Category: Past Events

Keynes, Cowen, & Capitalism Update

The first session rolled along pretty well, I thought, with 14 students and four faculty participating. I was pleased that everyone had something to say, and I hope you will make an effort to talk about this outside of the group. Our next meeting is February 16 at 3:30, and I am still looking for a regular room to meet.

For next time we will continue our discussion of The Great Stagnation, and in particular we will talk about whether we believe the central thesis. One synopsis of the thesis is that there are three pieces of bad news: there are fewer innovations, the yield on innovations has declined, and innovations are not resulting in high-quality employment gains. We talked a little bit about this idea of raising the status of scientists and what that might look like. In that vein, we might take a look at one of Cowen’s recent blog posts: a simple theory of why so many smart young people end up in finance and law. I’m not sure how to square one with the other.

On this point, I might add, Schumpter was optimistic that norms could change:

the prestige motive, more than any other, can be molded by simple reconditioning: successful performers may conceivably be satisfied nearly as well with the privilege—if granted with judicious economy—of being allowed to stick a penny stamp on their trousers as they are by receiving a million a year (CS&D, p. 208).

The discussion of science inevitably got at the nature of American higher education, an area that moves at a glacial pace, but might be amidst a revolution (who are you going to believe?). On this topic, Larry Summers’ offers his take on the future of education. I have been thinking about this for a while in terms of how we can do better down here on Briggs 2nd, and am wondering what the take of our new president will be.

We will also forge ahead with Cowen’s “The Inequality that Matters,” from The American Interest. It’s hard to think about the future of capitalism without thinking a bit about what inequality is and why it is (and isn’t) important. We read this in Econ 275 last term and I think it went over quite well.

Econ Movie Night — Seeds, Lysine, and Audiotape

The Economics Department proudly presents The Informant Tuesday night at 9:30 in the Warch Campus Center Cinema.

The movie “comically” recreates the character of Archer Daniels Midlands (ADM) employee, Mark Whitacre, the principal informant in the notorious lysine price fixing scandal. Lysine, as you probably know, is an essential amino acid used to fatten up hogs and broilers. If you mix it in with corn, you don’t have to spring for the relatively more expensive soymeal, or so I’m told.

Well, I’ll let deRoos (2006) characterize the market for us:

Lysine is an essential amino acid for the lean muscle development of hogs and poultry. Being a chemical compound, lysine is as close as we get to a homogeneous product. Farmers can obtain the required nutrients either through the use of soybeanmeal, or through the combination of corn and lysine… Industry experts suggest that there are no substantial costs involved in switching between these two nutrient sources. The shadow price of the alternative feed source (henceforth the “ceiling price”) can be approximated by a weighted average of corn and soybean meal prices. In the demand estimation results below, we will characterise demand as being relatively inelastic… Firms face capacity constraints. There is a great deal of heterogeneity in firm capacities, locations, and costs.

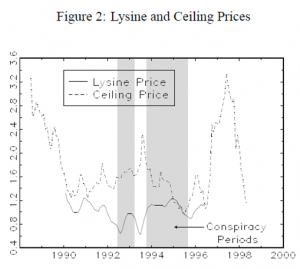

Through 1990 the market lysine market was dominated by three firms with prices (as you can see) somewhere north of $1 / lb. However, in 1991 ADM opened a massive production facility in Decatur, Illinois, doubling world capacity and pushing the price below $1 toward its (probable) marginal cost of $0.66 / lb.

Whitacre subsequently orchestrated a coordinated effort to fix prices among the four dominant producers (a CR4 of 95-97%), though there is some dispute as to what exactly happened. Nonetheless, price fixing is a per se violation of federal antitrust laws, so ADM was in pretty serious hot water as soon as Whitacre turned informant.

On the other hand, Whitacre was absolutely crazy himself. And the movie does a good job portraying the frustration and insanity of everyone involved in the situation as the events unfolded. It seems the best defense for ADM was to simply let Whitacre unravel and leave the prosecutors to deal with him.

Meanwhile, the economics of the case spawned a rather, well, let’s call it a rather spirited debate in the academic literature over the length of the conspiracy and the damages done. These are well documented in the sources below, particularly John Connor and Lawrence White, who trade body blows over the appropriate theoretical model, the appropriate choice of the conspiracy period, and the proverbial “but for” price (that is, the price that would have prevailed “but for” the conspiracy).

A truly remarkable episode all around.

Pop some corn and mix in three parts lysine. We’ll see you there.

