Bring your thoughts. Bring your questions and your thirst for knowledge to EconTea today at 4:30. Your favorite faculty members are excited to interact with you on the topics of the day.

Regime Uncertainty: Did the New Deal End the Great Depression?

There is a continuing debate, as you must know by now, as to whether Keynesian fiscal stimulus is an effective macroeconomic policy tool, especially with the US economy stuck in its current doldrums. There is probably no bigger detractor to this idea than Robert Higgs of the Independent Institute. Many on the Keynesian side say the $750 billion fiscal stimulus wasn’t big enough.

Higgs argues that the whole Keynesian paradigm is out of whack, that, in fact, more robust governmental involvement in times of a crisis creates pervasive uncertainties for the private sector. This “regime uncertainty,” whether it be from potential tax increases or other regulatory hurdles, shakes investor confidence and stifles capital formation. Who is going to play a game when the rules of the game are subject to potentially radical change?

Those of you who have taken Economics 240 might recall Higgs’ “ratchet effect,” but he is perhaps better know for this regime uncertainty idea. Higgs forwarded some of these arguments in the Journal of Economic History, and has recently bolstered it both in the Independent Review. He doesn’t see this as a unifying macro theory, but more as an element that is generally ignored (or ridiculed) by many macro theorists.

You can also catch Higgs talking about these issues with Russ Roberts on EconTalk.

Caveat Emptor

It might shock, shock many honor-bound Lawrentians that there are college students out there that don’t do their own work. In fact, as many of you are likely aware, there is a robust market for term papers out there that allow you to buy papers from levels from high school to Ph.D. on topics ranging from, well, from Moses Abramovitz to Frederik Ludvig Bang Zeuthen. It appears the going rate is about $10-$15 per page depending on how soon you need it.

This is certainly not a new phenomenon. Years back, Seth Stevenson surveyed the market and gave a few pointers for cheaters and lazeabouts to choose the right site to purchase a paper, and he looks at some of the market characteristics. For example, a custom paper is about twice as expensive as an off-the-rack piece.

But that was nearly 10 years ago, and certainly the market has matured by then. For a more recent treatment, behavioral economist Dan Ariely dipped his toe in to see what he could find, and what he found was well worth reading. Here are a few snippets:

We ordered a typical college term paper from four different essay mills, and as the topic of the paper we chose… (surprise!) Cheating… We submitted the four essays to WriteCheck.com, a website that inspects papers for plagiarism and found that two of the papers were 35-39% copied from existing works.

Someone plunks down $100 for a paper, and still gets dinged for cheating? Now that smarts. Exactly what recourse do you have in that situation? I guess you ask for your money back:

We decided to take action with the two largely plagiarized papers, and contacted the essay mills requesting our money back. Despite the solid proof that we provided, the companies insisted that they did not plagiarize. One company even tried to threaten us by saying that they will get in touch with the dean at Duke to alert them to the fact that we submitted work that is not ours.

I like their moxie — deny, deny, deny, threaten.

The comments to Ariely’s post are also interesting.

Stephen Colbert Testifies on Immigration

Don’t miss Colbert’s testimony before Congress on immigration. The guy clearly understands markets.

Beer Distributors Apply Political Economy Herbicide

It is a good couple of weeks for those interested in the economics of (and innovation in) illicit drug markets. First, HBO started up its mega super miniseries, Boardwalk Empire, about how an Atlantic City official built an organized crime empire following the enactment of the 22nd amendment prohibiting the production and sale of alcohol.

It is a good couple of weeks for those interested in the economics of (and innovation in) illicit drug markets. First, HBO started up its mega super miniseries, Boardwalk Empire, about how an Atlantic City official built an organized crime empire following the enactment of the 22nd amendment prohibiting the production and sale of alcohol.

Then we find out that there is an online “weed” price clearinghouse.

