Author: David Gerard

The Great Wines of New Jersey

Here’s a nice little piece on VoxEU from Orley Ashenfelter and his colleagues about how wine experts have trouble vertically differentiating wine quality. And when I say “have trouble” what I really mean is “they simply can’t do it.”

This column argues that alleged experts repeatedly cannot tell a superstar wine from a cheaper bottle.

We’ve sort of suspected this since the so-called Judgment of Paris back in 1976, but a more recent Judgment at Princeton adds some real perspective by pitting the wines of France against those of, um, New Jersey:

The important conclusion of the ranking, as analysed by Richard Quandt from Princeton, is that Clos des Mouches is statistically significantly better than the nine other whites, which are all judged of equal quality, while one New Jersey red wine is statistically worse than all other nine reds. None of the remaining wines, whether French or from New Jersey, is statistically different from the other. This implies that Château Mouton-Rothschild and Château Haut-Brion, two French superstars, cannot be distinguished from New Jersey reds, which cost only 5% of their French counterparts.

The bold is mine, indicating a bold conclusion, indeed.

As is sometimes the case, the most amusing part of the article is buried in the footnotes:

Ginsburgh, the only writer of this paper who contributed nothing to the Judgment of Princeton, wants nevertheless to point out that he did not even know that New Jersey produces wine.

La Cerveza Mas Roguish

Great post at Cheap Talk about beer pricing and Anheuser-Busch’s thwarted attempt to acquire Grupo Modelo, based on a New York Times article.

For decades, [the Justice Department] argue[s], Anheuser-Busch has been employing what game theorists call a “trigger strategy,” something like the beer equivalent of the Mutually Assured Destruction Doctrine. Anheuser-Busch signals to its competitors that if they lower their prices, it will start a vicious retail war…. Budweiser’s trigger strategy has been thwarted, though, by what game theorists call a “rogue player.” When Bud and Coors raise their prices, Grupo Modelo’s Corona does not.

Definitely worth reading, especially if you spent the last term engrossed in the ins-and-outs of the beer industry. See pages 168-170 of Tremblay & Tremblay for some illuminating background.

The Economics of Obesity

I will be participating in the “Weight of the Fox Valley Summit” this week, ostensibly to talk about the economics of obesity. Economists, of course, get their fingers in a lot of pies, and so this turns out to be a very broad ranging topic. For example, this USDA Economic Research Service workshop includes topics from why have Americans become more obese to labor market impacts of obesity, to what you might expect — implications for health insurance and economic costs of obesity.

I haven’t published in this area, but I did spend a year working with colleagues and students at Carnegie Mellon on a database charting obesity in the American population, so I have some idea of the basic issues. For those of you interested in an introduction, as always I recommend you go through the back issues of the Journal of Economic Perspectives to see what the profession has been up to. As per usual, you don’t have to go back very far to find some work by some top scholars in the area:

Jay Bhattacharya and Neeraj Sood (2011) “Who Pays for Obesity,” Journal of Economic Perspectives, 25(1): 139-158

David M. Cutler, Edward L. Glaeser, and Jesse M. Shapiro (2003) “Why Have Americans Become More Obese?” Journal of Economic Perspectives 17(3): 93-118.

Those should provide a reasonable, readable introduction to the economics literature on the topic, chock full of references to the primary research.

Another good source for a rough approximation is the EconTalk archive. I learned a lot listening to Russ Roberts interview Darius Lakdawalla. Here’s a nice cite on differential costs, with the surprising finding that the overweight and obese might actually live longer than “normal” weight folks, but spend a higher proportion of their years battling diabetes, hypertension, heart disease, and osteoarthritis. The authors estimate an additional $40,000 in lifetime medical expenses for the obese compared to someone with normal weight. Here’s that cite:

Darius Lakdawalla, Dana Goldman, Baoping Shang, The Health And Cost Consequences Of Obesity Among The Future Elderly, Health Affairs (2005)

Taking the Flare Out of US Energy Production?

