Update to TEDx Speakers List

As you may know, Lawrence is hosting a TEDx event this May, Re-imagining the Liberal Education. It looks like we are going to have to update our speaker list, as Bradley W. Bateman has been named President of Randolph College.

(Now) President Bateman was on campus last year as part of our Senior Experience, discussing his book Capitalist Revolutionary.

A big congratulations.

Economics Colloquium, Thursday at 4:30

–

The Institutional Revolution: The Duel of Honor

Douglas W. Allen

Simon Fraser University

The duel of honor – can you think of a more romantic topic for a St. Valentine’s Day lecture? The duel would seem to be a barbaric practice from an anachronistic age. Yet, Professor Allen provides a cogent theory of dueling, arguing that it provided a screen for otherwise unobservable investments in “social capital” – social investments that allowed aristocrats to demonstrate their allegiance to the crown. He argues that his “social capital” hypothesis is consistent with many of dueling’s peculiar institutional features, the rise and fall of the practice, and the salient differences between the European and American dueling practices. One suspects that he will also address Joseph Schumpeter’s duel with a recalcitrant campus librarian.

The talk is adopted from his recent book, The Institutional Revolution: Measurement and the Economic Emergence of the Modern World.

Professor Allen is on campus to discuss his classic work on North American agriculture, The Nature of the Farm (co-authored with Dean Lueck).

Thursday, February 14

Steitz Hall 102

4:30-5:30 p.m.

Schumpeter Turns 130

Happy Birthday (posthumously, of course) to Joseph Schumpeter (a.k.a., Jozsi, Schum, Schumy, Schump, Go-Go, and probably some less flattering names as well), born on February 8, 1883.

Happy Birthday (posthumously, of course) to Joseph Schumpeter (a.k.a., Jozsi, Schum, Schumy, Schump, Go-Go, and probably some less flattering names as well), born on February 8, 1883.

We’ve had a lot of fun with Schumpter over the past few years, including several iterations of Schumptoberfest (see here, here, and here), as well as an entire reading group built around him. Let’s hope that we can instill just a little bit of this into our student body:

Economists are at long last emerging from the stage in which price competition was all they saw. As soon as quality competition and sales effort are admitted into the sacred precincts of theory, the price variable is ousted from its dominant position… But in capitalist reality as distinguished from its textbook picture, it is not that kind of competition which counts but the competition from the new commodity, the new technology, the new source of supply, the new type of organization (the largest-scale unit of control for instance)–competition which commands a decisive cost or quality advantage and which strikes not at the margins of the profits and the outputs of the existing firms but at their foundations and their very lives. (Capitalism, Socialism, and Democracy, 84).

We’ll see you for Schumptoberfest 2013.

Modelo Justice

Amidst the hoopla of the triumphant release of Budweiser Black Crown, the King of Beers learned that its $20.1 billion offer to purchase Grupo Modelo — maker of Corona, that beer people put lemons in — had been given the kibosh by the good folks at the Department of Justice.

One of the key DoJ players in the blockages is our own LU alum William Baer, who had this to say:

This is the sort of product that matters to consumers. If you have a very slight price increase that happens because of this deal, it could mean that consumers will pay billions of dollars more.

Now, reaching for the back of my envelope, the average American guzzles down about 30 gallons of beer per year, about a half gallon per week. Now, if the price per gallon goes up $0.10, that would entail about $3 per person per year times 300 million people, or about a billion dollars (assuming the demand for beer is pretty inelastic, of course).

On the downside of all this consumer largess, young folks will probably be saddled with more STDs!

Thanks you to the formerly bearded “Mr. T” for the tip. Those of you in the 400 class should take a look. Very interesting stuff.

Student Loans

“Mr. P” points us to an infographic that breaks down a topic of potential interest to some of you — student loan debt. It appears that the median student owes between $10,000-$25,000, with the average between $10,000 and $50,000. My guess is that this isn’t the first you are hearing of this.

As the previous post indicates, it might be the case that higher education is about to see a shake up, which will probably include people more cognizant of the debt they are taking on.

It is also true that some of this debt seems completely justified, as college graduates continue to enjoy a healthy premium over those who lack a college degree.