And, now, via Marginal Revolution, we learn that the beer distributors actively oppose marijuana legalization in California. So quick 100 and political economy question — do beer distributors think marijuana and beer are more like complements or substitutes? To date, there is no word on whether manufacturers of Cheetos have taken a public stance on the isssue.

Interestingly, the teachers union supports legalization because of “the revenue that could be raised for the state.”

Where Do Good Ideas Come From?

I’m not sure, because Steven Johnson’s Where Good Ideas Come From isn’t out for a few weeks, and all I have is this four-minute video. Well, actually, I also have this longer video from over at TED (the new Harvard, I’m told). But as I’ve often said, movie, shmoovie, I’ll wait for the book.

Are “Weed” Prices Sticky?

Competition is on my mind. How do firms compete? By price? Quality? Product differentiation? Threatening potential entrants with physical violence? All good questions.

But if we just stick to price competition, how much price variation is there across markets? And why? Monday at the Econ TeaBA, we heard from a savvy young entrepreneurial type who claimed to be able to exploit exchange rate differences by selling used American stuff to Canadian customers. Wow!

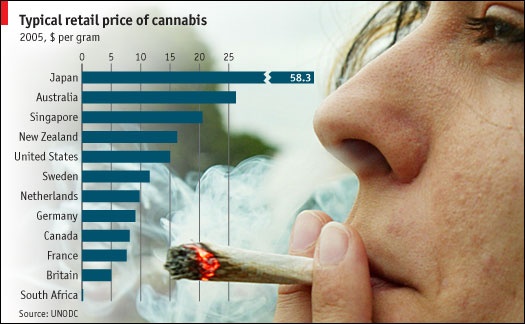

Of course, that whole enterprise sounded pretty idiosyncratic, so it is not entirely surprising that the law of one price didn’t seem to apply. But what about in markets where the product quality is fairly homogeneous and there are limited barriers to entry. Say, for instance, marijuana.

As most of you know, the US and most of the rest of the world restricts production and sale of most drugs, including marijuana, or “weed,” as it is sometimes called (among other terms). But my understanding is that even the threat of legal sanctions, fines, and even prison do not eliminate don’t stop a robust trade. Indeed, in his “Dear Undercover Economist” column, Tim Harford takes on this unusual question:

Dear Economist,

I have been a client of weed dealers in North America since the mid-1980s and no matter who the vendor, the price has remained $10 a gramme. I don’t think anything in 25 years has stayed fixed in price like weed has.

Dealers might have some power to increase prices, as it’s illegal, and there are some significant barriers to entry, such as getting arrested. But if I don’t like the prices, it’s pretty easy to grow some on my own, because it “grows like a weed”, even if it might not be as good as the dealer’s Cannabis sativa.

So how did we end up at $10 a gramme?

Sebastian

Dude, that is a puzzle, indeed. My first response is supply (a.k.a., “more weed”) would keep the real price from falling, but that doesn’t affect what economists call the “price stickiness” question. That is, why $10?

Check out Harford’s response here.

On the other hand, I have to wonder who Sebastian’s source is, as this past week, I was alerted to a site that tracks prices of various quality marijuana, www.priceofweed.com. The site stratifies prices based on self-reported quality, and also logs the amount of the purchase (lots of bulk discounts, of course). average price of a high-quality ounce of weed is listed as north of $400 here in America’s dairyland. The site legend of US prices suggests that Wisconsin marijuana is the pricey side. The site also contains information about “social acceptance” and “law enforcement.” So, one might expect some relationship between price, levels of enforcement, amount and quality.

A site that launched a thousand econometrics projects. Excellent.

Schumptoberfest Sign Up Continues

I have logged several folks for the Schumptoberfest weekend weekend, October 22 to 24, at Björklunden. If you are interested and would like IS credit, please sign up with me by Friday. I have some IS forms tacked on the board outside my office. it is best that you sign up by Friday.

Again, the requirements are:

- Complete the assigned readings.

- Travel to Björklunden over reading period (Friday evening until Sunday afternoon) and participate in our workshop.

- Write a short response paper (3-5 pages) to the ideas and discussions from the weekend.

