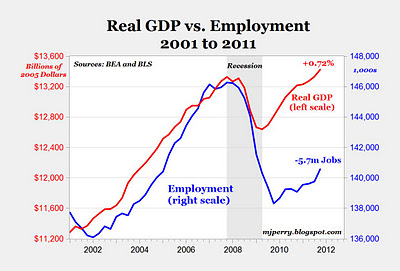

This week many of you are reading Brynjolfsson and McAfee’s book Race Against the Machine. The authors make reference to a September 28, 2011 Wall Street Journal article by Kathleen Madigan entitled “It’s Man vs. Machine and Man is Losing.” Madigan provides the chart below to illustrate the relative growth of equipment and software in comparison with payroll employment since the trough of the recession in June 2009.

As I have previously argued here and here, Madigan notes how the relative price of labor compared to capital is consistent with the pattern shown in the above chart. Again, job creation clearly is quite difficult if the incentives are perverse.