Bad News for Law Schools

From today’s New York Times, a sea change in the demand for legal education:

As of this month, there were 30,000 applicants to law schools for the fall, a 20 percent decrease from the same time last year and a 38 percent decline from 2010… Of some 200 law schools nationwide, only 4 have seen increases in applications this year. In 2004 there were 100,000 applicants to law schools; this year there are likely to be 54,000.

The demand decrease, it seems, is largely due to a combination of the law school price tag (a movement along the curve) and a sour job market (a shift in the curve). If the short-run supply curve for providing legal education is somewhat inelastic, expect a free fall in tuition rates.

A few schools, like the Vermont Law School, have started layoffs and buyouts of staff. Others, like at the University of Illinois, have offered across-the-board tuition discounts to keep up enrollments.

Demand decreases, quantity decreases, price decreases.

I wonder what this portends for undergraduate institutions?

Economics Colloquium, February 5 at 11:15

.

Waiting for Godot, and for Corporate Social Responsibility?

David Gerard

Lawrence University

Milton Friedman famously wrote ‘The Social Responsibility of Business is to Increase its Profits,’ and ever since (and probably even before) the economics profession has been scratching its collective head wondering whether this is indeed our professional consensus. In this talk, I put on the ‘mainstream economist’ hat and give an overview of some of the central issues in organizational economics, and the implications of this literature on the balancing of corporate profits and other (potentially) desirable social objectives.

The target length for the talk is 40 minutes.

Tuesday, February 5

Steitz Hall 102

11:15a.m. – 12 p.m.

Update: Looks like we made the front page.

Message in a Bottle?

I got mail!

Hi,

I’m currently stuck in the Sage basement due to poor door design. Attached is the assignment for today. Should someone come by, I’ll probably make it to class, but this way you’ll know I have the assignment done.

“Mr. C.”

Do me a favor, open the door, and let him out…

Lawrence Scholars Saturday

This weekend marks another big weekend for the Lawrence Scholars programs, including a visit from alums Hugh McLean, Jamie Reeve, and Mark Spertel for the Lawrence Scholars in Business program. Our guests will talk about commercial banking and private wealth management. I’ll try to get their bios up later today.

These events are excellent opportunities for you to get a glimpse at opportunities out in the real world, and to mix with professionals who actually want and have time to mix with you!

The Informant is Back

Once again this year, the Economics Department proudly presents The Informant Tuesday, January 29 at 9 p.m. in the Warch Campus Center Cinema.

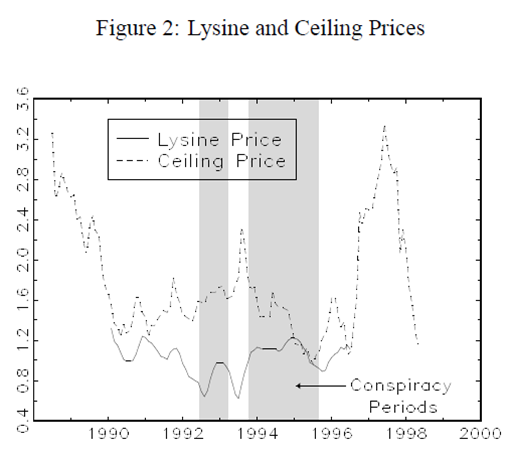

The movie “comically” recreates the character of Archer Daniels Midlands (ADM) employee, Mark Whitacre, the principal informant in the notorious lysine price fixing scandal. Lysine is an essential amino acid used to fatten up hogs and broilers. If you mix it in with corn, you don’t have to spring for the relatively more expensive soymeal, or so I’m told.

Well, I’ll let deRoos (2006) characterize the market for us:

Through 1990 the market lysine market was dominated by three firms with prices (as you can see) somewhere north of $1 / lb. However, in 1991 ADM opened a massive production facility in Decatur, Illinois, doubling world capacity and pushing the price below $1 toward its (probable) marginal cost of $0.66 / lb.

