Alum Seth Harris, who used to work in the admissions office at Lawrence and now works for Hardwick-Day, has posted a job opening for a data analyst. The position involves working with a small team of people to assist colleges and universities with managing their enrollments. If data analysis and frequent visits to colleges sound like fun to you, read the linked job announcement (Hardwick-Day Announcement) or check out the offering on the board outside Mr. Azzi’s office (BH 221).

Category: Life after Lawrence

LSB Chicago Trip, 2011 Edition

Sign-up for the 2011 Lawrence Scholars in Business Chicago trip is now open! The deadline to sign up is March 25th. To find out the details, click below. (TRIP IS AT CAPACITY)

Continue reading LSB Chicago Trip, 2011 Edition

Career Center Event this Sunday

It’s never too early to think about what you are going to do after you leave Lawrence. In fact, thinking about what you might do after graduation could well open up some exciting opportunities whilst you are still here in the friendly confines of Appleton.

This Sunday (February 27) alumni will be on campus for the Shine Light, More Light on Your Future conference. I recommend that you seize the opportunity to meet our alumni and discuss their career paths and experiences. They are here because they love Lawrence and want to help folks just like you.

Here’s the scoop (see below) from the Career Center blog.

Date: Sunday, February 27, 2011

Time: 10:30 a.m.-3:30 p.m.

Location: Warch Campus Center

Whether or not you know what direction you are headed, take advantage of this unique opportunity to learn from those who have gone before you.

Registration is required.

Cost: One meal swipe.

Contact Sherri at 832-6854 or alumni@lawrence.edu to register by February 23, 2011.

Internships

Though the time to look for the best internships has passed, many may still be looking for something for this summer.  A new website, Intern Match, says that

A new website, Intern Match, says that

By focusing on attracting a high volume of smaller organizations, InternMatch will greatly increase the number of opportunities and diversity of choice available to students. The InternMatch Platform will also act as a one-stop-shop for finding/applying for opportunities, communicating with organizations, and building a professional profile that will showcase interests, talent and experience.

Students who want to volunteer will find that InternMatch allows them to combine community impact with career-building. Internships for nonprofits allow socially-conscious students to maximize social impact, build their resumes, and gain critical real world experience.

Worth a try, if you are in the market for an internship.

A Question of Consumption? An Analysis of the Relative Effectiveness of Multilateral and Bilateral Aid Receipts

Our recent graduate, Oliver Zornow, has just published his paper entitled “A Question of Consumption? An Analysis of the Relative Effectiveness of Multilateral and Bilateral Aid Receipts” in the Undergraduate Economic Review. Here is the abstract of his paper:

“The literature focusing on the effects of foreign aid on economic growth contains a wide range of conclusions. Despite this lack of consensus, policy makers have been strongly influenced by the work of Burnside and Dollar (2000) (B&D). In addition to their primary conclusion that total aid is linked with growth in a good policy environment, B&D make a claim which is not directly supported by their results. My research is motivated by their claim that multilateral aid is the most effective form of aid. This paper demonstrates that B&D’s data does not support this claim.”

If you’re interested, you can download and read the paper from the journal website:

http://digitalcommons.iwu.edu/uer/vol7/iss1/12/

Congratulations, Oliver!

Economics SpecialTea w/ Dave Mitchell

Job/internship Opportunity

EntrepreneurTheArts

Another very interesting person I heard at the CEO conference on Friday was Lisa Canning. Well-known for Entrepreneurthearts.com, Lisa Canning is a prominent face of arts entrepreneurship these days.