The Dakotas continue to be in the news for something other than Al Swearengen’s vocabulary, as the hydraulic fracturing boom continues the dramatic expansion of natural gas and oil production. In fact, the natural gas production has driven domestic prices so low that almost a third of all natural gas is simply burned off, called “flaring,” as the marginal cost of capturing and sending it to market is evidently higher than the market price. Yes, you read that correctly, almost a third of all natural gas production is literally set on fire rather than captured and sold to consumers. Consequently, the bright lights of North Dakota can now be seen from space.

One of the reasons natural gas production is so abundant is that it is a co-product with the far more valuable shale oil down there, and the Energy Information Agency (EIA) estimates that the US will be the leading oil producer in the world by 2020, producing more than any single country in OPEC. That is hard to believe.

But back to the gas — doesn’t that seem rather silly, all that flaring? Do economists really believe that this is the “efficient” use of a scarce resource.

Well, no, we don’t.

And one of the main reasons is that the “external” cost of the carbon dioxide remains unpriced. Economist Ed Dolan discusses the basic economics of flaring and the potential effects of a carbon tax.

Of course, my guess is that given the discrepancy between U.S. and world natural gas prices (or here), we should be seeing the opening up of more robust export markets some time in the future. Or, one would expect that we would.

Another possibility is a move to natural gas in the transport sector.

Either way, the brown revolution is upon us.

American Capitalism as A Delicious Milkshake

One of the greatest films you are ever likely to see about the intensity, competition and dynamism in American capitalism, There Will be Blood, is the midnight movie tonight in the Warch Campus Cinema. As I watched the movie, I marveled at how all of those people and resources made their way into the middle of backwater nowhere within days of identifying a promising play. If you are a night owl type, I recommend you stroll over and see it.

As for the famous “milkshake” reference, that has to do with the “fugitive” nature of petroleum. Indeed, as I tell my students, oil is more like buffalo, and gold is more like cows. Gary Libecap has written extensively on oil field unitization as a solution to the “milkshake” problem. Indeed, yours truly knows a thing or two about how this all played out.

Armen Alchian: You tell me the rules and I’ll tell you what outcomes to expect

One of my favorite economists died earlier this week, Armen Alchian of the UCLA school of economics. If you don’t feel like reading any further, there is a Wall Street Journal obituary that probably says whatever I say, only better. But, since he’s had such a pronounced impact on how I think and what I teach, I’ll add my piece to the dialog anyway.

For those of you who have taken Orgs/Theory of the Firm with me, Alchian, of course, is influential with his piece on team production (Alchian and Demsetz — the grocer article), as well as his work on asset specificity (Klein, Crawford, and Alchian). These have, of course, been cited thousands of times because they are foundational to how economists think about firms. And his review with Susan Woodward of Oliver Williamson’s vision of transaction cost economics, “The Firm Is Dead; Long Live the Firm,” will undoubtedly leave you smarter for having read it.

Alchian is also renowned for his work that helped to spawn “evolutionary” economics, writing at about the same time as Schumpeter, it turns out. The paper “Uncertainty, evolution, and economic theory” is also a classic that has also been cited thousands of times, and has shaped how economists think about the dynamics of market competition.

I also cover the Alchian and Allen conjecture during the first week of Econ 300, so the teeming masses of students taking that this Spring should look out for that. Speaking of Allen, here he is discussing UCLA economics and the liberal arts, cited right here at LU Econ Blog.

If you are interested in reading something touching about Alchian, I suggest this piece by Fred McChesney, which contains this cool story from Alchian himself:

The year before the H-bomb was successfully created [in the 1950s], we in the economics division at RAND were curious as to what the essential metal was—lithium, beryllium, thorium, or some other. The engineers and physicists wouldn’t tell us economists, quite properly, given the security restrictions. So I told them I would find out. I read the U.S. Department of Commerce Year Book to see which firms made which of the possible ingredients. For the last six months of the year prior to the successful test of the bomb, I traced the stock prices of those firms. I used no inside information. Lo and behold! One firm’s stock prices rose, as best I can recall, from about $2 or $3 per share in August to about $13 per share in December. It was the Lithium Corp. of America. In January, I wrote and circulated within RAND a memorandum titled “The Stock Market Speaks.” Two days later I was told to withdraw it. The bomb was tested successfully in February, and thereafter the stock price stabilized.