Whitacre subsequently orchestrated a coordinated effort to fix prices among the four dominant producers (a CR4 of 95-97%), though there is some dispute as to what exactly happened. Nonetheless, price fixing is a per se violation of federal antitrust laws, so ADM was in pretty serious hot water as soon as Whitacre turned informant.

On the other hand, Whitacre was absolutely crazy himself. And the movie does a good job portraying the frustration and insanity of everyone involved in the situation as the events unfolded. It seems the best defense for ADM was to simply let Whitacre unravel and leave the prosecutors to deal with him.

Meanwhile, the economics of the case spawned a rather, well, let’s call it a rather spirited debate in the academic literature over the length of the conspiracy and the damages done. These are well documented in the sources below, particularly John Connor and Lawrence White, who trade body blows over the appropriate theoretical model, the appropriate choice of the conspiracy period, and the proverbial “but for” price (that is, the price that would have prevailed “but for” the conspiracy).

A truly remarkable episode all around.

Pop some corn and mix in three parts lysine. We’ll see you there.

For further reading:

John M .Connor (1997) “The Global Lysine Price-Fixing Conspiracy of 1992-1995,” Review of Agricultural Economics, 19 (Fall/Winter), 412-427.

Nicholas deRoos (2006) “Examining models of collusion: The market for lysine,” International Journal of Industrial Organization, 24(6): 1083-1107

Lawrence White (2001) “Lysine and Price Fixing: How Long? How Severe? Review of Industrial Organization,18 (1):23-31

Will Taxes Cause Golfer to Miss the Green?

As you probably know, the recent changes to the tax law mean that the most taxpayers are going to share more of their income with the government in the coming years. Or perhaps you didn’t know?

Well, taxes went up for everyone who continues to work, at least. Economists often worry that tax increases will have a deleterious effect on the economy, causing some to lose jobs and others not to be able to find jobs.

Economists also sometimes worry that workers will quit working because taxes take such a severe bite that it simply isn’t worth punching the clock any longer. Indeed, earlier this year the French government enacted a 75% tax on the wealthy, causing Gerard Depardieu (no relation) to flee the country. Many who favor more modest government expenditures cheered Depardieu as he thumbed his nose at le percepteur.

Closer to home, golf phenom Phil Mickelson is now openly talking about “going Depardieu” after seeing a combination of federal and state tax increases that are shrinking his wallet. But a funny thing happened on the way home from H&R Block, someone took a look at the numbers and found Mickelson’s case less compelling.

Here’s a taste:

For starters, courtesy of President Obama’s re-election and the subsequent fiscal cliff negotiations, Mickelson will experience an increase in his top tax rate on ordinary income from 35% to 39.6%, and an increase in his top rate on long-term capital gains and qualified dividends from 15% to 20%. Clearly, when faced with tax hikes of that magnitude, it stops making economic sense for Mickelson to continue to swing a metal stick up to 70 times a day in exchange for the $48 million he earns on an annual basis.

Now, we know that when a man of means stands up to decry his tax burden someone will be there to ridicule him. But, what makes Mickelson’s case special is that the source of this snark is none other than Forbes magazine.

Here’s some perspective on the high end of the U.S. income distribution: The family cutoff to be in the 1% seems to be about $500,000 per annum. Between tournament purses and product endorsements, Mickelson earns somewhere just south of $50 million.

That’s a long tail.

Outsourcing American Jobs

Outsourcing is once again in the news, including this attention-grabbing headline: “Developer outsources job to China so he can watch cat videos.”

That’s a pretty self explanatory, though misleading, characterization, I’d say. It seems he’s outsourcing his job because he can reduce his own personal costs significantly without a detectable decrease in quality. That’s efficiency enhancing, no?

Further evidence to support my conjecture comes near the end of the article:

The kicker: Further digging found that Bob was taking jobs with other firms and outsourcing that work to China too. “It looked like he earned several hundred thousand dollars a year, and only had to pay the Chinese consulting firm about fifty grand annually,” said Verizon.

All this seems to suggest that there is no world equilibrium wage in the software industry right now.

And, as for what he does with the time saved — watching lolcats videos — well, de gustibus non est disputandum.

