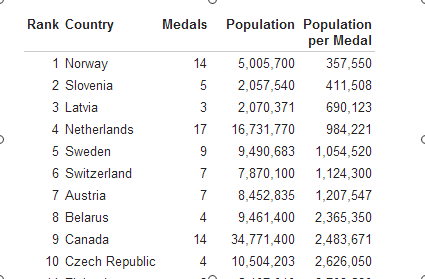

Every two years sportscasters around the nation and around the world keep track of Olympic glory by reporting the medal count. Currently, the Netherlands leads the pack with 17 medals, with the U.S. and Russian Federation close behind at 16.

Every two years sportscasters around the nation and around the world keep track of Olympic glory by reporting the medal count. Currently, the Netherlands leads the pack with 17 medals, with the U.S. and Russian Federation close behind at 16.

But is that really a fair comparison? The U.S. has almost 20 times as many people as the Netherlands and therefore 20 times more citizens who could potentially excel in dancing on ice, skeet shooting, curling, or bandying (?). It would be like measuring economic development by total GDP rather than per-capita GDP (wait, we do that, too).

That’s why it’s refreshing that the good folks at www.medalspercapita.com are keeping it real for us, taking the total medal count and dividing by the population. “Olympic Glory in Proportion” is their motto, and I couldn’t agree more.

With that adjustment, tiny Norway with just 5 million people (fewer people than in Wisconsin!) is in the lead, with the Netherlands falling to fourth. Slovenia, with a mere two million people, has racked up five medals and is in the second spot. The U.S. is a distant 22nd place. Owie.

They also weight medals based per dollar of GDP, which really shakes things up. With this adjustment, Latvia, Slovenia, and Belarus are completely dusting the competition.

In case anyone was wondering, Hungary has yet to medal in these Olympics, so the per capita adjustment doesn’t do much in this case. Indeed, the proud Hungarian nation hasn’t had a medal in the Winter Games since the indomitable Krisztina Regőczy and András Sallay took silver in the ice dancing back in 1980.

I guess since it was a silver medal they were somewhat domitable.

I just made my way over to Briggs because I have a 20-page paper due, and I am, like, totally stressed out about it.** I was wondering why there were students milling around outside, and it turns out that they were victims of the time change — the building is supposed to open at 1, but evidently security didn’t push its clock forward yet.

I just made my way over to Briggs because I have a 20-page paper due, and I am, like, totally stressed out about it.** I was wondering why there were students milling around outside, and it turns out that they were victims of the time change — the building is supposed to open at 1, but evidently security didn’t push its clock forward yet.