For further reading:

John M .Connor (1997) “The Global Lysine Price-Fixing Conspiracy of 1992-1995,” Review of Agricultural Economics, 19 (Fall/Winter), 412-427.

Nicholas deRoos (2006) “Examining models of collusion: The market for lysine,” International Journal of Industrial Organization, 24(6): 1083-1107

Lawrence White (2001) “Lysine and Price Fixing: How Long? How Severe? Review of Industrial Organization,18 (1):23-31

Economics Colloquium

Some Misconceptions about Preferences

Dan Hausman

Herbert A. Simon and Hilldale Professor

Department of Philosophy

University of Wisconsin – Madison

Monday, January 9, 4:30 pm

Steitz Hall 102

In this talk, which is drawn from my book, Preference, Value, Choice and Welfare (Cambridge University Press, 2011), I argue that preferences in economics are and ought to be understood as total comparative evaluations. They are consequently more like judgments than feelings, and they are not mere matters of taste. They cannot be defined by choices (as revealed preference theorists mistakenly maintain), and they cannot be defined in terms of self‐ interest or expected benefit. In addition, in contrast to what many economists believe, I shall argue that economics already contains an account of preference formation, and that it can and should say more about how agents form and modify their preferences.

This article gives you a preview:

In particular, I shall discuss three mistakes concerning preferences that are common among economists and other social scientists. There are others, but this article will be long enough as it is.

- Preferences are matters of taste, concerning which rational criticism or discussion is inapplicable.

- Preference rankings are rankings of alternatives in terms of expected (self-interested) benefits.

- Preferences can be defined in terms of choices, as in revealed-preference theory.

And in a recent interview, this is what Professor Hausman has to say about his book:

The book is about preferences, mainly as they are and ought to be understood in economics, but I also have some things to say about preferences in everyday language and action, in psychology, and in philosophical reflection on action and morality. In this book I clarify the notion of preferences that economists rely on and to a considerable extent defend the way economists use the notion of preference. But I am also critical of misconceptions concerning preferences that many economists and other social scientists hold. Continue reading Economics Colloquium

No Nukes is Good Nukes? Or, No Nukes is Bad Air?

The first Economics Colloquium is November 9 at 4:30 in Steitz 102. Here are the details:

No Nukes is Good Nukes? Or, No Nukes is Bad Air?

Paul S. Fischbeck

Carnegie Mellon University

What if the U.S. phased out its nuclear power plants? Where would the power come from? Would the reliability of the electricity system suffer? What about the effects on emissions of carbon dioxide and criteria pollutants?

Paul Fischbeck provides his approach to addressing these questions, along with some provocative results, in the inaugural lecture of a new Economics Colloquium series. He is professor in both the Departments of Engineering & Public Policy and Social & Decision Sciences at Carnegie Mellon, and an expert on quantitative risk assessment and the treatment of uncertainty.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Wednesday, November 9

Steitz Hall 102

4:30 p.m.

Jim Lyon and the World of Money and Banking

Thursday, you will have two opportunities to engage with Jim Lyon, Lawrence alum and First Vice President of the Federal Reserve Bank of Minneapolis. He will be discussing “Too Big to Fail” and the Dodd-Frank Act response at 9:00 in Money and Monetary Policy (Briggs 225). He also will chair a mock Federal Open Market Committee meeting in which students in the course will represent members of the Board of Governors and Presidents of the 12 district Federal Reserve Banks. You are welcome to join us for either part of the class.

At 4:30, we will have an Econ Tea with Mr. Lyon as well. This will be an open and free-wheeling session for which the topic will be “Everything you always wanted to know about money and banking and ARE NOT afraid to ask.” Come for the discussion or just come for the cookies and tea.

Lawrence Scholars in Law / Business Event

This Wednesday, Basil Vasiliou (1972 alum) will be on campus to talk about the potential benefits of a masters in business administration (MBA) and a law degree. The Lawrence Scholars in Law and Lawrence Scholars in Business programs are co-hosting the event. Mr. Vasiliou’s talk will be at 5:30 p.m. in the Campus Center Cinema, and is followed by an informal dinner with students in Andrew Commons, Parish/Perille rooms.

After graduating from Lawrence, Mr. Vasiliou picked up an MBA from the University of Chicago and a law degree from Fordham, and he has worked in the financial sector, including serving as chairman and CEO of Vasiliou & Co. since 1986.

You might consider bookmarking this page to keep abreast of the Lawrence Scholars events.

