If you want to find out more about the three terrific ACM programs in Chicago, come to the 4:30 Meeting today in the Kraemer Room at the Warch Center, click on the link below, or see me.

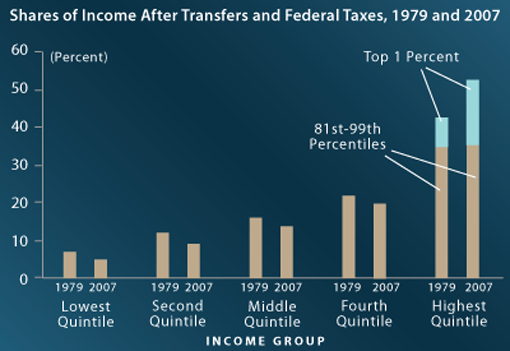

Trends in the Distribution of U.S. Household Income

The “official scorekeeper” for Congress, the Congressional Budget Office, has just released a report on how the distribution of household income has changed from 1979 (when coincidentally I came to Lawrence) to 2007. Their bottom line result is displayed in the figure below. The “CBO estimates that the dispersion of market income grew by about one-quarter between 1979 and 2007, while the dispersion of after-tax (and governmental transfers) income grew by about one third.” In particular, the share of after-tax, after transfer household income that accrued to those with the highest 1% of income grew from 8% in 1979 to 17% in 2007. One should be a bit cautious about these comparisons since the there is a lot of movement in and out of different income brackets. In short, it’s unlikely that most of the households counted in the 1979 calculation are in the 2007 calculation. I encourage you to read the summary or the full report.

Streaming Profitability? Less So Than July

Back in July I was telling you about Netflix and its remarkable stock price ascension. At the time, its price was rising rapidly with a price flirting with $300, and it was overall looking like a good bet (click on the chart to your right). If the author was to be believed, it was a great bet. Indeed, the stock price rose 60 points in the week following that post (did our loyal readers run out and bid the price up?).

So let this be a lesson about getting your stock tips from The Atlantic, things can change pretty fast these days. Today I pick up my local computer and Netflix shareholders — the ones who haven’t bailed, that is — are bemoaning a stream of remarkable decisions that have kneecapped the company’s stock price, sending it into a free fall back toward $100 per share.

UPDATE: During the time I was writing this post, the stock price opened 40 points lower at about $75. Wow. Here it is in real time.

Of course, this could be one of those cases where Netflix management is taking the long view instead of grubbing for short-term profits. The original argument is that there were significant barriers to entry in streaming content, and that seems to be what management still believes — no close substitutes, no potential entrants with the same type of content.

This will likely make its way into both IO and the Senior Read. A very interesting situation, indeed.

The Magic Sauce?, or Where’s the Beef?

Here’s a couple of easily digestible, certainly thought-provoking, pieces on business start ups and job creation. The first is via Professor Finkler, who sends along one of these new, cool Kaufman Foundation sketchbooks. In this one, Kaufman President Carl Schramm asserts the best indicator of whether a country will grow is the number, not the size, of firms created every year. That’s quite an assertion. Here’s more from the Kaufmann blog.

In the blue corner, James Surowieki at The New Yorker argues that small businesses are not the source of growth.

Who are you going to believe?

Lawrence Scholars in Law / Business Event

This Wednesday, Basil Vasiliou (1972 alum) will be on campus to talk about the potential benefits of a masters in business administration (MBA) and a law degree. The Lawrence Scholars in Law and Lawrence Scholars in Business programs are co-hosting the event. Mr. Vasiliou’s talk will be at 5:30 p.m. in the Campus Center Cinema, and is followed by an informal dinner with students in Andrew Commons, Parish/Perille rooms.

After graduating from Lawrence, Mr. Vasiliou picked up an MBA from the University of Chicago and a law degree from Fordham, and he has worked in the financial sector, including serving as chairman and CEO of Vasiliou & Co. since 1986.