She founded the Institute for Arts Entrepreneurship, which has a two-year post-graduate certificate program that could be of interest to many Lawrentians. Their mission: “The IAE is committed to helping our students discover meaningful solutions to one essential question: As a person committed to the arts, how do I develop the knowledge and skills to create a successful, meaningful and sustainable life in today’s world?” Ms. Canning has started six highly successful ventures in the past twenty-some years. She sold all of them to start the Institute for Arts Entrepreneurship, except one: the one that is about her “baby,” the instrument she has played since her childhood, the clarinet. Lisa’s Clarinet Shop is still helping musicians of all levels find the perfect clarinet. Even when she was running those earlier businesses, Lisa hired artists and helped them build on their artistic skills and develop entrepreneurial skills. Artists can use their empathy and ability to connect with people to become successful entrepreneurs. Rather than pitching the “what” to a customer, it is much more important to make a human connection around the “why” and the “how.” This is good advice to anyone–Gary Vaughan was telling me on the way home that in any business, people buy from you because they like you. As Lisa said, she never has to talk about price, because it becomes a secondary issue to the customer. She is certainly a very kind and very emotional person, and I believe that she can teach a lot to artists about “entrepreneuring their art.” I hope we can get her to Lawrence in the not-so-distant future.

Collegiate Entrepreneurs’ Organization conference

Gary Vaughan and I spent the last two days at the Collegiate Entrepreneurs’ Organization (CEO) conference in Chicago. The conference is largely sponsored by the Coleman Foundation, who also made our Entrepreneurship in the Arts course possible through a grant, and who continue to fund some of our arts entrepreneurship initiatives. Our own Alex Chee and Cuong D. Nguyen are still at the conference.

This three-day event features a number of entrepreneurs who share their experiences with about 1500 students from all over the country. We heard, among others, Jimmy John talk about his story. (His father lent him $25K to start a hot-dog stand, and said that if he makes it, Jimmy gets 52% of the company, father gets 48%; if he fails, he agrees to enlist. The threat of boot camp pushed Jimmy to succeed and buy out his father. How did he sell his first sandwiches? Well, he didn’t. After he opened his shop and not a soul showed up by 2pm, he grabbed a few sandwiches and went to the neighboring businesses to hand them out as samples.) Another interesting person I heard was Phillip Leslie. Formerly a Microsoft software engineer (mobiles apps division), Mr. Leslie just couldn’t help getting into the iPhone app gold rush when he was an MBA student at Chicago’s Booth School of Business. So he launched ProOnGo, a mobile expense reporting app. In the middle ages, when you went on a business trip, you came home with a pocketful of receipts, which you then meticulously recorded and submitted. With ProOnGo, when you get that receipt, you take a pic of it with your iPhone, or Blackberry, or whatever, and in a few seconds you are done. At the end of the trip, you click to submit your expenses in excel or pdf format. Huge hit. Mr. Leslie gave very good advice indeed on how to make it with an app. For example, do you know the three ways to make money with an app? Through ads, one-time sales, or subscription service. Sounds obvious, but, actually, he is one of the pioneers of the last of these: it was believed that subscription service just wouldn’t be viable for iPhone apps. And how much do you get per impression if you advertise on your free app? Well, between a tenth of a penny and a penny. He also encouraged students with economics and social science-type skills to pair up with computer science majors to produce an app. But be clear about one thing: is this a hobby (which will cost you money), or a business (which should make you money)?

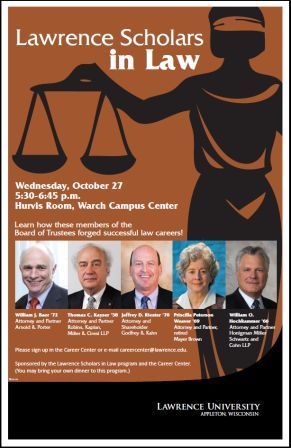

Lawrence Scholars in Law Wrap

The Lawrence Scholars in Law kicked off in style with a capacity crowd (35-40 students) and a festival-type atmosphere, with about 15 students joining us for dinner. As I said in my introductory remarks, the alumni talent on hand for our panel was extraordinary. Each is a lawyer and a member of the Lawrence board of trustees, and each is very enthusiastic about he prospects for the LSL program.

