Great post at Cheap Talk about beer pricing and Anheuser-Busch’s thwarted attempt to acquire Grupo Modelo, based on a New York Times article.

For decades, [the Justice Department] argue[s], Anheuser-Busch has been employing what game theorists call a “trigger strategy,” something like the beer equivalent of the Mutually Assured Destruction Doctrine. Anheuser-Busch signals to its competitors that if they lower their prices, it will start a vicious retail war…. Budweiser’s trigger strategy has been thwarted, though, by what game theorists call a “rogue player.” When Bud and Coors raise their prices, Grupo Modelo’s Corona does not.

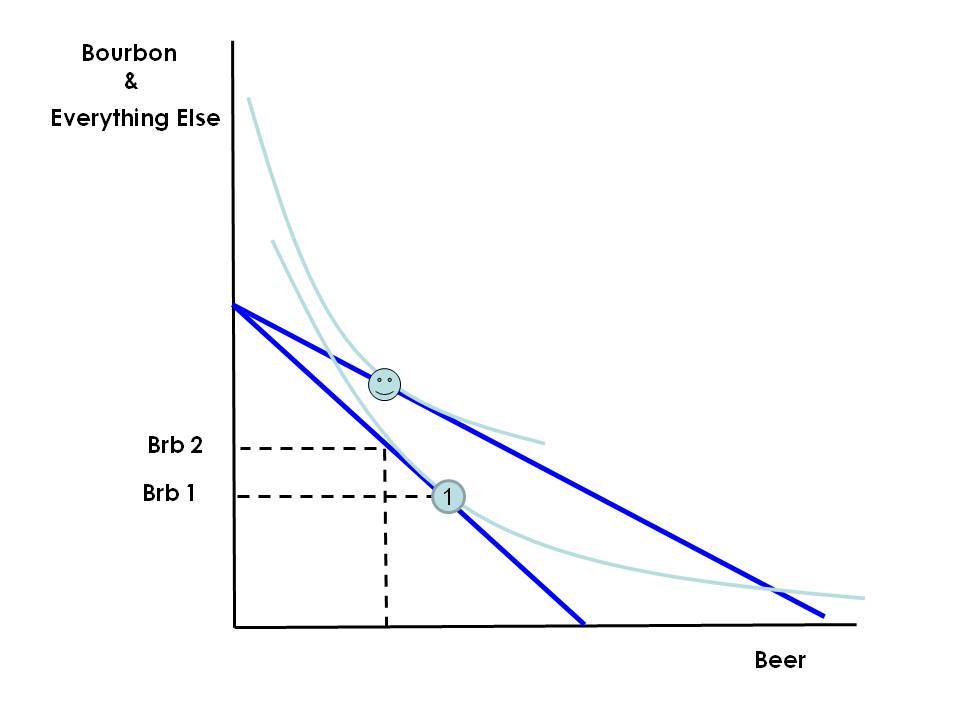

Definitely worth reading, especially if you spent the last term engrossed in the ins-and-outs of the beer industry. See pages 168-170 of Tremblay & Tremblay for some illuminating background.

I am ‘serving’ as the Guest Bartender on Wednesday in the Viking Room from 9:30 p.m. to 11 p.m.

I am ‘serving’ as the Guest Bartender on Wednesday in the Viking Room from 9:30 p.m. to 11 p.m. It is a good couple of weeks for those interested in the economics of (and innovation in) illicit drug markets. First, HBO started up its mega super miniseries,

It is a good couple of weeks for those interested in the economics of (and innovation in) illicit drug markets. First, HBO started up its mega super miniseries,