We would like to engage students who have a good understanding of micro theory and are interested in innovation and entrepreneurship. The readings dovetail nicely with my Economics 400 (IO) and 450 (theory of the firm) courses.

We would like to engage students who have a good understanding of micro theory and are interested in innovation and entrepreneurship. The readings dovetail nicely with my Economics 400 (IO) and 450 (theory of the firm) courses.

I am in the process of completing the reading list and will provide both PDFs and reading guides for the materials within the next week.

Global Competitiveness

The U.S. is number 4 according to the global competitiveness survey just released by the World Economic Forum. It dropped from second to fourth in the past year. Switzerland, Sweden, and Singapore (is there something about S?) lie above the US. What’s behind these rankings? Should anyone care? See today’s Financial Times Lex column for both an editorial opinion on the survey and for a link to the full report. The website for the report contains profiles of each country as well as informative commentary about its meaning.

Krugman vs. Rajan on the Causes of and Responses to US Economic Stagnation

Paul Krugman rejects the claims that Raghuram Rajan makes about why the US entered the financial crisis. Furthermore he argues that the cause is not particularly important and that more macroeconomic policy stimulus is needed until the US returns to pre-recession levels of employment and GDP. Rajan argues that such stimulus is partly the reason why the crisis was created and that fundamental reform is required.

Cafe Hayek provides links to both articles in a recent posting.

Raghuram Rajan responds to criticism from Krugman and Wells. Much of his response will be familiar to Cafe Hayek readers but it is convenient to have all of Krugman’s mistakes about the housing bubble assembled in one place.

Schumptoberfest IS Coming

As an addition to the burgeoning I&E program, the inaugural Schumptoberfest™ is coming to Björklunden over reading period weekend, October 22-24. If interested, you need to sign up with Professor Gerard.

What is Schumptoberfest ? In short, it is a celebration of the ideas of economist Joseph Schumpeter, the subject of our first I&E Reading Group earlier this year. Through reading and discussion, we will develop a better understanding of innovation and entrepreneurship generally, and particularly the importance of economic organization fomenting or retarding entrepreneurial activities. Of course, we also hope to develop a rapport among the students and faculty interested in these topics.

To encourage and reward participation, we are offering a two-credit independent study. The expectations for the IS are as follows:

- Complete the required readings.

- Travel to Björklunden over reading period (Friday evening until Sunday afternoon) and participate in our workshop.

- Produce a short response paper (3-5 pages) to material and ideas discussed over the weekend.*

The target audience for Schumptoberfest is students who have a firm grasp of micro theory and have an interest in the scholarship on innovation and entrepreneurship. The course should be an exceptionally good fit for students who have taken or are planning to take Industrial Organization and The Economics of the Firm.

Those interested need to sign up with Professor Gerard as soon as possible. Those interested in receiving the two independent study credits need to sign up with him by Friday, September 24. We expect 10-15 students and 3-5 faculty members to participate.

*Professor Gerard will provide the readings and reading guides over the course of the next few weeks. We will set the parameters of the writing assignment during the retreat.

Schumptoberfest design by K. Richter

Talk Like a Pirate Day

It’s Talk Like a Pirate Day over at The Mudd, and elsewhere.

Perhaps you should celebrate by reading Peter Leeson’s The Invisible Hook, an economic analysis of piratical organization. Or perhaps the JPE piece it was based on. Or even one of its many favorable reviews.

Here’s the gist:

The idea of the invisible hook is that pirates, though they’re criminals, are still driven by their self-interest. So they were driven to build systems of government and social structures that allowed them to better pursue their criminal ends.

I read this over the summer and found it interesting that the classic pirates created reasonably democratic governance structures with built-in checks and balances, whereas most organized crime we think of today — including modern-day pirates, I’d guess — is more conventionally hierarchical.

First Fall Economics Tea, Monday at 4:30

We will hold the Economics TeaBAs this term on Mondays at 4:30 p.m. in Briggs 217.

