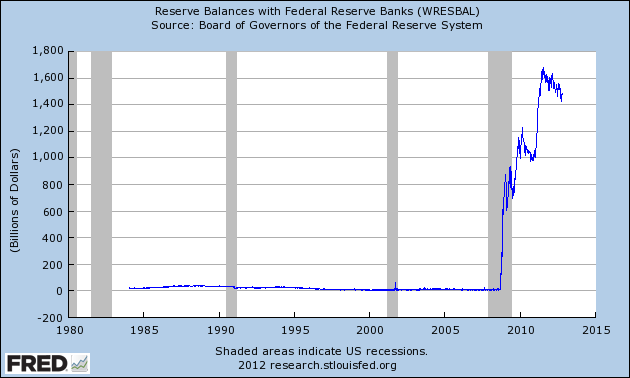

Robert Higgs has a very readable post about the demand for holding cash these days. To wit, the Fed has been pumping massive amounts of liquidity into the system over the past four years, and what has the public been doing with it?

Nothing.

Exhibit A, this extraordinary graph from our pal, FRED, shows the run up in bank reserve balances from roughly $0 in 2009 to about $1.5 trillion today. In other words, that’s cash on hand, ready to lend, reserve balances, come and get it.

Higgs points out that this would normally be inflationary, potentially seriously inflationary, but that hasn’t happened because loans aren’t going out and the velocity of money seems to have tanked.

What is the velocity of money?, you ask.

Well, if you have to ask, it is the ratio of nominal GDP to the money supply. That didn’t help? Then try here (or if you aren’t from a campus URL, here).

So, that leaves us with the question, why are people holding so much money?

Tough to say. But here’s some food for thought:

- At a price north of $1700 / oz, gold is a pretty expensive store of value.

- Treasuries are yielding about 0%, about the same as the under-the-mattress play (TIPS are actually negative — you pay the government to hold your money, figure that one out).

- Who knows what’s in store for the stock market? Greece is in the process of defaulting as I type this. Is that the domino that sets off Europe and brings us down with it? Is the presidential election going to be resolved in a timely fashion? Hey, if I knew, I wouldn’t be holding cash.

- The US, of course, is no different (see Reinhart and Rogoff’s latest on this point). The choice may well be “fiscal cliff” versus “painful austerity.” Not sure I like the sound of either of these.

One of the things I assume you learn in macro is that money creation only works if the financial system makes loans, otherwise, not going to happen. Higgs is the champion of the “regime uncertainty” idea, and while I have no pony in this race, I have no better explanation.