This past week the EPA finally proposed a rule that would limit carbon emissions from new electricity generation. The rule is the second of a double whammy for coal producers, who are already under intense competitive pressures from the rapid expansion and steep price decreases from domestic natural gas.

According the the Washington Post:

The proposed rule … will require any new power plant to emit no more than 1,000 pounds of carbon dioxide per megawatt hour of electricity produced. The average U.S. natural gas plant, which emits 800 to 850 pounds of CO2 per megawatt hour, meets that standard; coal plants emit an average of 1,768 pounds of carbon dioxide per megawatt hour.

What this effectively means is that any new coal plant construction would have to be built with carbon capture and sequestration technology, or CCS, (see here for details), making it extremely unlikely that the private sector will finance new coal-fired electricity production any time soon.

What will be the effect of this policy on new plant construction? I recently co-authored a paper* that looked at the new electricity plant construction decision as a function of natural gas and carbon prices, including an analysis of what would happen if there was a requirement that new coal plants have carbon capture technology, and we conclude that building CCS plants with private money is very unlikely. Here is some background of our analysis from our abstract:

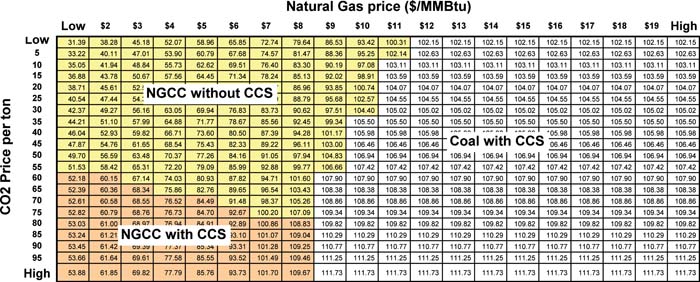

Our objective is to assess the commercial viability of CCS given pervasive future uncertainties, particularly uncertainties about future natural gas and CO2 prices. Using data from the Integrated Environmental Control Model (IECM), we develop an interactive Excel-based spreadsheet tool to compare levelized-average costs of four different new-construction 500 MW power plants: natural gas combined cycle (NGCC) with CCS, NCGG without CCS, supercritical coal with CCS, and supercritical coal without CCS. With low natural gas prices, the NGCC without the sequestration option is the dominant technology. Overall, CCS projects for either natural gas or coal projects are unlikely to be the lowest-cost option for CO2 prices less than $50 per ton.

Figure 5 below shows the relevant figure for the case where coal plants are required to have carbon capture. Along the horizontal axis, there is natural gas prices and along the vertical axis is carbon prices (assuming a baseline coal price of $40/ton).

Under current conditions with natural gas between $2 and $3 and a zero price on carbon, the lowest-cost option is natural gas without CCS (betwen $38 and $45 per MWh to generate). Without a price on carbon, $11/MMBtu is the switchover point at which the coal plant with CCS becomes viable.

Even with a positive CO2 price — whether from a carbon tax or a permit scheme — new coal plant construction still isn’t the lowest cost option without a combination of high natural gas prices and high CO2 prices. For example, with natural gas prices of $10 / MMBtu, the CO2 price would have to be $60 / ton before a coal with CCS plant becomes the lowest-cost option, with generation costs of $108 / MWh.

This seems unrealistic for any number of reasons, not the least of which is that I doubt there is popular support to quadruple electricity prices. Moreover, policy discussions of CO2 prices rarely consider prices in this range. Indeed, this price is at the very high end of estimates of the social costs of carbon, where estimates are more in the $20-$30 per ton range (though, of course, coal generates social costs via emissions of SO2 and particulates).

You can download the spreadsheet here.

* Paul S. Fischbeck, David Gerard, and Sean T. McCoy, (2012) “Sensitivity analysis of the build decision for carbon capture and sequestration projects,” Greenhouse Gases: Science and Technology. 2 (1): 36-45.