A couple of points emerged from the discussion. The first is that there is no right major that you need to choose to apply. Our four panelists came from four different majors — history, government, economics, and piano performance. The second theme seemed to be that a law degree opens up many doors, not just the door to the big law firm.

Panelist Jeff Riester also pointed prospective law students to Law School: Getting In, Getting Out, Getting On, by Michael Ariens. This seems like a good resource, and pre-law advisor Steve Wulf and myself will hold onto it if you care to take a look at it.

We are planning one LSL per term this year, and we would like to encourage you to provide us with feedback, as well as input into content for future programs.

More from The Lawrentian.

Lawrence Scholars in Law!

Firmly on the coattails of the extraordinary success of the Lawrence Scholars in Business program, the inaugural Lawrence Scholars in Law event kicks off at 5:30 on Wednesday, October 27 in the Hurvis Room of the Warch Campus Center.

Who should attend this session? I would suggest anyone who is thinking about a law career should clear their schedule for this one. Also, anyone who isn’t sure about their own career ambitions might consider poking her head in. Many students these days work for a few years before returning to pursue a law degree. And liberal arts majors generally, and economics majors in particular, have potential to succeed.

The talent on hand for this program is exceptional. We have five successful attorneys, each a partner or a shareholder (what’s the difference? Good question to ask) with a major law firm. And each with a member of the Lawrence University Board of Trustees. They are:

- William J. Baer ’72 Attorney and Partner: Arnold & Porter

- Thomas C. Kayser ’58 Attorney and Partner: Robins, Kaplan, Miller & Ciresi LLP

- Jeffrey D. Riester ’70 Attorney and Shareholder: Godfrey & Kahn

- Priscilla Peterson Weaver ’69 Attorney and Partner, retired: Mayer Brown

- William O. Hochkammer ’66 Attorney and Partner: Honigman Miller Schwartz and Cohn LLP

Professor Gerard will also be on hand to moderate.

Please sign up in the Career Center or e-mail careercenter@lawrence.edu to make your intentions known.

You are welcome to bring your dinner to the program. Or, better yet, plan to dine with the five panelists afterwords.

Dana Fellowship at Ronin Capital

INVITATION

An information session regarding the Fellowship will be held on Saturday, September 25. The session will begin with lunch in the Schuman Dining Room beginning at 12:00 noon followed by an information session from 1:00 until 3:00 p.m. in the Hurvis Room of the Warch Campus Center. Mr. Larry Domash ’81, who is a partner with Ronin Capital (a world – wide proprietary trading firm based in Chicago) and Imtiaz Khan ’09 will be facilitating the session. To sign up for lunch and/or the information session, please stop by or call the Career Center (920 832 6561). Registration deadline is Wednesday, September 22.

HISTORY

During the summer of 2009, Ronin Capital hired Imtiaz Khan ’09 to work on a research project examining, in part, the causes and opportunities associated with the 2007 – 2008 “US financial markets crisis.” The success of this project led to the establishment of the James Dana Fellowship for graduating Lawrence University students.

GOING FORWARD

For each of the next five years (2011 – 2016) Mr. Domash ’81 will be hiring 1 student annually from LU to serve as a Dana Fellow. Each Dana Fellow hired will work on an empirical project. While the background and formatting work for the study will be performed in Chicago – some of the empirical data gathering will take place in NYC and London.

The finished project will be published for distribution to clients/ consultants / academics – for review and feedback. The LU grads chosen to be Dana Fellows will also receive training in research techniques and have the opportunity to observe how their research translates to trading for approximately 1 year. The individual will receive full salary and bonus during their work with Mr. Domash as well as a reference for placement. Upon completion of the project, Mr. Domash will work with the individual and help in all aspects of placement in an investment advisory or Wall Street style trading firm – if desired.

During 2011 – 2012, the named Dana Fellow will be working on a research project examining the 2010 Sovereign Debt Crisis in Europe and will encompass both a statistical and abstract examination of European Government finances as well as policies relating to fiscal and tax policies. It is envisioned that the study will try to provide a statistical substantiation to Keynesian economic theory..