An awesome precursor to the event study!

For a forceful statement on the economics of property rights, check out Alchian’s piece here that ends with a bang:

Private property rights do not conflict with human rights. They are human rights. Private property rights are the rights of humans to use specified goods and to exchange them. Any restraint on private property rights shifts the balance of power from impersonal attributes toward personal attributes and toward behavior that political authorities approve. That is a fundamental reason for preference of a system of strong private property rights: private property rights protect individual liberty.

Finally, here is our recent guest, Doug Allen, talking about Alchian’s influence.

Han Solo, Sharecropper?

Movie icon Harrison Ford will reportedly return reprise his iconic role as intergalactic hero Han Solo in the upcoming Disney epic, Star Wars VII: A Sith in Time til Episode Nine.

Movie icon Harrison Ford will reportedly return reprise his iconic role as intergalactic hero Han Solo in the upcoming Disney epic, Star Wars VII: A Sith in Time til Episode Nine.

On the heels of Doug Allen’s visit, we pause to ask whether Mr. Ford be paid a fixed wage, or will instead demand a share of the revenues from the film and the merchandising?

Perhaps we should consult Darlene Chisholm for some clues?

Sustainable China Info Sessions

If you are interested in spending the 2013-14 Winter Break in China as part of Sustainable China: Integrating Culture, Conservation, and Commerce , you should plan to attend an information session at the Warch Campus Cinema

Wednesday, February 27th at 4:30 PM

OR

Thursday, February 28th at 11:10 AM

Here are the Program Components:

- Fall 2013 courses – Environment and the Economy, Destination China, Chinese for Special Purposes (including language related to science and the environment), and Contemporary Chinese film

- December trip to China with urban and rural segments chosen from sites in Shanghai, Wuxi, Guizhou Province, Shenzhen, & Hong Kong

- Paid independent summer research support

- Post graduate internships

The program is funded by a 4 year Henry Luce Foundation Initiative on Asian Studies and the Environment

Disorderly Monday Talk

Update to TEDx Speakers List

As you may know, Lawrence is hosting a TEDx event this May, Re-imagining the Liberal Education. It looks like we are going to have to update our speaker list, as Bradley W. Bateman has been named President of Randolph College.

(Now) President Bateman was on campus last year as part of our Senior Experience, discussing his book Capitalist Revolutionary.

A big congratulations.

Economics Colloquium, Thursday at 4:30

–

The Institutional Revolution: The Duel of Honor

Douglas W. Allen

Simon Fraser University

The duel of honor – can you think of a more romantic topic for a St. Valentine’s Day lecture? The duel would seem to be a barbaric practice from an anachronistic age. Yet, Professor Allen provides a cogent theory of dueling, arguing that it provided a screen for otherwise unobservable investments in “social capital” – social investments that allowed aristocrats to demonstrate their allegiance to the crown. He argues that his “social capital” hypothesis is consistent with many of dueling’s peculiar institutional features, the rise and fall of the practice, and the salient differences between the European and American dueling practices. One suspects that he will also address Joseph Schumpeter’s duel with a recalcitrant campus librarian.

The talk is adopted from his recent book, The Institutional Revolution: Measurement and the Economic Emergence of the Modern World.

Professor Allen is on campus to discuss his classic work on North American agriculture, The Nature of the Farm (co-authored with Dean Lueck).

Thursday, February 14

Steitz Hall 102

4:30-5:30 p.m.

Schumpeter Turns 130

Happy Birthday (posthumously, of course) to Joseph Schumpeter (a.k.a., Jozsi, Schum, Schumy, Schump, Go-Go, and probably some less flattering names as well), born on February 8, 1883.