You might consider bookmarking this page to keep abreast of the Lawrence Scholars events.

A Lot More Light

This Saturday, October 29 is a maelstrom of opportunities for those of you looking to eventually enter the working world as Lawrence launches its 2011 More Light! Career Conference. There are many, many alumni coming back to give some pep talks on leadership, taking initiative, career paths into various vocations, and what you students can do to prepare for Life After Lawrence NOW.

The particulars are quite remarkable:

Leadership in Life After Lawrence – Stansbury Theater 9:00 a.m. – 10:15 a.m. with the following distinguished alumni:

- ABC News “Nightline,” Co-Anchor, Terry Moran ‘82

- Kimberly-Clark Corporation, Division President, Joanne Bauer ’77

- Emmy Award-Winning Filmmaker, Catherine Tatge ‘72

- Former U.S. Ambassador to India, David Mulford ‘59

- Business Executive, Author and Professor, Harry Jansen Kraemer ‘77

Lawrence Scholars Secrets to Success panel discussions in:

- Business…..10:30 – 11:45 a.m. Steitz Hall, Room 102

- International Careers…..10:30 – 11:45 a.m. Steitz Hall, Room 202

- Law…..1:00 – 2:15 p.m. Steitz Hall, Room 102

- Athletics…..1:00 – 2:15 p.m. Steitz Hall, Room 202

- Arts & Entertainment…..2:30 – 3:45 p.m. Steitz Hall, Room 102

- Medicine…..2:30 – 3:45 p.m. Steitz Hall, Room 202

You can also attend a Networking Lunch at Andrew Commons at 12:00 noon, giving you an opportunity to lunch with alumni.

Finally, there is the Japan’s Ministry of Education’s Japan English Teaching (J.E.T.) Info Session – Career Center 4:15 – 5:00 p.m., where Michael Van Krey ’94, Japanese teacher with Evanston Township High School and former JET teacher will discuss the application process as well as his experiences with the J.E.T. program. Michael will be joined by Joette Bump, President – JET Alumni Association, Wisconsin Subchapter.

Who Says Symmetry is No Graphing Matter?

Professor Scott Corry from upstairs in the math department will give a Science Hall Colloquium, “Symmetry: An Example from Graph Theory,” on Tuesday, November 1 at 11:10. The Colloquium is intended for a general audience, and according to usually reliable sources, Professor Corry will be speaking at a level the general public like me can understand. Here are the particulars:

Professor Scott Corry from upstairs in the math department will give a Science Hall Colloquium, “Symmetry: An Example from Graph Theory,” on Tuesday, November 1 at 11:10. The Colloquium is intended for a general audience, and according to usually reliable sources, Professor Corry will be speaking at a level the general public like me can understand. Here are the particulars:

Abstract: Professor Corry will provide a glimpse of how mathematicians ask and investigate questions in pure mathematics. Rather than speaking in broad generalities, he will describe one of his recent theorems about symmetries of finite graphs. No specific mathematical knowledge will be presumed, so all interested parties are heartily encouraged to attend.

Regular readers of this blog might remember Professor Corry as the winner of the 2011 Young Teacher Award right here at LU, so you can expect a clear, engaging talk.

Tuesday, November 1

Steitz Hall 102

11:10am

Dilbert and the Opportunity Cost of Time

David Zetland, in his aguanomics blog (www.aguanomics.com) posted the following Dilbert cartoon. When someone asks you to do something (from a job or project perspective), think about the value of your time.

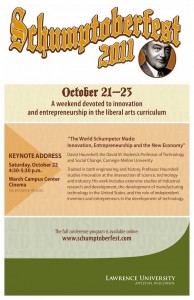

The World Schumpeter Made, or the World That Made Schumpeter?

SCHUMPETERFEST, OCTOBER 22, 2010

Warch Campus Center

Saturday, October 22, 4:30 p.m.

