You may recall the Deepwater Horizon spill, that sent some five million barrels of oil into the Gulf of Mexico between April and July of 2010. At the time, we posted about it extensively, and linked up an Econbrowser post that estimated that within two weeks the stock market had already dinged BP to the tune of $20 billion:

The adjusted closing price of BP on May 4, 2010 was $51.20 whereas had the oil spill not happened I’ve estimated the price would have been $58.11. This amounts to a net loss of $6.91 per share. BP has 3.13 billion shares outstanding amounting to a net loss in $21.62 billion.

That estimate turned out to be almost exactly what BP seems to have committed to its oil spill trust fund:

BP, in agreement with the US government, set up a $20-billion trust to provide confidence that funds would be available. The trust fund was established to satisfy claims adjudicated by the Gulf Coast Claims Facility (GCCF), final judgments in litigation and litigation settlements, state and local response costs and claims, and natural resource damages and related costs.

In 2011, BP contributed a total of $10.1 billion to the fund, including our second year commitment of $5 billion to the trust and the cash settlements received from MOEX USA Corporation (MOEX), Weatherford US., LP (Weatherford), and Anadarko Petroleum Company (Anadarko). This brings the total amount contributed to the trust to $15.1 billion. The remaining committed contributions totalling $4.9 billion are scheduled to be made in 2012 which includes the $250 million settlement with Cameron. The trust disbursed $3.7 billion in 2011 and the total paid out since its establishment amounted to $6.7 billion by the end of 2011.

However, the stock price did not stop at $50, but continued a free fall down to about $35, a price so low that there was speculation that BP stock was undervalued and ripe for takeover.

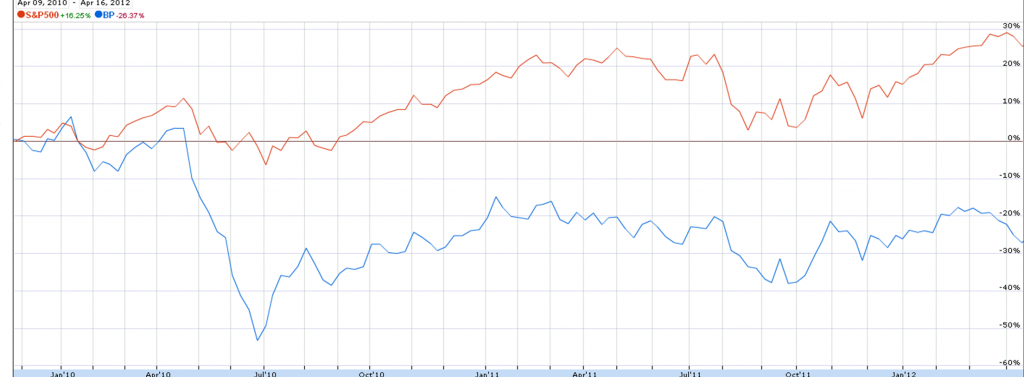

While this is old news, I was taking a look at the BP stock price over the past two years and I noticed that its stock is still trading at about $40, indicating that the initial hit was a permanent shock. And, further, it is rather remarkable — at least using standard ocular estimation techniques — how closely BP stock has tracked the broader market.

The chart shows the S&P 500 index in red and the BP stock in blue, beginning about two weeks before the spill. Between April and July of 2010, BP’s stock price spilled value at about the same rate that the Deepwater Horizon rig spilled oil. Despite some gyrations and the settlement, the BP price has not recovered. It seems the market has punished BP with a permanent hit.