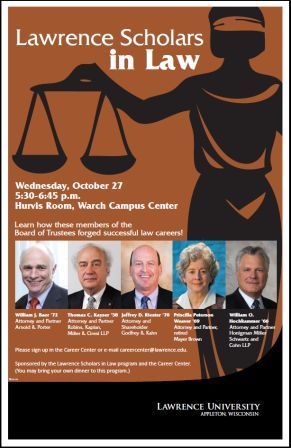

Firmly on the coattails of the extraordinary success of the Lawrence Scholars in Business program, the inaugural Lawrence Scholars in Law event kicks off at 5:30 on Wednesday, October 27 in the Hurvis Room of the Warch Campus Center.

Who should attend this session? I would suggest anyone who is thinking about a law career should clear their schedule for this one. Also, anyone who isn’t sure about their own career ambitions might consider poking her head in. Many students these days work for a few years before returning to pursue a law degree. And liberal arts majors generally, and economics majors in particular, have potential to succeed.

The talent on hand for this program is exceptional. We have five successful attorneys, each a partner or a shareholder (what’s the difference? Good question to ask) with a major law firm. And each with a member of the Lawrence University Board of Trustees. They are:

- William J. Baer ’72 Attorney and Partner: Arnold & Porter

- Thomas C. Kayser ’58 Attorney and Partner: Robins, Kaplan, Miller & Ciresi LLP

- Jeffrey D. Riester ’70 Attorney and Shareholder: Godfrey & Kahn

- Priscilla Peterson Weaver ’69 Attorney and Partner, retired: Mayer Brown

- William O. Hochkammer ’66 Attorney and Partner: Honigman Miller Schwartz and Cohn LLP

Professor Gerard will also be on hand to moderate.

Please sign up in the Career Center or e-mail careercenter@lawrence.edu to make your intentions known.

You are welcome to bring your dinner to the program. Or, better yet, plan to dine with the five panelists afterwords.

n the second post here, I will simply concentrate on Chapter VII of Capitalism, Socialism, and Democracy, and try to tie together some themes for the weekend. For our purposes, I have numbered the paragraphs 1-13.

n the second post here, I will simply concentrate on Chapter VII of Capitalism, Socialism, and Democracy, and try to tie together some themes for the weekend. For our purposes, I have numbered the paragraphs 1-13.

This is a first in a series of short posts to guide the Schumptoberfest readings. I included these readings literally to give you an introduction to Schumpeter and the “Schumpeterian Hypotheses.”

This is a first in a series of short posts to guide the Schumptoberfest readings. I included these readings literally to give you an introduction to Schumpeter and the “Schumpeterian Hypotheses.”

PBS senior correspondent Ray Suarez will be on campus Tuesday to deliver the University Convocation lecture, “

PBS senior correspondent Ray Suarez will be on campus Tuesday to deliver the University Convocation lecture, “