A Lot More Light

This Saturday, October 29 is a maelstrom of opportunities for those of you looking to eventually enter the working world as Lawrence launches its 2011 More Light! Career Conference. There are many, many alumni coming back to give some pep talks on leadership, taking initiative, career paths into various vocations, and what you students can do to prepare for Life After Lawrence NOW.

The particulars are quite remarkable:

Leadership in Life After Lawrence – Stansbury Theater 9:00 a.m. – 10:15 a.m. with the following distinguished alumni:

- ABC News “Nightline,” Co-Anchor, Terry Moran ‘82

- Kimberly-Clark Corporation, Division President, Joanne Bauer ’77

- Emmy Award-Winning Filmmaker, Catherine Tatge ‘72

- Former U.S. Ambassador to India, David Mulford ‘59

- Business Executive, Author and Professor, Harry Jansen Kraemer ‘77

Lawrence Scholars Secrets to Success panel discussions in:

- Business…..10:30 – 11:45 a.m. Steitz Hall, Room 102

- International Careers…..10:30 – 11:45 a.m. Steitz Hall, Room 202

- Law…..1:00 – 2:15 p.m. Steitz Hall, Room 102

- Athletics…..1:00 – 2:15 p.m. Steitz Hall, Room 202

- Arts & Entertainment…..2:30 – 3:45 p.m. Steitz Hall, Room 102

- Medicine…..2:30 – 3:45 p.m. Steitz Hall, Room 202

You can also attend a Networking Lunch at Andrew Commons at 12:00 noon, giving you an opportunity to lunch with alumni.

Finally, there is the Japan’s Ministry of Education’s Japan English Teaching (J.E.T.) Info Session – Career Center 4:15 – 5:00 p.m., where Michael Van Krey ’94, Japanese teacher with Evanston Township High School and former JET teacher will discuss the application process as well as his experiences with the J.E.T. program. Michael will be joined by Joette Bump, President – JET Alumni Association, Wisconsin Subchapter.

Who Says Symmetry is No Graphing Matter?

Professor Scott Corry from upstairs in the math department will give a Science Hall Colloquium, “Symmetry: An Example from Graph Theory,” on Tuesday, November 1 at 11:10. The Colloquium is intended for a general audience, and according to usually reliable sources, Professor Corry will be speaking at a level the general public like me can understand. Here are the particulars:

Professor Scott Corry from upstairs in the math department will give a Science Hall Colloquium, “Symmetry: An Example from Graph Theory,” on Tuesday, November 1 at 11:10. The Colloquium is intended for a general audience, and according to usually reliable sources, Professor Corry will be speaking at a level the general public like me can understand. Here are the particulars:

Abstract: Professor Corry will provide a glimpse of how mathematicians ask and investigate questions in pure mathematics. Rather than speaking in broad generalities, he will describe one of his recent theorems about symmetries of finite graphs. No specific mathematical knowledge will be presumed, so all interested parties are heartily encouraged to attend.

Regular readers of this blog might remember Professor Corry as the winner of the 2011 Young Teacher Award right here at LU, so you can expect a clear, engaging talk.

Tuesday, November 1

Steitz Hall 102

11:10am

The World Schumpeter Made, or the World That Made Schumpeter?

SCHUMPETERFEST, OCTOBER 22, 2010

Warch Campus Center

Saturday, October 22, 4:30 p.m.

David A. Hounshell

Roderick Professor of Technology & Social Change

Carnegie Mellon University

I present a brief overview of Joseph A. Schumpeter’s fundamental theory of innovation and the entrepreneurial function in capitalism. I further demonstrate how Schumpeter realized that the principal locus of innovation had changed between the time he first launched his ideas in Theory of Economic Development (1911) and 1942, when Capitalism, Socialism, and Democracy first appeared. The shift in locus had profound repercussions for Schumpeter’s thinking about capitalism, which I discuss. I also demonstrate that just as there was an intermediate position between the Schumpeter of 1911 (often called “Schumpeter, Mark 1”) and the Schumpeter of 1942 (“Schumpeter, Mark 2”), what I call “Schumpeter, Mark 1.5.” Drawing from my research on the history of industrial R&D in the United States, I historicize these three versions of Schumpeterian theory about the entrepreneurial function in capitalism. I go further, however, to channel Schumpeter’s thoughts about the entrepreneur and the locus of innovation in American capitalism over the last sixty-one years since his death—what I am calling “Schumpeter, Mark 3” (ca. 1965) and “Schumpeter 4.0” (ca. 2011, to express it in the lexicon we use today). Looking into the future, I complete the Schumpeterian arc of capitalism by concluding with thoughts about the locus of innovation in 2050, the centennial year of Schumpeter’s death, when the principal locus of innovation might well be where Schumpeter believed it was in 1911, under what he called Competitive Capitalism.