David A. Hounshell

Roderick Professor of Technology & Social Change

Carnegie Mellon University

I present a brief overview of Joseph A. Schumpeter’s fundamental theory of innovation and the entrepreneurial function in capitalism. I further demonstrate how Schumpeter realized that the principal locus of innovation had changed between the time he first launched his ideas in Theory of Economic Development (1911) and 1942, when Capitalism, Socialism, and Democracy first appeared. The shift in locus had profound repercussions for Schumpeter’s thinking about capitalism, which I discuss. I also demonstrate that just as there was an intermediate position between the Schumpeter of 1911 (often called “Schumpeter, Mark 1”) and the Schumpeter of 1942 (“Schumpeter, Mark 2”), what I call “Schumpeter, Mark 1.5.” Drawing from my research on the history of industrial R&D in the United States, I historicize these three versions of Schumpeterian theory about the entrepreneurial function in capitalism. I go further, however, to channel Schumpeter’s thoughts about the entrepreneur and the locus of innovation in American capitalism over the last sixty-one years since his death—what I am calling “Schumpeter, Mark 3” (ca. 1965) and “Schumpeter 4.0” (ca. 2011, to express it in the lexicon we use today). Looking into the future, I complete the Schumpeterian arc of capitalism by concluding with thoughts about the locus of innovation in 2050, the centennial year of Schumpeter’s death, when the principal locus of innovation might well be where Schumpeter believed it was in 1911, under what he called Competitive Capitalism.

About the Speaker: David Hounshell was originally trained as an electrical engineer (BSEE, Southern Methodist University, 1972) before he saw the bright light of history of science, technology, business, and public policy (Ph.D., History, University of Delaware, 1978). His early publications include work on inventors in electrical and communications technologies of the 19th-century, for which he received the Browder J. Thompson Prize of the IEEE in 1978. His first book, From the American System to Mass Production, 1800-1932 (Johns Hopkins University Press, 1984) remains in print today; the Society for the History of Technology (SHOT) awarded it the Dexter Prize in 1987. Science and Corporate Strategy: DuPont R&D, 1902-1980 (Cambridge University Press, 1988), co-authored with John Kenly Smith, Jr., received the Newcomen Prize in 1991. He is the recipient of the Business History Conference’s Williamson Medal (1992) and the Society for the History of Technology’s Leonardo DaVinci Medal (2007). He served as President of SHOT in 2002 and 2003. He has published on Cold War science and technology, the history of industrial research and development, and technology-forcing regulation in post-World War II United States.

Coming Saturday: “The World Schumpeter Made”

Historian David Hounshell from Carnegie Mellon University will be on campus this weekend to deliver a talk, “The World Schumpeter Made: Innovation, Entrepreneurship, and the New Economy.” Professor Hounshell has deep knowledge of the U.S. innovation system, and the talk will touch on who funds R&D and why it matters. If you would like to see him in action, here is a talk he gave at the Kaufman Foundation last year: “Innovation and the Growth of the American Economy.”

Historian David Hounshell from Carnegie Mellon University will be on campus this weekend to deliver a talk, “The World Schumpeter Made: Innovation, Entrepreneurship, and the New Economy.” Professor Hounshell has deep knowledge of the U.S. innovation system, and the talk will touch on who funds R&D and why it matters. If you would like to see him in action, here is a talk he gave at the Kaufman Foundation last year: “Innovation and the Growth of the American Economy.”

