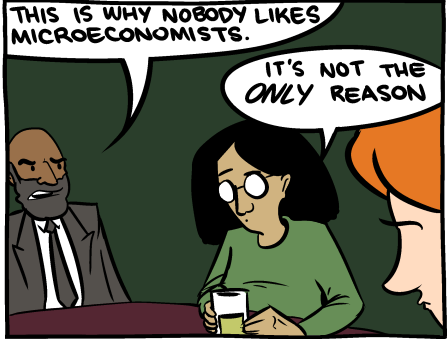

This bit of amusement is brought to you by the University of Oklahoma’s Kevin Grier. Federal Reserve Chair Ben Bernanke opposes a congressional rule that would require the Fed to follow a policy rule.

“The Fed already has a rule,” Mr. Bernanke said during a panel discussion at the Brookings Institution’s Hutchins Center on Fiscal and Monetary Policy. “It’s committed to hitting a 2% inflation target and aiming for the natural rate of unemployment. These are rules.”

And here are the data showing 33 straight months of consumer prices rising at less than 2%:

Duke University Political Economist

Duke University Political Economist