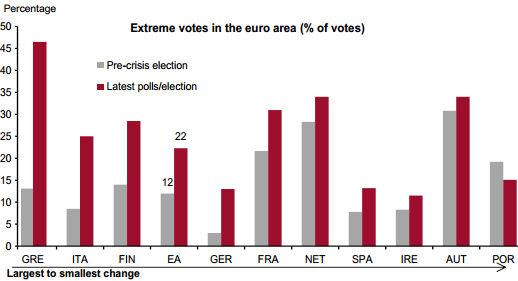

Jordan Weismann has an interesting bit in The Atlantic on the recent decline in gold prices — off about 15% from last-year’s peak — that includes some fascinating perspective on China and the world economy:

[China] deregulated its gold market in 2001, and since then, it has gone from consuming about a third as much gold as the developed west to overtaking it by 2011. Let me repeat that: the Chinese buy more gold than the entire west combined.

The current gold price seems pretty high to me. Back when I was thinking more about the mining industry, (nominal) prices were less than $400 /oz; today’s prices are north of $1500. So, even adjusting for inflation, that is a pretty good ride. But when I looked for a graphic to illustrate the changes, I came across this nice blog post on how it’s hard to find an “objective” series of real gold prices.

Gold markets are interesting for all sorts of reasons that I won’t get into here. Perhaps I will start cobbling together a reading list on the many dimensions of the economics of gold and gold markets.