A bit more on the potential NFL strike — my friend and colleague, Rodney Paul, is on NPR’s Marketplace talking about the dark days looming for DirecTV if owners and players fail to come to terms on a new labor agreement.

A bit more on the potential NFL strike — my friend and colleague, Rodney Paul, is on NPR’s Marketplace talking about the dark days looming for DirecTV if owners and players fail to come to terms on a new labor agreement.

For those of you who don’t follow these sorts of things, DirecTV is a satellite television service that serves as the exclusive provider of the NFL Sunday Ticket, which has beaucoup benefits for the football fan. Specifically, the Sunday Ticket provides access to pretty much every NFL game, allowing for orgiastic quantities of football viewing.

Yet, I find this absolutely astonishing:

regardless of whether or not there is a season, the company (DirecTV) still has to make roughly $1 billion in payments (to the NFL).

Wow! That seems like a lot of money. But my guess is that it could have been even more. To wit, I wonder if they didn’t consider the strike as a possibility, or they negotiated a lower price based on continuing payments to the NFL even in the event of a work stoppage?

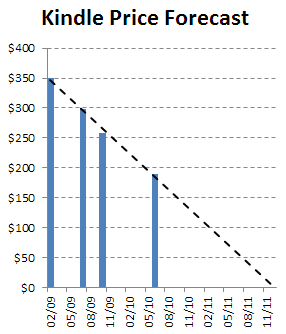

In a recent issue of Vanity Fair (of all places),

In a recent issue of Vanity Fair (of all places),