The James Dana Fellowship was established with a dual purpose: 1.) to create viable empirical research leading to new trading bond/equity trading strategies at Ronin Capital; 2.) to establish a mentoring and networking community for Lawrence graduates and undergraduates within the trading and Wall Street finance industry. Part of the requirements of the fellowship is to help Lawrence undergrads gain insight into the trading community and to “give back to the University” by donating time.

Who are they looking for to be Dana Fellows?

- Self starters

- Students who have excellent communication skills and are fluent in operating all aspects of the Microsoft Office product suite.

- Students that enjoy research.

- Students that can work by themselves and who are comfortable in a team environment.

- Students genuinely curious about the Sovereign Debt Crisis of 2010.

- Students that can ask any question and not be embarrassed

- Students that have enjoyed their Lawrence experience.

- Most of all the ability to learn.

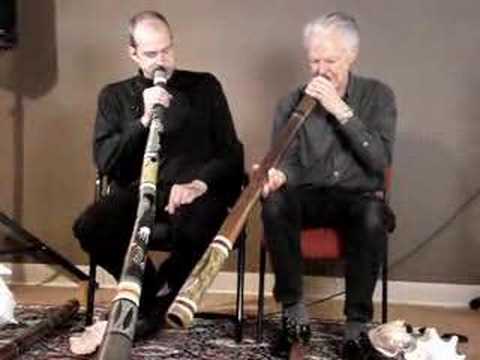

Didje See that Dean Pertl Article?

Speaking of careers in business, Dean of the Conservatory, Brian Pertl, poses the question, “What on earth could playing a Mozart symphony have to do with leading a budget proposal meeting?”

Speaking of careers in business, Dean of the Conservatory, Brian Pertl, poses the question, “What on earth could playing a Mozart symphony have to do with leading a budget proposal meeting?”

Plenty is his response at the Entrepreneur The Arts blog.

Coming on the heels of the successful Entrepreneurship in the Arts and Society class this past term, this is a very encouraging message indeed. And especially so for those of us who believe in the mission and the viability of the liberal arts.

Don’t forget, former Fed Chair Alan Greenspan was a clarinet student at Julliard before dropping out to tour with Stan Getz. Is that why they called him Maestro?

Don’t Feel Like You *Have* To Become a CEO

News from the research front that (some) economics majors are going places. To wit, “the share of graduates who were Economics majors who were CEOs in 2004 was greater than that for any other major, including Business Administration and Engineering.”

Here’s the paper, appropriately titled “Economics: A Good Choice of Major for Future CEOs,” and here’s from the abstract:

We find evidence that Economics is a good choice of major for those aspiring to become a CEO. Economics ranked third with 9% of the CEOs of the S&P 500 companies in 2004 being undergraduate Economics majors, behind Business Administration and Engineering majors, each of which accounted for 20% of the CEOs. When adjusting for size of the pool of graduates, those with undergraduate degrees in Economics are shown to have had a greater likelihood of becoming an S&P 500 CEO than any other major. That is, the share of graduates who were Economics majors who were CEOs in 2004 was greater than that for any other major, including Business Administration and Engineering. The findings also show that a higher percentage of CEOs who were Economics majors subsequently completed a graduate degree – often an MBA – than did their counterparts with Business Administration and Engineering degrees.

I nicked that from Marginal Revolution, and I’m certain there will be plenty of snarky commentary over there about it.

Some other interesting data over there. For example, the total number of business majors is split pretty evenly between males and females, but economics is 70% male. Of course, females now make up 60% of the undergraduate population.

Star-power at Lawrence this Saturday

This Saturday the Lawrence Scholars in Business program will have its final event of the year: the Entertainment Summit. This event should be of interest not only to economics and other majors who are interested in the business of show-biz, but also to Conservatory and Arts students interested in getting into the entertainment world.

