Though Spring does not appear to be right around the corner, the Spring Term is closer than you think! Here are some of the highlights from Economics for the Spring Term.

ECON 495: Individual and Community TR 12:30-2:20 in the Econ Seminar Room, Professor Wulf.

Professor Steve Wulf (!) is cross-listing his fabulous course for the economics department for the first time. That being the case, here is the course description: This course studies a variety of theoretical responses to the emergence of open societies in the West. Topics include the competing demands of individuality and community in religious, commercial, and political life. The course promises a very healthy dose of history of economic thought.

ECON 460: International Trade MWF 8:30-9:40 in the Econ Seminar Room, Professor Devkota.

ECON 405: Innovation and Entrepreneurship 9:50-11:00 MWF in the Econ Seminar Room, Professor Galambos.

For those of you looking for some theoretical foundations to thinking about innovation & entrepreneurship, look no farther. An excellent complement to IO and Theory of the Firm.

ECON 320: Intermediate Macroeconomics MTWR Briggs 223.

Always a highlight!

ECON 295: Labor Economics 3:10-4:20 MWF in the Econ Seminar Room, Professor Rhodes

If you are looking for a 200-level economics course next term, this is a good bet. This should be excellent prep for Econ 300 in the Fall.

ECON 200: Development Economics 11:10-12:20 MWF in the Econ Seminar Room, Professor Devkota

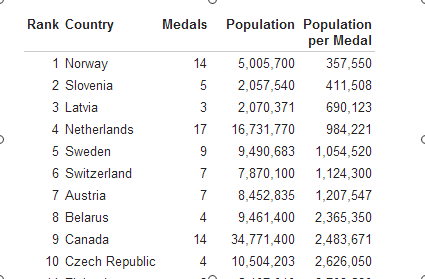

This is also a good bet for next term, especially for those interested in understanding economic growth across countries.

ECON 225: Decision Theory MWF 1:50-3:00 Briggs 223, Professor Galambos

This class is not full, but enrollment is heavy (30+). We have committed to offering this in 2014-15 and expect it will be offered in 2015-16.

ECON 280: Environmental Economics TR 12:30-2:20, Briggs 223, Professor Gerard

This class is full and the current wait list is 9. It is offered each year, including Spring 2015.

ECON 120: Introduction to Macroeconomics MWF 12:30-1:40, Briggs 223, Professor Rhodes

The longest journey begins with the first step… and then the second step. This could go either way, as ECON 100 is not a prerequisite.