Professor Georgiou will be offering ECON 495, Advanced Topics in Law and Economics, this fall on Monday, Wednesday, Friday in the 3:10 to 4:20 time slot. The prerequisite for the course is ECON 300 or consent of the instructor. If you have had ECON 271 or ECON 280, this might be an extremely attractive follow on.

Here is the teaser:

Should a grandson that killed his grandfather be allowed to be his heir? Should theft be punishable by death? Why is blackmail illegal? Should smoking be allowed in bars? Should a bystander be punished for not rescuing a drowning person? What is the purpose of limited liability for shareholders? Why is polygamy not allowed?

These questions seem to touch very distinct areas of the law. But there is one and (maybe) only one way to go about answering all of them: Economic Analysis! In this class we will show that economic efficiency is what makes a good law and that laws that don’t make sense can be critiqued with economic arguments. Law and economics is a class that expands the scope of economics and limits the arbitrariness of the law.

Registration resumes in a couple of days, so please stand up and be counted.

ive tool

ive tool Alright, I still don’t have an accounting of our numbers (and I’m not even listed as an instructor), but it’s time to start talking about Wapshott’s Keynes Hayek book.

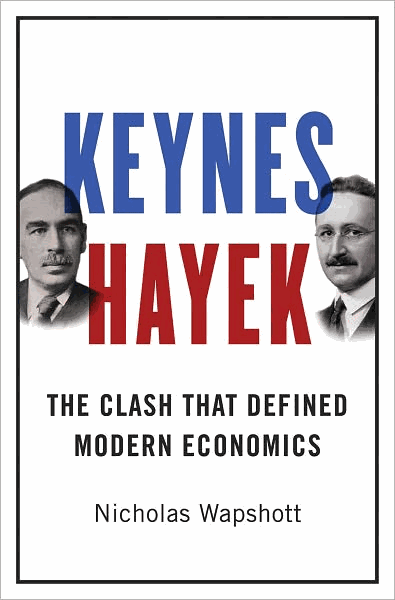

Alright, I still don’t have an accounting of our numbers (and I’m not even listed as an instructor), but it’s time to start talking about Wapshott’s Keynes Hayek book. This term’s economics read, DS 391 Keynes Hayek and Other Dead Economists, triumphantly kicks off this Thursday at 3:25 in Steitz 230.

This term’s economics read, DS 391 Keynes Hayek and Other Dead Economists, triumphantly kicks off this Thursday at 3:25 in Steitz 230.