A Revolutionary Experience

Doug Allen from Simon Fraser University will be on campus on February 14 as part of the Senior Experience in economics. In addition to The Experience, Professor Allen will also deliver a public lecture on his recent book, The Institutional Revolution: Measurement and the Economic Emergence of the Modern World. The book is a collection of work that principally examines the ‘peculiar’ institutions surrounding the British aristocracy and other pre-modern European curiosities , including the sale of public offices and military commands to the practice of dueling to “settle” disputes.

Doug Allen from Simon Fraser University will be on campus on February 14 as part of the Senior Experience in economics. In addition to The Experience, Professor Allen will also deliver a public lecture on his recent book, The Institutional Revolution: Measurement and the Economic Emergence of the Modern World. The book is a collection of work that principally examines the ‘peculiar’ institutions surrounding the British aristocracy and other pre-modern European curiosities , including the sale of public offices and military commands to the practice of dueling to “settle” disputes.

Professor Allen’s talk will focus on dueling!

Here are a couple of the papers that serve as the foundation for The Institutional Revolution, available via the genius of Google Scholar.

Douglas W. Allen and Clyde G. Reed (2006) “The Duel of Honor: Screening for Unobservable Social Capital,” American Law and Economics Review: 1–35.

Douglas W Allen (2002) “The British Navy Rules: Monitoring and Incompatible Incentives in the Age of Fighting Sail,” Explorations in Economic History, 39(2):113-232.

Douglas W. Allen (2009) “A Theory of the Pre-Modern British Aristocracy,” Explorations in Economic History, 46:299–313.

Douglas W. Allen and Yoram Barzel (2011) “The Evolution of Criminal Law and Police During the Pre-Modern Era” Journal of Law, Economics, and Organization, 27(3):540–567.

Seems Like a Good Job Interview Question

I’m not sure this has anything to do with economics, but given the cross-disciplinary spirit that exists here on campus I thought I would post it anyway:

Would you rather fight 100 duck-sized horses or one horse-sized duck?

That was a question that was posed to President Obama (he declined to answer) that I read about at the Kottke blog. And, as per usual, Mr. Kottke has way more on the topic than we could reasonably hope to expect.

Energy Revolution, Cont…

For the past two years or so, I have been telling students that the proliferation of natural gas production is one of the most significant stories — and certainly environmental stories — of the past decade. I give you further proof from the Energy Information Agency website on electricity generation:

[F]or the first time since EIA began collecting the data, generation from natural gas-fired plants is virtually equal to generation from coal-fired plants, with each fuel providing 32% of total generation.

The 32% number for coal is astoundingly low, as within the past decade the conventional wisdom was that coal was likely to provide the majority (>50%) of electricity generation.

The Washington Post included this graph in its blurb on the demise of US coal.

This brief from a few months back shows previous data in the right-hand box, and breaks down trends in the share of net generation in the left-hand box. The accompanying text provides some reasons for the decline:

What does it all mean? Well, it means a lot. One of the causes of the switch is the much, much lower price of natural gas over the past several years. The switch from coal to natural gas also significantly reduces carbon emissions per unit of electricity output.

Train in Vain

If there is a story about incentives that is more awesome than this one, I’d be interested to hear it.

A cargo train filled with biofuels crossed the border between the US and Canada 24 times between the 15th of June and the 28th of June 2010; not once did it unload its cargo, yet it still earned millions of dollars…

Each time the loaded train crossed the border the cargo earned its owner a certain amount of Renewable Identification Numbers (RINs), which were awarded by the US EPA to “promote and track production and importation of renewable fuels such as ethanol and biodiesel.” The RINs were supposed to be retired each time the shipment passed the border, but due to a glitch not all of them were. This enabled Bioversal to accumulate over 12 million RINs from the 24 trips, worth between 50 cents and $1 each, which they can then sell on to oil companies that haven’t met the EPA’s renewable fuel requirements.

It’s like a children’s joke: why did the train cross the border? As the man says, if you pay people to do something, you’ll get more of that something.

I wonder if this type of thing goes into the life-cycle analysis of biofuels?