The EconTBA is a great opportunity for you to take a break from your studies to come and chat with your favorite economics professors and students. Last year we had a vibrant guest list, ranging from professors in other departments to visiting speakers to emeritus faculty. And even if you don’t like us, there are always the “free” tea and cookies for you to enjoy.

This was formerly called “Economics Tea,” but we decided it was too risky to lock in to one beverage, given potential for changes in prices and income. Hence, Economics TeaBA.

See you Mondays.

Toxie, We Hardly Knew Ye

Some of you may remember that last year we brought you a link to Toxie Cam , where folks at NPR purchased a so-called “toxic asset” to help them understand the mortgage crisis and the financial crisis more generally. To wit,

We bought Toxie for $1,000 earlier this year. Every month, we get a check. It’s a small piece of the payments people are making on their mortgages. And every month, more houses get foreclosed on and sold off by the bank. When enough houses get sold off by the bank, Toxie will be dead.

Hilarity ensued, of course, when they dedicated a live streaming web feed to a stack of paper, a la the live feed of the BP platform gusher. They went on:

She’s not dead yet — but things are looking grim. Last month, we got $72.41; so far, we’ve received a total of $449. This month, our payment was zero dollars and zero cents. We could still get another payment next month — maybe.

Well, it looks as she’s pretty much dead now, and as the value of the “Toxie” is converging to the paper it’s printed on. So, in a final hurrah, NPR gives us some back story from before Toxie was toxic. This in includes a rather spectacular aerial photo of a neighborhood that was planned but never developed.

The Toxie Cam was part of an NPR series that seems pretty engaging. Certainly not the worst thing you’ll read about the financial crisis.

The Yuan Also Rises?

For a variety of reasons, Chinese economic policy makers resist pressures to allow the yuan (or renminbi) to rise against the dollar. On this side of the great pond (i.e., the Pacific Ocean), politicians (see H.R. 2378 Ryan-Murphy bill) and many economists clamor for explicit pressure that “forces” the Chinese to allow the yuan to appreciate. What would happen if the yuan were to rise markedly against the dollar? Several observations are worth making.

1. Much of the trade deficit that exists between the US and China arises from the sale of final goods. The value added by Chinese firms in these goods, however, is rather small. So what? If the yuan rises, it means that Chinese firms will be able to purchase intermediate goods more cheaply than at present; thus, the decrease in the cost of Chinese goods in yuan terms will counter the rise in the exchange rate and limit the change in prices to American consumers.

2. It’s not clear that changes in the nominal exchange rate drive large changes in purchasing. For example, the Japanese yen was forced to appreciate against the dollar in the late 1980s. Such a rise has had limited impact on trade with Japan. The U.S. runs trade deficits with virtually all of its major trading partners. This is a natural outgrowth of diminishing savings relative to (tangible) investment over past three decades.

3. On a related point, Gillian Tett, in today’s Financial Times argues that the Japanese experience with a rising yuan could be replicated in China. Unless China reforms its banking and financial system in a way that decentralizes the allocation of capital, it may suffer the economic stagnation that Japan has suffered for the past two decades. Cheap capital, centrally allocated, tends to yield excess capacity in politically sensitive industries. I have heard this argument on many occasions in China. If China’s economy were to suffer a long period of weakness, demand for US, European, and Asia goods would diminish, not rise.

4. The iron triangle or impossible trilogy restricts countries from having a) open capital markets, b) a fixed exchange rate, and c) independent monetary policy at the same time. Different countries, based on the depth and breadth of their domestic capital markets and their social time preferences, as well as their desire to attract capital, make different choices. China chooses some combination of capital controls and limited monetary independence along with a fixed exchange rate. The US and Europe, with much more developed capital markets, choose to allow exchange rates to float. Small countries, dependent on world trade and world interest rates, such as Hong Kong and Estonia, forgo independent monetary policy. There is no right choice. Each country manipulates the tools it believes give it the highest level of economic welfare.