Professor Hounshell is a pretty good source for this type of insight. He literally wrote the book on the genesis and evolution of the U.S. industrial system with From the American System to Mass Production, 1800-1932. Murray Rothbard himself had this to say about Hounshell’s influence:

Until recent years, the history of technology used to be written, and taught, for its own sake and almost completely isolated from economic and social history…

This tiresome tradition came to a sudden end with the arrival of the fascinating and crucially important work of David A. Hounshell, From the American System to Mass Production, 1800-1932, which created a new paradigm dominating the field of American technological history. Hounshell’s achievement was to integrate technological with economic and social history, and bring us, for the first time, a genuine history of the development of mass production. Thus, for example, in his pioneering history of the bicycle industry of the 1890s, Hounshell showed that the bicycle was, in two ways, a critical prelude to the invention and development of the automobile because, (1) the bicycle taught consumers the possibility and the joy of individual mobile transportation (in contrast to the mass transportation between fixed points essential to the railroad; and (2) it taught bicycle makers the technology of the wheel, the tire, and the axle. It is no accident that the first automobiles were made in bicycle shops.*

In addition to the opus on mass production, Professor Hounshell is also steeped in studying industrial research and development, including a definitive piece on DuPont: Science and Corporate Strategy: Dupont R&D, 1902-1980. This work chronicles corporate strategy and innovation, and has been described as “one of the most comprehensive business history books ever written.”

Of course, he continues to keep busy, and his talk Saturday will incorporate some of his current work on the evolution of industrial innovation. I am looking forward to hearing what he has to say.

Professor Hounshell’s talk is at 4:30 in the Warsh Campus Cinema. We hope to see you there.

Who Won the Nobel Prize in Economics This Year? Professor Finkler’s Mentors, That’s Who

Most of you have probably never heard of either Tom Sargent or Chris Sims. I’m not surprised; however, if you are an economics major at Lawrence, they have influenced how you have been taught. I learned macroeconomics from Sargent. His emphasis on the microfoundations of macroeconomics forms the base of how I think about macro questions. In short, a strong understanding of labor markets and how they work is critical to serious macroeconomic policy making. Few of our decision-makers today understand that link. Stated differently, Okun’s Law (for every 2 percentage points that output is below potential output, the unemployment rate is 1 percentage point above its “natural” level) is an empirical relationship, not a theoretical one, that is if you are not a reductionist (to simple correlations.) Sargent convinced me that to reduce the unemployment rate in this country, one’s understanding must go well beyond how monetary and fiscal policy affect aggregate demand.

Chris Sims, a first rate econometrician, has addressed the fundamental questions of causality in macroeconomics, especially time series causality. For those of you without a clue what this means, he tried to solve the chicken (money growth) and egg (GDP growth) problem; which came first? His answer came in a 1972 American Economic Review paper entitled “Money, Income and Causality.” Given his award, my students in Money and Monetary Policy will have an opportunity to work through this paper later this term. Of course, Sims did not stop there. No reductionist he, he broadened the question to ask of the variables that matter in macroeconomic discussion (Real GDP, Unemployment rate, stock of money, wages, the price level, and import prices), how do they relate to one other. This paper, published in Econometrica in 1980 under the title “Macroeconomics and Reality”, is a much tougher read. The conceptual direction and the results, however, are not hard to understand. Sims argued that we should learn how the histories of each of these variables are related to each another. He developed Vector Autoregression Techniques to answer this question. These techniques have been embedded in contemporary econometrics software packages and in the work of many macroeconomists. Despite the title of the paper, Sims did not believe he had found “the holy grail”, but he believed that an clear understanding of the time series relationships amongst the key macro variables was essential to know where to look for it.

Of course, I am happy to discuss their work with any and all interested. I am honored to have been a student of both of these creative economists and celebrate their receipt of the Nobel Prize in Economics for 2011.

Third Annual Predict the Economics Nobel Contest… Wait, what?

Well, I didn’t manage to get the contest running this year and, lo!, the Nobel Prize in Economics committee met anyway and made its awards.

I’m no macro guy (who is these days?), but the Nobel Committee saw fit to award this year’s prize to Thomas Sargent and Christopher Sims for their work in empirical macroeconomics. As per usual, Tyler Cowen at Marginal Revolution is all over it.

Sims here and Sargent here.