About the Speaker: David Hounshell was originally trained as an electrical engineer (BSEE, Southern Methodist University, 1972) before he saw the bright light of history of science, technology, business, and public policy (Ph.D., History, University of Delaware, 1978). His early publications include work on inventors in electrical and communications technologies of the 19th-century, for which he received the Browder J. Thompson Prize of the IEEE in 1978. His first book, From the American System to Mass Production, 1800-1932 (Johns Hopkins University Press, 1984) remains in print today; the Society for the History of Technology (SHOT) awarded it the Dexter Prize in 1987. Science and Corporate Strategy: DuPont R&D, 1902-1980 (Cambridge University Press, 1988), co-authored with John Kenly Smith, Jr., received the Newcomen Prize in 1991. He is the recipient of the Business History Conference’s Williamson Medal (1992) and the Society for the History of Technology’s Leonardo DaVinci Medal (2007). He served as President of SHOT in 2002 and 2003. He has published on Cold War science and technology, the history of industrial research and development, and technology-forcing regulation in post-World War II United States.

Coming Saturday: “The World Schumpeter Made”

Historian David Hounshell from Carnegie Mellon University will be on campus this weekend to deliver a talk, “The World Schumpeter Made: Innovation, Entrepreneurship, and the New Economy.” Professor Hounshell has deep knowledge of the U.S. innovation system, and the talk will touch on who funds R&D and why it matters. If you would like to see him in action, here is a talk he gave at the Kaufman Foundation last year: “Innovation and the Growth of the American Economy.”

Historian David Hounshell from Carnegie Mellon University will be on campus this weekend to deliver a talk, “The World Schumpeter Made: Innovation, Entrepreneurship, and the New Economy.” Professor Hounshell has deep knowledge of the U.S. innovation system, and the talk will touch on who funds R&D and why it matters. If you would like to see him in action, here is a talk he gave at the Kaufman Foundation last year: “Innovation and the Growth of the American Economy.”

Professor Hounshell is a pretty good source for this type of insight. He literally wrote the book on the genesis and evolution of the U.S. industrial system with From the American System to Mass Production, 1800-1932. Murray Rothbard himself had this to say about Hounshell’s influence:

Until recent years, the history of technology used to be written, and taught, for its own sake and almost completely isolated from economic and social history…

This tiresome tradition came to a sudden end with the arrival of the fascinating and crucially important work of David A. Hounshell, From the American System to Mass Production, 1800-1932, which created a new paradigm dominating the field of American technological history. Hounshell’s achievement was to integrate technological with economic and social history, and bring us, for the first time, a genuine history of the development of mass production. Thus, for example, in his pioneering history of the bicycle industry of the 1890s, Hounshell showed that the bicycle was, in two ways, a critical prelude to the invention and development of the automobile because, (1) the bicycle taught consumers the possibility and the joy of individual mobile transportation (in contrast to the mass transportation between fixed points essential to the railroad; and (2) it taught bicycle makers the technology of the wheel, the tire, and the axle. It is no accident that the first automobiles were made in bicycle shops.*

In addition to the opus on mass production, Professor Hounshell is also steeped in studying industrial research and development, including a definitive piece on DuPont: Science and Corporate Strategy: Dupont R&D, 1902-1980. This work chronicles corporate strategy and innovation, and has been described as “one of the most comprehensive business history books ever written.”

Of course, he continues to keep busy, and his talk Saturday will incorporate some of his current work on the evolution of industrial innovation. I am looking forward to hearing what he has to say.

Professor Hounshell’s talk is at 4:30 in the Warsh Campus Cinema. We hope to see you there.

Schumptoberfest is here

This year’s turbocharged Schumptoberfest is also known as the ACM workshop on Innovation and Entrepreneurship in the Liberal Arts Curriculum. You can find the program online at www.schumptoberfest.com, or click on the posters below. The keynote address is open to the public, and you wouldn’t want to miss it if you are on campus. If you are interested in some of the other sessions, talk to Professor Gerard or Galambos.