Happy Birthday (posthumously, of course) to Joseph Schumpeter (a.k.a., Jozsi, Schum, Schumy, Schump, Go-Go, and probably some less flattering names as well), born on February 8, 1883.

We’ve had a lot of fun with Schumpter over the past few years, including several iterations of Schumptoberfest (see here, here, and here), as well as an entire reading group built around him. Let’s hope that we can instill just a little bit of this into our student body:

Economists are at long last emerging from the stage in which price competition was all they saw. As soon as quality competition and sales effort are admitted into the sacred precincts of theory, the price variable is ousted from its dominant position… But in capitalist reality as distinguished from its textbook picture, it is not that kind of competition which counts but the competition from the new commodity, the new technology, the new source of supply, the new type of organization (the largest-scale unit of control for instance)–competition which commands a decisive cost or quality advantage and which strikes not at the margins of the profits and the outputs of the existing firms but at their foundations and their very lives. (Capitalism, Socialism, and Democracy, 84).

We’ll see you for Schumptoberfest 2013.

Modelo Justice

Amidst the hoopla of the triumphant release of Budweiser Black Crown, the King of Beers learned that its $20.1 billion offer to purchase Grupo Modelo — maker of Corona, that beer people put lemons in — had been given the kibosh by the good folks at the Department of Justice.

One of the key DoJ players in the blockages is our own LU alum William Baer, who had this to say:

This is the sort of product that matters to consumers. If you have a very slight price increase that happens because of this deal, it could mean that consumers will pay billions of dollars more.

Now, reaching for the back of my envelope, the average American guzzles down about 30 gallons of beer per year, about a half gallon per week. Now, if the price per gallon goes up $0.10, that would entail about $3 per person per year times 300 million people, or about a billion dollars (assuming the demand for beer is pretty inelastic, of course).

On the downside of all this consumer largess, young folks will probably be saddled with more STDs!

Thanks you to the formerly bearded “Mr. T” for the tip. Those of you in the 400 class should take a look. Very interesting stuff.

Student Loans

“Mr. P” points us to an infographic that breaks down a topic of potential interest to some of you — student loan debt. It appears that the median student owes between $10,000-$25,000, with the average between $10,000 and $50,000. My guess is that this isn’t the first you are hearing of this.

As the previous post indicates, it might be the case that higher education is about to see a shake up, which will probably include people more cognizant of the debt they are taking on.

It is also true that some of this debt seems completely justified, as college graduates continue to enjoy a healthy premium over those who lack a college degree.

Bad News for Law Schools

From today’s New York Times, a sea change in the demand for legal education:

As of this month, there were 30,000 applicants to law schools for the fall, a 20 percent decrease from the same time last year and a 38 percent decline from 2010… Of some 200 law schools nationwide, only 4 have seen increases in applications this year. In 2004 there were 100,000 applicants to law schools; this year there are likely to be 54,000.

The demand decrease, it seems, is largely due to a combination of the law school price tag (a movement along the curve) and a sour job market (a shift in the curve). If the short-run supply curve for providing legal education is somewhat inelastic, expect a free fall in tuition rates.

A few schools, like the Vermont Law School, have started layoffs and buyouts of staff. Others, like at the University of Illinois, have offered across-the-board tuition discounts to keep up enrollments.

Demand decreases, quantity decreases, price decreases.

I wonder what this portends for undergraduate institutions?

Economics Colloquium, February 5 at 11:15

.

Waiting for Godot, and for Corporate Social Responsibility?

David Gerard

Lawrence University

Milton Friedman famously wrote ‘The Social Responsibility of Business is to Increase its Profits,’ and ever since (and probably even before) the economics profession has been scratching its collective head wondering whether this is indeed our professional consensus. In this talk, I put on the ‘mainstream economist’ hat and give an overview of some of the central issues in organizational economics, and the implications of this literature on the balancing of corporate profits and other (potentially) desirable social objectives.

The target length for the talk is 40 minutes.