My advice to US policy makers: be careful what you ask for.

Out with the Old, In with the New Palgrave

Do you think the liquidity preference is the choice of beverages at our weekly Econ TeaBA? Or perhaps you are under the impression that a LaGrangian multiplier is a French calculator? If so, you might consider checking out The New Palgrave Dictionary of Economics online. The dictionary is a great resource for quick, readable, often authoritative pieces covering everything from Moses Abramovitz to Frederik Ludvig Bang Zeuthen.

But don’t take my word for it, here’s the advertising from the publisher:

This new edition retains the inspiring tradition of bringing together the world’s most influential economists writing in their own voice on their areas of expertise, but in its online incarnation it has married this tradition with the benefits of a dynamic, updated resource serving the information needs of a new generation of economists.

Seriously, this is an excellent resource, and you should utilize it. It’s brought to us by the good folks at The Mudd.

Prof. Brozek Screens Forbidden Planet, Tues at 9:30

Is there a bigger champion of the educational movie on campus than Professor Brozek? I think the answer is decidedly not. In the spirit (sort of) of last year’s international film series, this term he brings us Forbidden Planet to entertain and enlighten us in ways that only sci-fi movies from the 1950s can.

The movie screens Tuesday, September 21 at 9:30 p.m. in Warch Cinema. Everyone in Freshman Studies (and beyond?) is invited.

For those of you who had a reasonably normal childhood, here’s the basic storyline:

Forbidden Planet is an adaptation of The Tempest set on the planet Altair IV in the year 2257 – Shakespeare in space suits, essentially. The parallels between the movie and the play are numerous – Dr. Morbius and his daughter, Altaira, are the only human inhabitants of the planet, although they have a faithful servant in Robby the Robot. When a mission from Earth comes to rescue Dr. Morbius, they discover threats (a machine that creates monsters in the crew’s subconscious) as well as romance (Altaira and a young Leslie Nielson as Commander Adams).

Part of the fun of Forbidden Planet – especially in the context of Freshman Studies – is picking out the parallels between the film and the play. It’s also interesting, though, to look at the spots where they diverge – SPOILER ALERT SPOILER ALERT I CAN’T BELIEVE HE SENT ME ALL THESE SPOILERS

If you’d like to read more, check out “Shakespeare in Outer Space: Forbidden Planet as Adaptation of The Tempest,” by Miguel Angel Gonzalez Campos at the University of Malaga.

The target audience is Freshman Studies students, but I don’t think we’re quite that picky. See you there.

Dana Fellowship at Ronin Capital

INVITATION

An information session regarding the Fellowship will be held on Saturday, September 25. The session will begin with lunch in the Schuman Dining Room beginning at 12:00 noon followed by an information session from 1:00 until 3:00 p.m. in the Hurvis Room of the Warch Campus Center. Mr. Larry Domash ’81, who is a partner with Ronin Capital (a world – wide proprietary trading firm based in Chicago) and Imtiaz Khan ’09 will be facilitating the session. To sign up for lunch and/or the information session, please stop by or call the Career Center (920 832 6561). Registration deadline is Wednesday, September 22.

HISTORY

During the summer of 2009, Ronin Capital hired Imtiaz Khan ’09 to work on a research project examining, in part, the causes and opportunities associated with the 2007 – 2008 “US financial markets crisis.” The success of this project led to the establishment of the James Dana Fellowship for graduating Lawrence University students.

GOING FORWARD

For each of the next five years (2011 – 2016) Mr. Domash ’81 will be hiring 1 student annually from LU to serve as a Dana Fellow. Each Dana Fellow hired will work on an empirical project. While the background and formatting work for the study will be performed in Chicago – some of the empirical data gathering will take place in NYC and London.

The finished project will be published for distribution to clients/ consultants / academics – for review and feedback. The LU grads chosen to be Dana Fellows will also receive training in research techniques and have the opportunity to observe how their research translates to trading for approximately 1 year. The individual will receive full salary and bonus during their work with Mr. Domash as well as a reference for placement. Upon completion of the project, Mr. Domash will work with the individual and help in all aspects of placement in an investment advisory or Wall Street style trading firm – if desired.