Though I disavow any knowledge of it now, I had Sargent for my macro texts back in grad school — known as black Sargent and red Sargent because one was black and one was red (I forget which was which). For some of us, the mathematics was on the challenging side, and we had to spend a lot of time solving those spectral analysis problems. I remember this like it was yesterday, one of my classmates asked if there was a “Cliffs Notes” version of black Sargent.

The professor replied, “Black Sargent is the Cliffs Notes.”

UPDATE: Tim Taylor has a very readable, conversable even, commentary at his new blog.

Sentry Insurance on Campus Tuesday

Colin Watkins ’11 of Sentry Insurance will be on campus Tuesday, October 11 at 5:30 in the Kraemer Room – WCC.

Sentry has internships in Actuary Science, investments, marketing, finance, and information technology. Mr. Watkins can also talk to you about the application process for the full-time Leadership Development Program.

Schumptoberfest is here

This year’s turbocharged Schumptoberfest is also known as the ACM workshop on Innovation and Entrepreneurship in the Liberal Arts Curriculum. You can find the program online at www.schumptoberfest.com, or click on the posters below. The keynote address is open to the public, and you wouldn’t want to miss it if you are on campus. If you are interested in some of the other sessions, talk to Professor Gerard or Galambos.

Economics for the 21st Century

David Warsh has an Economic Principals piece on the direction of the economics profession for the next decade. Warsh points to a compilation of 55 papers, Ten Years & Beyond: Economists Answer NSF’s Call for Long-Term Research Agendas, posted at the Social Science Research Network. Charles Schultze from Brookings provides some perspective in the title piece:

The National Science Foundation’s Directorate for the Social, Behavioral and Economic Sciences (NSF/SBE) for challenging economists and other relevant research communities “to step outside of present demands and to think boldly about future promises.” Specifically, NSF/SBE invited groups and individuals in August 2010 to write white papers that describe grand challenge questions in their sciences that transcend near-term funding cycles and are “likely to drive next generation research in the social, behavioral, and economic sciences.” NSF/SBE planned to use these white papers “to frame innovative research for the year 2020 and beyond that enhances fundamental knowledge and benefits society in many ways… We are disseminating the white papers of interest to economists independent of the NSF because these papers offer a number of exciting and at times provocative ideas about future research agendas in economics that are worth further consideration by economists.

There are many titles that look promising, including Deidre McCloskey’s “Language and Interest in the Economy,” which argues that economists should pay more attention to the role of persuasion. A number of us have been plowing through McCloskey’s Bourgeois Dignity, so we certainly welcome a succinct case.

Some other provocative titles include Nicholas Bloom’s “Key Outstanding Questions in Social Sciences,” David Autor and Lawrence Katz’s “Grand Challenges in the Study of Employment and Technological Change,” Randall Krozner’s “Implications of the Financial Crisis,” and Kenneth Rogoff’s “Three Challenges Facing Modern Macroeconomics.”

These are short, generally readable pieces from some of the biggest names in the profession. This seems like a good place to poke around.

Sustainable China

As many of you know, Lawrence received a grant from the Luce Foundation to explore a program we call Sustainable China: Integrating Culture, Conservation, and Commerce. Thursday and Friday we will be hosting two visitors from the Karst Institute at Guizhou Normal University in Guiyang, China. They will be giving a talk on Friday afternoon at 3:10 in Steitz 102 and are available for Q & A after the talk. Please below for details or green posters in various spots in Briggs Hall.

Sustainable China: Integrating Culture, Conservation and Commerce

~~~~~~~~~~~~~~~~~~~~~~~~~~

Ren Xiaodong

Professor at the Institute of South China Karst and Director of the Community-Based Conservation and Research Development Center at

Guizhou Normal University

“Integrated Management of Nature Reserves in Guizhou Province”

Professor Ren will discuss efforts to incorporate a variety of stakeholders in the management of the Chishui Nature Reserve. The reserve is a national treasure as well as the source of water for the Moutai Liquor.

Zhou Zongfa

Vice Dean Institute of South China Karst and Professor in School of Geography and Biological Science at Guizhou Normal University

“Use of Geographic Information Systems (GIS) for the study of Karst and Caves in Guizhou Province”

Professor Zhou will address how GIS systems help identify the characteristics of sedimentary rocks in China which will assist decision-makers in evaluating the effects of and planning for future economic development in Guizhou Province.