Sustainable China

As many of you know, Lawrence received a grant from the Luce Foundation to explore a program we call Sustainable China: Integrating Culture, Conservation, and Commerce. Thursday and Friday we will be hosting two visitors from the Karst Institute at Guizhou Normal University in Guiyang, China. They will be giving a talk on Friday afternoon at 3:10 in Steitz 102 and are available for Q & A after the talk. Please below for details or green posters in various spots in Briggs Hall.

Sustainable China: Integrating Culture, Conservation and Commerce

~~~~~~~~~~~~~~~~~~~~~~~~~~

Ren Xiaodong

Professor at the Institute of South China Karst and Director of the Community-Based Conservation and Research Development Center at

Guizhou Normal University

“Integrated Management of Nature Reserves in Guizhou Province”

Professor Ren will discuss efforts to incorporate a variety of stakeholders in the management of the Chishui Nature Reserve. The reserve is a national treasure as well as the source of water for the Moutai Liquor.

Zhou Zongfa

Vice Dean Institute of South China Karst and Professor in School of Geography and Biological Science at Guizhou Normal University

“Use of Geographic Information Systems (GIS) for the study of Karst and Caves in Guizhou Province”

Professor Zhou will address how GIS systems help identify the characteristics of sedimentary rocks in China which will assist decision-makers in evaluating the effects of and planning for future economic development in Guizhou Province.

~~~~~~~~~~~~~~~~~~~~~~~~~~

Friday, September 30th

3:10pm

Steitz Hall 102

Harry Kraemer’s Visit

I hope that all of you are planning to attend Harry Kraemer’s matriculation convocation address on values and leadership, which takes place at 11:10 on Thursday in the chapel. Prior to his convo address, Kraemer will be coming to my Money and Monetary Policy course to talk about his view of the state of the US economy. This will take place at 10 AM in Briggs Hall 225 (or possibly 224) . All are welcome to join.

“No more gorillas in hysterical herds”

On Sunday, former Senator Russ Feingold will pick up an honorary degree and deliver our Commencement speech as our seniors prepare to march off in glory. Feingold was a notoriously independent voice, as evidenced by his lone vote against the PATRIOT Act. Illustrating the odd second dimension of American politics, this week Tea Party hero, Rand Paul, nearly derailed the reauthorization of the PATRIOT Act by fundamentally siding with Senator Feingold’s position on the encroachment of federal power.

Indeed, the libertarian press shed a tear for Feingold, even comparing him to the incomparable Wisconsin icon, Robert LaFollette.

As H.L. Mencken wrote of the original LaFollette:

There is no ring in his nose. Nobody owns him. Nobody bosses him. Nobody even advises him. Right or wrong, he has stood on his own bottom, firmly and resolutely, since the day he was first heard of in politics, battling for his ideas in good weather and bad, facing great odds gladly, going against his followers as well as with his followers, taking his own line always and sticking to it with superb courage and resolution.

Suppose all Americans were like LaFollette? What a country it would be! No more depressing goose-stepping. No more gorillas in hysterical herds. No more trimming and trembling. Does it matter what his ideas are? Personally, I am against four-fifths of them, but what are the odds?…You may fancy them or you may dislike them, but you can’t get away from the fact that they are whooped by a man who, as politicians go among us, is almost miraculously frank, courageous, honest and first-rate.

So farewell to Feingold.

Indeed, I bet civil libertarians miss Senator Feingold on the floor, as he and Paul would have made for interesting bedfellow. Here’s Lynne Kiesling at Knowledge Problem on some recent trends in security versus liberty tradeoffs.

Weekend Football

The Warch Campus Center Cinema proudly presents the Saturday Champions League Final between FC Barcelona and Manchester United, beginning at 1 p.m. and ending in a 0-0 tie and penalty kicks around 3:30. Ah, that was a cheap shot. Even so, I do find the lulls whilst the players writhe around on the ground an excellent chance to catch up on my reading.

Is it already two years ago that Barca beat down and humiliated Man U? Well, you can kick all that out the window when these two get together.

You can bring refreshments, but please don’t leave a Messi.

Econ Picnic, Thursday 5 p.m. Hiatt Patio

The year-end picnic, more affectionately known as the Econ-nic, is set for Thursday at 5 p.m. on Hiatt Patio. There will be pizza bread and soft drinks access to a water fountain for those who would like to dine with us. We will be robo-mailing you and circulating a sign up sheet over the next week.