During 2011 – 2012, the named Dana Fellow will be working on a research project examining the 2010 Sovereign Debt Crisis in Europe and will encompass both a statistical and abstract examination of European Government finances as well as policies relating to fiscal and tax policies. It is envisioned that the study will try to provide a statistical substantiation to Keynesian economic theory..

The James Dana Fellowship was established with a dual purpose: 1.) to create viable empirical research leading to new trading bond/equity trading strategies at Ronin Capital; 2.) to establish a mentoring and networking community for Lawrence graduates and undergraduates within the trading and Wall Street finance industry. Part of the requirements of the fellowship is to help Lawrence undergrads gain insight into the trading community and to “give back to the University” by donating time.

Who are they looking for to be Dana Fellows?

- Self starters

- Students who have excellent communication skills and are fluent in operating all aspects of the Microsoft Office product suite.

- Students that enjoy research.

- Students that can work by themselves and who are comfortable in a team environment.

- Students genuinely curious about the Sovereign Debt Crisis of 2010.

- Students that can ask any question and not be embarrassed

- Students that have enjoyed their Lawrence experience.

- Most of all the ability to learn.

Is Gladwell’s Perspective on K-12 an Outlier?

I just finished up Malcolm Gladwell’s Outliers: The Story of Success, with a rather unconventional take on the U.S. public schools. The girl he is discussing, Marita, is from a single-parent, low-income household. He is concluding a chapter on an experimental public school program in New York City, the Knowledge is Power Program (KIPP, for short).

Marita doesn’t need a brand-new school with acres of playing field and gleaming facilities. She doesn’t need a laptop, a smaller class, a teacher with PhD, or a bigger apartment. She doesn’t need a higher IQ or a mind as quick as Chris Langan’s (a genius discussed earlier in the book). All those things would be nice, of course. But they miss the point. Marita just needed a chance.

That is both a conclusion about our schooling, as well as a conclusion about how our society produces talent. Gladwell is the master storyteller, and in Outliers he writes convincingly how a combination of arbitrary advantages mixed with an extraordinary work ethic can compound to produce “outlier” talents ranging from Bill Gates to Canadian professional hockey players.

Indeed, Gladwell is explicitly discounting exceptional talent as a significant factor in determining exceptional success. Instead, he contends that there is some threshold level at which incremental improvements don’t matter. So, there are many people who could have been Bill Gates, but Bill Gates was the only one with that level of ability that happened to fall into a situation that allowed him to become such a dominant captain of industry.

Those interested in a discussion on this point far outside of my research domain might consult the special issue of Behavior Genetics on people with high cognitive ability. In that issue, psychologist David Lubinski addresses Outliers and concludes: “The vast majority of scientists in talent development would say that it takes at least ability, ambition, and opportunity; there is no need to minimize the importance of any of these when it takes all three.”

I am certainly not qualified to discuss the literature on talent development, so I will leave it at that. My feeling is that Gladwell consistently conflates more mundane successes associated with someone like Marita with extraordinary successes of someone like Mario Lemuiex. This makes it both easier and more difficult to attack his argument. On the one hand, I completely buy the argument that most successful people are a product of chance and of hard work — there are few truly self-made men. On the other hand, it’s hard to believe that truly great scientists and mathematicians aren’t blessed with a skill set far beyond the domain of the 95th-percentile student.

Wells Capital Management Positions

The Investment Risk Management team at Wells Capital Management is currently recruiting college seniors for two Associate Investment Risk Analyst positions. The ideal candidate would have excellent problem-solving skills, a strong math background with a preference for computer science, and an interest in the financial markets. Strong communication skills and the ability to work effectively as part of a team are also very important. See Kathy Heinzen in the Career Center or me for details.

The application deadline is September 30; so take action if you are interested.