~~~~~~~~~~~~~~~~~~~~~~~~~~

Friday, September 30th

3:10pm

Steitz Hall 102

Less than Peak Perfomance

Following an earlier post on Daniel Yergin’s piece in the Wall Street Journal (promoting his new book), I came across James Hamilton‘s response to Yergin’s basic argument. I use Hamilton as a primary source for teaching the resources piece of my Environmental Economics class, and he is an important player in the public debate.

Next up, we have a Michael Gilberson post that provides an overview of the issues and going through Hamilton’s critique of Yergin. I find his response particularly useful because he gets at why peak oil might be an issue worth worrying about, and also has a section devoted to “supply and demand: boring and relevant.” He prefaces his supply and demand discussion with this:

Hamilton draws attention to the slow rate of the supply response relative to demand growth. He is right, this is where the action is with respect to understanding recent oil market developments … and nothing about what he said depends upon whether the peak in world oil production did happen in 2005 or 2007, or will happen in 2011, or won’t happen until 2100 … and framing remarks as about peak oil distracts attention from the real issues.

Indeed. For those of you who attended the LSB session on petroleum last year certainly know that people with money in the energy industry pay very close attention to supply and demand fundamentals.

Sustainable Energy without the Hot Air

Esteemed alumnus Thomas Baer has been making the rounds on campus, visiting the I&E class and delivering a nice Science Hall Colloquium earlier today (here’s his bio). Dr. Baer gave a rundown of his perspective on renewable energy technologies, particularly solar energy, and even more particularly solar energy made with silicon.

Esteemed alumnus Thomas Baer has been making the rounds on campus, visiting the I&E class and delivering a nice Science Hall Colloquium earlier today (here’s his bio). Dr. Baer gave a rundown of his perspective on renewable energy technologies, particularly solar energy, and even more particularly solar energy made with silicon.

I’ll spare you the details of the role of photonics (since I didn’t quite understand those details), but I will second his recommendation of David MacKay’s excellent Sustainable Energy Without the Hot Air. I bought several copies of this and generally loan them out to anyone interested in energy policy. Indeed, I was working with another colleague on developing a course around the book prior to moving to Lawrence a couple of years back.

If you haven’t borrowed my book already, you can download a copy here.

September Newsletter, Report from the Chair

The Economics Department Newsletter is up and ready for action. Though I am not the Chair, I am privy to his Report.

Here’s the teaser:

Report from the Chair

Marty Finkler, professor of economics and John R. Kimberly Distinguished Professor in the American Economic System

Marty Finkler, professor of economics and John R. Kimberly Distinguished Professor in the American Economic System

Like a shark, the Economics department has to move forward in order to survive. The department has added new personnel, helped launch the Lawrence Scholars in Business program, and is introducing a new Innovation & Entrepreneurship emphasis to its curriculum. Department Chair Marty Finkler runs down these activities and invites your input.

Read more…

Calculus Review

For those of you who need a little refresher, tell them the good people on Briggs 2nd sent you.

CTL math tutors will be holding several calculus review sessions designed for students who want to “brush up” on critical skills used in classes including: Calculus II and III as well as various chemistry and physics courses. Workshops will cover the basics of integrals or derivatives and will be held in Briggs 420 at the following dates/times. If you have questions, please contact Julie Haurykiewicz, CTL Director. Thanks!

Derivative Reviews:

Wednesday, September 28 at 9 p.m.

Monday, October 3, at 8:30 p.m. The integraDerivatives

Integral Reviews:

Thursday, September 29 at 8:00pm

Tuesday, October 4 at 7:00pm