Econ Read — Francis Spufford’s Red Plenty

This term’s Economics Department Read features Francis Spufford’s Red Plenty: Industry! Progress! Abundance! Inside the Fifties Soviet Dream. The book is a hybrid history-fiction that uses many historical events and people to characterize the salad years of the Soviet Union, back when people thought central planning wasn’t a pipe dream.

Well, of course it was a pipe dream, and this book goes a long way to developing an understanding of planned economies and also the Soviet mentality. According to historian Marhall Poe, who has actually done some work on the Soviet Union himself, Red Plenty is the real deal:

[Red Plenty] contains more “truth” about the Soviet project than an entire library of “serious” novels and dry-as-dust histories. If I had to recommend one book on the Soviet Union to someone who wanted to understand it, Red Plenty would be it.

In the interview Poe says that Spufford “is one of those people that took all of that liberal arts crap seriously.”

Hey! Sounds like our kind of guy.

As for the logistics, it is a one-unit directed study that will meet most Tuesdays during winter term from 11:10-12:15. You can get sign up sheets and signatures from Professor Galambos or Professor Gerard.

(As long as we’re on the subject, Poe also interviews Appleton-native David Brandenberger about his recent book, Propaganda State in Crisis: Soviet Ideology, Indoctrination, and Terror under Stalin.)

The Fiscal Cliff Averted?

Yesterday, Congress passed legislation designed to avoid the strictures Congress enacted in the summer of 2011 to enable the United States government to borrow in excess of the existent debt ceiling. These provisions would have allowed the income tax cuts enacted in the George W. Bush era to expire as well as imposed spending limits on defense and discretionary non-defense spending.

There are numerous provisions in yesterday’s bill, summarized by the White House here. The Congressional Joint Committee on Taxation estimates the increased revenue from the bill to yield $62o over 10 years, far short of the 4 trillion dollars some estimate will be need to generate a sustainable level of debt. Furthermore, the debt ceiling and expenditure components of the “cliff” will remain subjects of political debate for at least the next two months when further action will be required. In short, we have “kicked the can down the proverbial road” again.

Bruce Bartlett, in a New York Times Economix posting yesterday, offers little in the way of enthusiasm regarding the political feasibility of making serious headway in addressing prospective budget deficits now and in the near future. His argument parallels the time inconsistency argument that earned Edward Prescott and Finn Kydland the Nobel Prize in Economics in 2004.

The Congress that raises taxes and cuts benefits will suffer politically, while the benefits of lower deficits will accrue to future Congresses.

He goes on to argue that

Historically, what has moved Congress to enact big deficit-reduction packages was the prospect of quick improvement in terms of inflation, growth and interest rates. Given that deficit reduction today is very unlikely to improve any of these in the near term, deficit hawks lack any real payoff from a grand bargain.

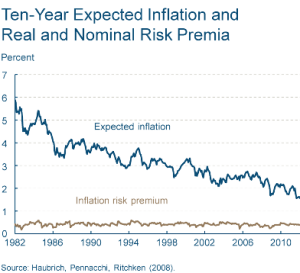

Inflation has been low and stable as has expected inflation.

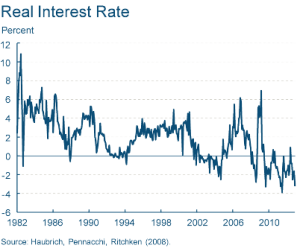

Even though expected inflation has been stable or declining for the past decade, real interest rates for treasuries (see chart below) – market rates minus expected inflation – has been negative for much of the past decade with the exception of the brief positive values in 2005 – 2007 and with expected deflation in late 2008. If real interests are negative, the crowding effects of public sector borrowing are non-existent; thus, the cost of running deficits has not “spooked” the markets. Of course, permanent negative real interest rates are not sustainable since few lenders will continue to offer their savings in exchange for reduced future consumption.

In the famous song from The Lion King, Hakuna Matata – there are no worries or no problem. Of course, such attitudes last only as long as those who lend money to the US government continue to do so. As Reinhart and Rogoff argue persuasively in This Time is Different: Eight Centuries of Financial Folly, this time is not different. Financial excesses and repression eventually must be paid for. We just don’t know when or how severe the price will be.