Tuesday, February 5

Steitz Hall 102

11:15a.m. – 12 p.m.

Update: Looks like we made the front page.

Message in a Bottle?

I got mail!

Hi,

I’m currently stuck in the Sage basement due to poor door design. Attached is the assignment for today. Should someone come by, I’ll probably make it to class, but this way you’ll know I have the assignment done.

“Mr. C.”

Do me a favor, open the door, and let him out…

Lawrence Scholars Saturday

This weekend marks another big weekend for the Lawrence Scholars programs, including a visit from alums Hugh McLean, Jamie Reeve, and Mark Spertel for the Lawrence Scholars in Business program. Our guests will talk about commercial banking and private wealth management. I’ll try to get their bios up later today.

These events are excellent opportunities for you to get a glimpse at opportunities out in the real world, and to mix with professionals who actually want and have time to mix with you!

The Informant is Back

Once again this year, the Economics Department proudly presents The Informant Tuesday, January 29 at 9 p.m. in the Warch Campus Center Cinema.

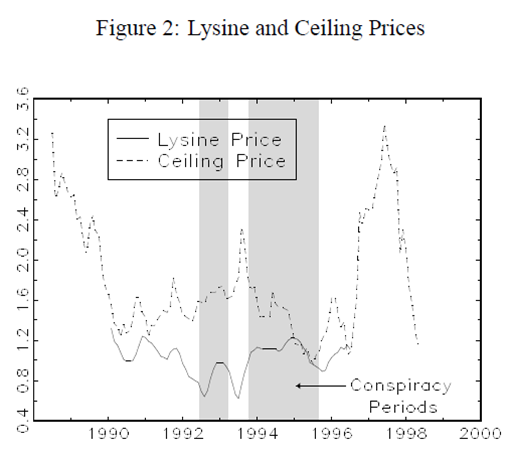

The movie “comically” recreates the character of Archer Daniels Midlands (ADM) employee, Mark Whitacre, the principal informant in the notorious lysine price fixing scandal. Lysine is an essential amino acid used to fatten up hogs and broilers. If you mix it in with corn, you don’t have to spring for the relatively more expensive soymeal, or so I’m told.

Well, I’ll let deRoos (2006) characterize the market for us:

Through 1990 the market lysine market was dominated by three firms with prices (as you can see) somewhere north of $1 / lb. However, in 1991 ADM opened a massive production facility in Decatur, Illinois, doubling world capacity and pushing the price below $1 toward its (probable) marginal cost of $0.66 / lb.

Whitacre subsequently orchestrated a coordinated effort to fix prices among the four dominant producers (a CR4 of 95-97%), though there is some dispute as to what exactly happened. Nonetheless, price fixing is a per se violation of federal antitrust laws, so ADM was in pretty serious hot water as soon as Whitacre turned informant.

On the other hand, Whitacre was absolutely crazy himself. And the movie does a good job portraying the frustration and insanity of everyone involved in the situation as the events unfolded. It seems the best defense for ADM was to simply let Whitacre unravel and leave the prosecutors to deal with him.

Meanwhile, the economics of the case spawned a rather, well, let’s call it a rather spirited debate in the academic literature over the length of the conspiracy and the damages done. These are well documented in the sources below, particularly John Connor and Lawrence White, who trade body blows over the appropriate theoretical model, the appropriate choice of the conspiracy period, and the proverbial “but for” price (that is, the price that would have prevailed “but for” the conspiracy).

A truly remarkable episode all around.

Pop some corn and mix in three parts lysine. We’ll see you there.

For further reading:

John M .Connor (1997) “The Global Lysine Price-Fixing Conspiracy of 1992-1995,” Review of Agricultural Economics, 19 (Fall/Winter), 412-427.

Nicholas deRoos (2006) “Examining models of collusion: The market for lysine,” International Journal of Industrial Organization, 24(6): 1083-1107

Lawrence White (2001) “Lysine and Price Fixing: How Long? How Severe? Review of Industrial Organization,18 (1):23-31