The year-end picnic, more affectionately known as the Econ-nic, is set for Thursday at 5 p.m. on Hiatt Patio. There will be pizza bread and soft drinks access to a water fountain for those who would like to dine with us. We will be robo-mailing you and circulating a sign up sheet over the next week.

Rabbit Gallery off and running Saturday

Well, not quite yet, but they have secured space in the Conkey’s building.

For those of you hiding under a rock, the idea of The Rabbit Gallery is to put art galleries in vacant shops, allowing artists to display their work and pay a lower commissions for display. The intrepid entrepreneurship of Ranga and his brethren has secured the $700 to get the gallery out of its hole and into Conkey’s.

The special VIP launch date (for those only who contributed!) is May 14th (tomorrow) at 4:30…. See you there.

The launch date for the general public is Tuesday, May 17th.

Lawrence Alumna Addresses Mexican Immigration

Lawrence alumna, Sarah Bohn will be here Monday night at 7:30 in the Wriston Auditorium to give the Povolny lecture. Her topic will be “Mexican Immigration and the U.S. Economy.” Follow the link for details.

Lawrence alumna, Sarah Bohn will be here Monday night at 7:30 in the Wriston Auditorium to give the Povolny lecture. Her topic will be “Mexican Immigration and the U.S. Economy.” Follow the link for details.

Dr. Bohn will also be guest lecturer in Econ 320 – Macroeconomic Theory on Tuesday. The topic will be the state of U.S. labor markets. Visitors are welcome.

Finally, for those students interested in talking to Dr. Bohn about graduate school or careers in economics, come join us for Econ Tea, Tuesday afternoon at 4:30 in Briggs 217

LSB Chicago trip, 2011

It’s the third time, and that makes it a tradition: reading period in Spring term means that it’s time for the Lawrence Scholars in Business Chicago trip. Open to all Lawrence students, the trip is sponsored by the LSB program, and made possible by the generosity of Lawrence alumni who open up their board rooms for our students. For two days, 33 Lawrence students got an immersion experience in Chicago’s bustling world of business and finance.

At the Chicago Mercantile Exchange, Natalie Garber ’97, Daniel Kolev ’98, and Michael O’Connell ’81 reassured us that a liberal arts education is the perfect foundation for much of what they do at the CME. O’Connell, a Managing Director with broad previous experience in the financial industry, was a biology major at Lawrence, and advised students to take the hard courses and do well in them in order to show both ambition and ability to potential employers. (Not to mention that doing well hard courses has the added benefit of learning a lot.) We had a chance to look at the trading pits, too, to hear the yelling, and to learn the basics of the zany hand-signal language that traders use.

On the 46th floor of Three First National Plaza, Harry M. Jansen Kraemer ’77 welcomed us to Madison Dearborn Partners with lunch

and a (connected and convex) table big enough for 35 people. With an amazing view of Lake Michigan and downtown as a backdrop, we had a fascinating, captivating, interesting dialogue with Harry Kraemer. He reminded us that he has very few answers, but many opinions, and then shared many of those opinions with us. On careers: divide a sheet into three columns, write things you enjoy doing in the first, things you would rather avoid in the second, and in the third column, write down occupations that maximize what’s in the first column while minimizing what’s in the second. If this seems simple, that’s because it’s meant to be: Kraemer prefers to make things simple, whenever that’s possible. That is a rare gift, and one we appreciated very much as we listened to him explain, in simple terms, what private equity firms do, how they do it, and what the interesting issues surrounding those activities are. Though Kraemer’s charisma cannot be conveyed in a book, many of his opinions can, and you can read about them here. Kraemer generously presented to every one of us a signed copy of his book.

and a (connected and convex) table big enough for 35 people. With an amazing view of Lake Michigan and downtown as a backdrop, we had a fascinating, captivating, interesting dialogue with Harry Kraemer. He reminded us that he has very few answers, but many opinions, and then shared many of those opinions with us. On careers: divide a sheet into three columns, write things you enjoy doing in the first, things you would rather avoid in the second, and in the third column, write down occupations that maximize what’s in the first column while minimizing what’s in the second. If this seems simple, that’s because it’s meant to be: Kraemer prefers to make things simple, whenever that’s possible. That is a rare gift, and one we appreciated very much as we listened to him explain, in simple terms, what private equity firms do, how they do it, and what the interesting issues surrounding those activities are. Though Kraemer’s charisma cannot be conveyed in a book, many of his opinions can, and you can read about them here. Kraemer generously presented to every one of us a signed copy of his book.