Five Lawrentians who know that world very well will be here to tell us about it: Alan Berger, Emeline Davis, Lee Shallat Chemel, Liz Cole, and Campbell Scott. Take a moment to click on those links, and marvel at the star-power arriving to campus on Saturday. Campbell Scott will be showing his new mockumentary, Company Retreat, at 7:15 pm on Friday, May 21st, in the Warch Cinema.

Please sign up in the Career Center, or by email at careercenter@lawrence.edu.

Economics Majors are Tops

According to a just published survey by payscale.com, economics majors receive the highest mid-career salary among all majors surveyed. The $50,000 average starting salary isn’t too shabby either. Check out the details.

Nothing Elementary About It!

You should check out the Watson Fellowships if you think you might be in the running. If you are intellectually curious and have a good idea, this is a big opportunity.

Watson Fellowship

Information sessions!

Wed. April 21st 11:10-12:20 Runckel, and 2:00-3:00 Kraemer

Warch Campus Center

With the Director of the Thomas J. Watson Foundation

Cleveland Johnson

What is the Watson Fellowship?

Simply put, one of the coolest fellowships ever offered. The winner of a Watson Fellowship receives $25,000 to carry out a one-year independent study of her own design.

Qualifications:

The Watson is awarded to graduating seniors. The winner must carry out the proposed study outside of their home country (typically the US), and they must be gone for the entire year (no sneaking home for the holidays). The proposal should be focused on something the applicant is passionate about, but may not have had a chance to explore before. Sword-making, rain-forest ecology, mermaid myths, and the role of harmonics in sacred music are just a few of the topics previous winners have studied. Our winner this year, Alex Winter, will be heading off to Asia to study on-line gaming culture.

Time Line

Applications are due at the end of September at the start of your graduating year, BUT it is never too early to start thinking about what you might propose. So everyone is welcome to this information session given by the Watson Director himself. Don’t miss this amazing opportunity!

We have scheduled two separate sessions for your convenience!

Lawrence Scholars in Business Chicago trip

The LSB program sponsors an educational trip to Chicago every year. The purpose of the trip is to provide students an “immersion experience” in one of the country’s financial centers. The trip will take place during reading period, on May 6th and 7th. We will leave at 6:00 am on Thursday, May 6th, and return in the evening on Friday. We will have a full schedule, visiting the Chicago Board of Trade, the Federal Reserve Bank, as well as some firms including Madison Dearborn, Copia Capital, the consulting firm Deloitte and Touche, and The Northern Trust Bank. The costs of the trip are covered by the LSB program. This trip is a great opportunity to learn about the financial world (and a consulting firm) up-close, in a way that you couldn’t do on your own.

If you would like to join, sign up by giving Adam Galambos an envelope with $20 in it, and your name on it. We will return the money to you when you board the bus at 5:45 am on May 6th. Should there be more students interested in going than spaces, preference will be given to students who did not go on the trip last year and to juniors and seniors, as they are less likely to have another chance to go. But, if you are interested in the business world, sign up, whoever you are—if you don’t get to go, we’ll return your deposit, of course. The deadline for signing up is April 12th. Email Adam Galambos with questions.

Alternative Investments Summit

Join us this Saturday, 3:30, the Hurvis room, to learn about private equity and other kinds of alternative investments. The session will be led by Bob Perille ’80, Managing Director at Shamrock Capital, the private equity firm started by Roy Disney, Walt Disney’s nephew. Alan Allweiss ’77, Managing Director at LBC Credit Partners, Dan Howell ’74, Senior Managing Director, Mesirow Financial, and Bryan Torcivia ’81, mergers and acquisitions consultant (BAT Consulting) will join Mr. Perille in explaining alternative investments and what’s wrong with hedge funds.

Mr. Perille will bring offering memoranda (an offering memorandum is a document explaining the details of an investment to potential investors), and student teams will have to decide whether to buy the firm or not, and for how much.

Last year there was a substantial prize!

Sign up in the career center or at careercenter@lawrence.edu.