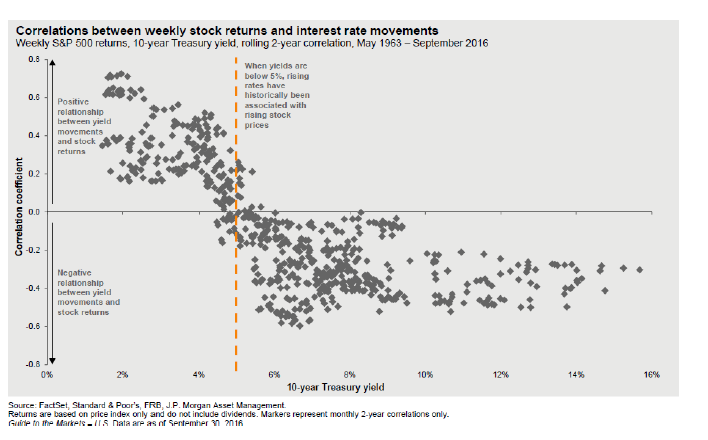

Investment analyst and former Lawrence professor Jeff Miller provides a weekly column entitled Weighing the Week Ahead that employs many charts and offers an array of insights related to both the state of the U.S. economy and investment opportunities. This week’s version provides a link to a quarterly chartbook assembled by JP Morgan that will give even the most numerate among us plenty of food for thought. One chart of particular interest to investors suggests that when 10 year U.S. Treasuries offer relatively low interest rates (e.g., below 5%), increases in their yield are correlated with increased stock returns.

Investment analyst and former Lawrence professor Jeff Miller provides a weekly column entitled Weighing the Week Ahead that employs many charts and offers an array of insights related to both the state of the U.S. economy and investment opportunities. This week’s version provides a link to a quarterly chartbook assembled by JP Morgan that will give even the most numerate among us plenty of food for thought. One chart of particular interest to investors suggests that when 10 year U.S. Treasuries offer relatively low interest rates (e.g., below 5%), increases in their yield are correlated with increased stock returns.

A few weeks ago, despite its substantial girth, I added the new Kaufmann Foundation volume, Invention of Enterprise: Entrepreneurship from Ancient Mesopotamia to Modern Times to the black hole that is my reading list. The reason for my excitement was the extra-ordinary group of volume editors. David Landes is a pioneer in entrepreneurship and development, having written the highly-regarded

A few weeks ago, despite its substantial girth, I added the new Kaufmann Foundation volume, Invention of Enterprise: Entrepreneurship from Ancient Mesopotamia to Modern Times to the black hole that is my reading list. The reason for my excitement was the extra-ordinary group of volume editors. David Landes is a pioneer in entrepreneurship and development, having written the highly-regarded  Several blogs that I read have pointed to Russ Roberts’ new essay on the financial crisis,

Several blogs that I read have pointed to Russ Roberts’ new essay on the financial crisis,