing market and subsidize people buying expensive houses?

Two: End the tax deduction companies get for providing health-care to employees. Neither employees nor employers pay taxes on workplace health insurance benefits. That encourages fancier insurance coverage, driving up usage and, therefore, health costs overall. Eliminating the deduction will drive up costs for people with workplace healthcare, but makes the health-care market fairer.

Three: Eliminate the corporate income tax. Completely. If companies reinvest the money into their businesses, that’s good. Don’t tax companies in an effort to tax rich people.

Four: Eliminate all income and payroll taxes. All of them. For everyone. Taxes discourage whatever you’re taxing, but we like income, so why tax it? Payroll taxes discourage creating jobs. Not such a good idea. Instead, impose a consumption tax, designed to be progressive to protect lower-income households.

Five: Tax carbon emissions. Yes, that means higher gasoline prices. It’s a kind of consumption tax, and can be structured to make sure it doesn’t disproportionately harm lower-income Americans. More, it’s taxing something that’s bad, which gives people an incentive to stop polluting.

Six: Legalize marijuana. Stop spending so much trying to put pot users and dealers in jail — it costs a lot of money to catch them, prosecute them, and then put them up in jail. Criminalizing drugs also drives drug prices up, making gang leaders rich.

The catch, of course, is that politicians tend to not like these policies. You can listen to the full NPR segment here.

For more on what economists do and don’t agree on, you might check out this survey from Robert Whaples at the Econ Journal Watch.

“Economics is what economists do”

As I was preparing for Econ 100 for next term, I came across a piece by Roger Backhouse and Steven Medema on the definition of economics. Or, to put it more bluntly, what exactly is economics anyway?

Backhouse and Medema run through a bunch of textbook descriptions of what dismal scientists spend their time thinking about, and offer up a few choice quotes. The first candidate is from the indefatigable Paul Krugman and Robin Wells from their intro textbook: “Economics is the study of economies, at both the level of individuals and of society as a whole.”

That seems pretty accurate, but I don’t think economics is nearly as exciting as they make it sound. ;-)

Here’s another from David Colander, a man who knows a thing or two about The Making of an Economist. He says “Economics is the study of how human beings coordinate their wants and desires, given the decision-making mechanisms, social customs, and political realities of the society.”

Coordination, indeed. For us market types, scarce resources are generated and distributed via market forces (e.g., prices), and there are all sorts of “agents” running around maximizing this and that — utility, profit, market share, Facebook friends, etc…

Harvard’s Greg Mankiw simply says “Economics is the study of how society manages its scarce resources.” Pithy, to the point, possibly accurate, and consistent with what Robert Heilbronner tells us in The Worldly Philosophers. More on that later.

Or perhaps try the more pro-market friendly Gwartney and Stroup et al.: “[E]conomics is the study of human behavior, with a particular focus on human decision making.”

Couldn’t that describe psychology?

Scarcity, choices, allocation, behavior, decision making — not exactly narrowing down our subject here, are we?

So, for the punch line, here is the classic Jacob Viner quip, “Economics is what economists do.”

That’s it!

Thanks to Mr. T for the tip. You can read the full piece here.

And here is the citation: Roger E. Backhouse and Steven G. Medema. 2009. “Retrospectives: On the Definition of Economics.” Journal of Economic Perspectives, 23(1): 221–33.

Backhouse, by the way, is one of the co-authors of our ECON DS-391 and Econ 601 books. So we’ll be hearing more from him in the coming weeks.